EUR/USD

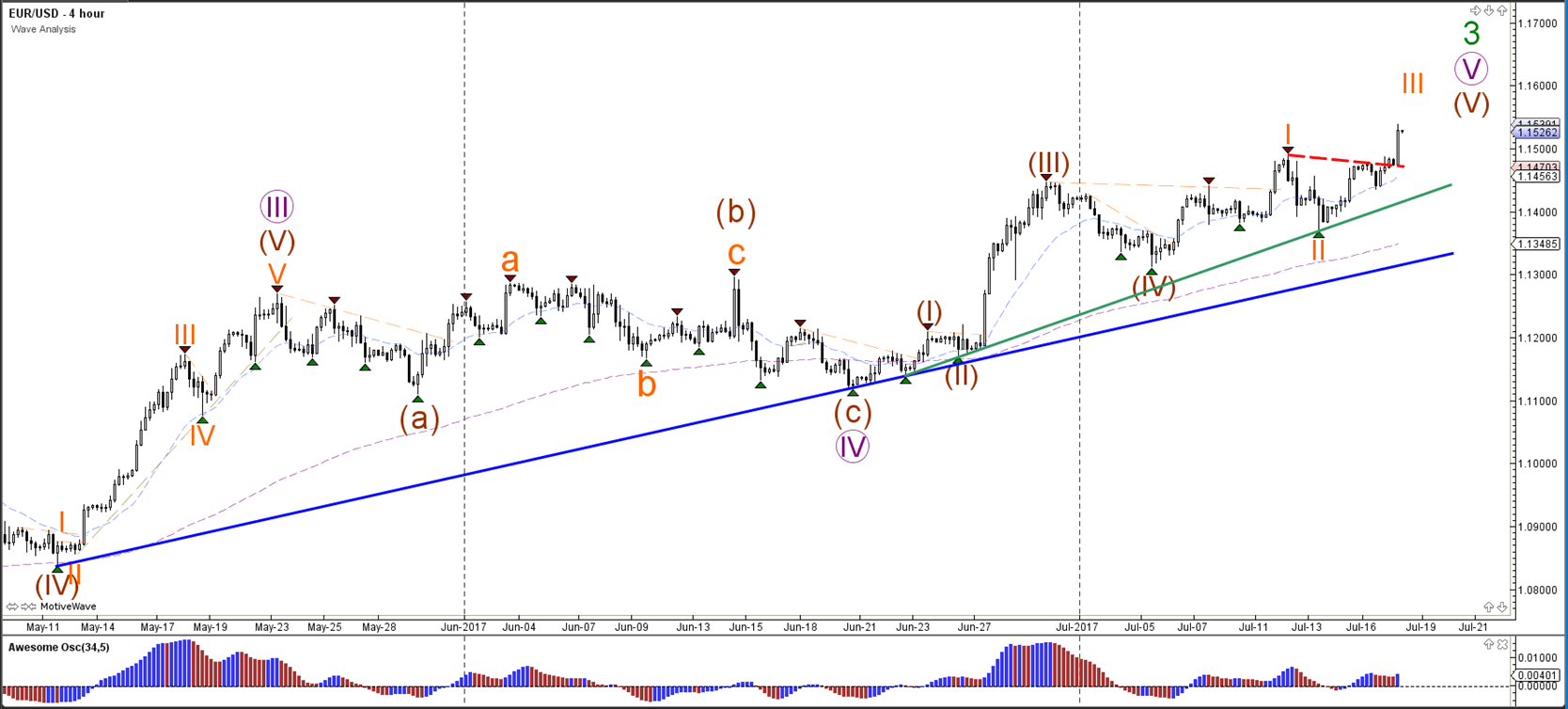

4 hour

The EUR/USD uptrend is ready to continue higher now that price has broken above the resistance trend line (dotted red) and 1.15 round level. The bullish breakout confirms the continuation of the wave 3 (green).

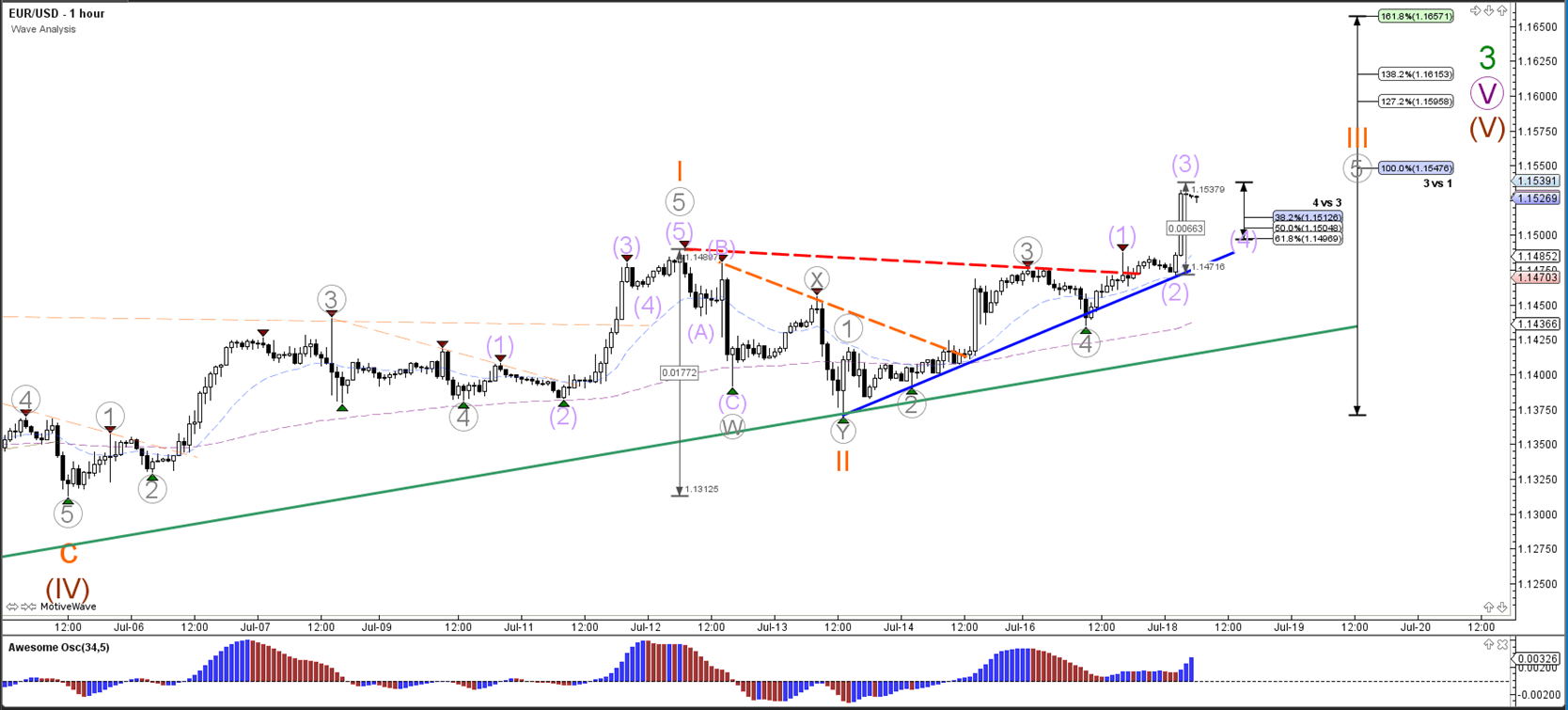

1 hour

The EUR/USD is most likely building a wave 3 (orange) momentum. Within the 3rd wave price seems to be extending the bullish impulse via 5 waves (purple) within the 5th wave (grey). A small retracement could occur now or later as part of the wave 4 (purple) and the Fibonacci levels of wave 4 vs 3 could act as potential support for a new bounce towards the Fibonacci targets of wave 3 vs 1.

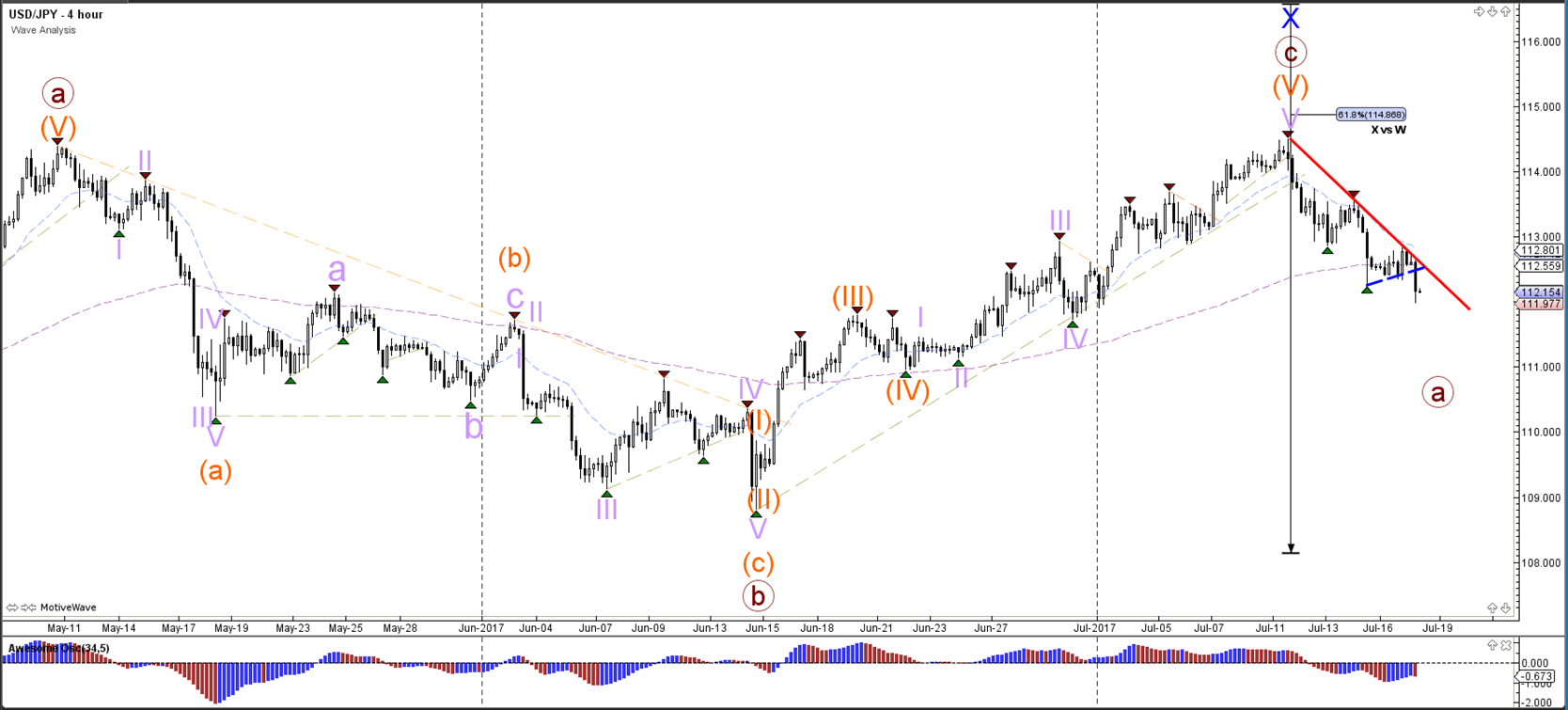

USD/JPY

4 hour

The USD/JPY continuation of the bearish momentum is increasing the chance of a bearish reversal and the completion of a wave X (blue) at the top.

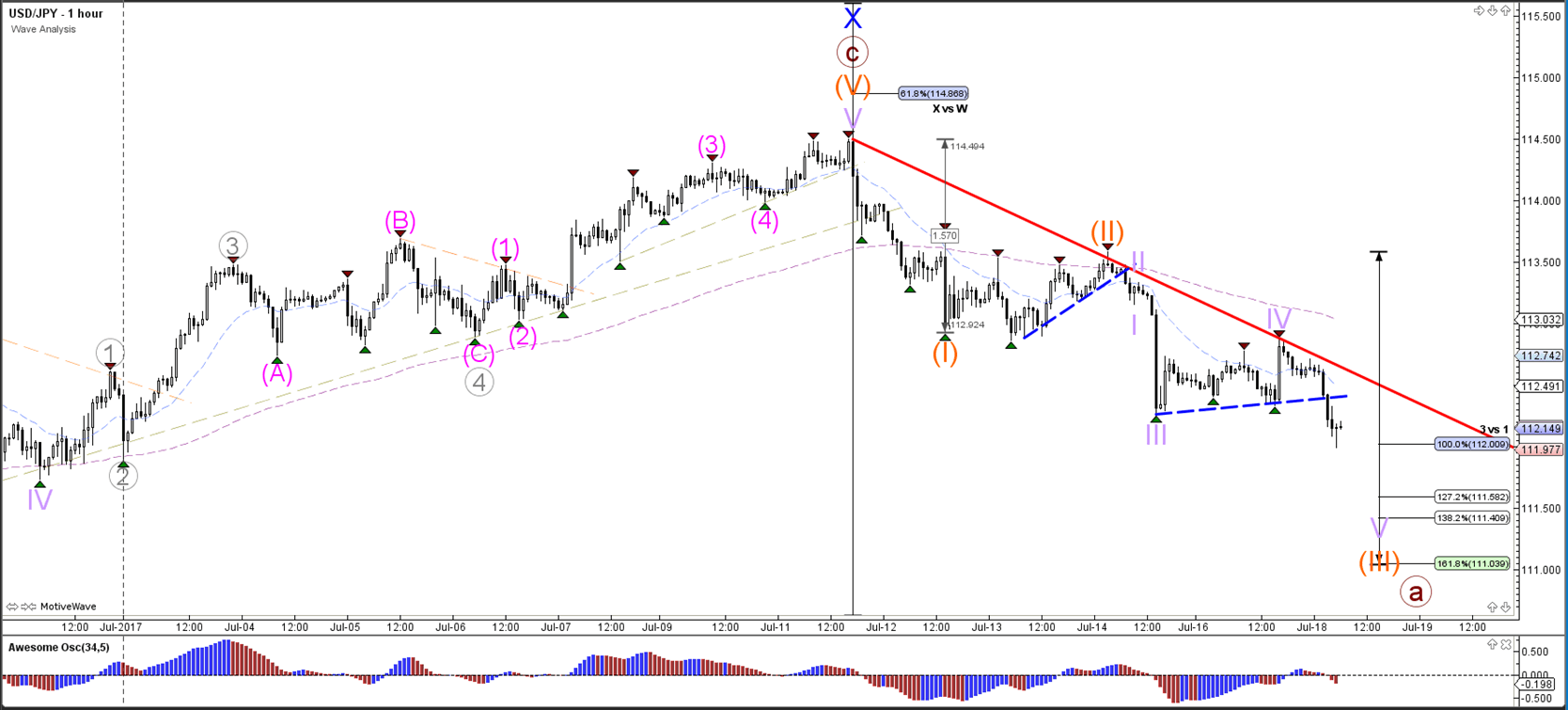

1 hour

The USD/JPY indeed turned at the resistance trend line (red) which confirmed the wave 4 (purple). The break below the support trend line (dotted blue) could indicate the potential for USD/JPY to move lower towards the Fibonacci targets.

GBP/USD

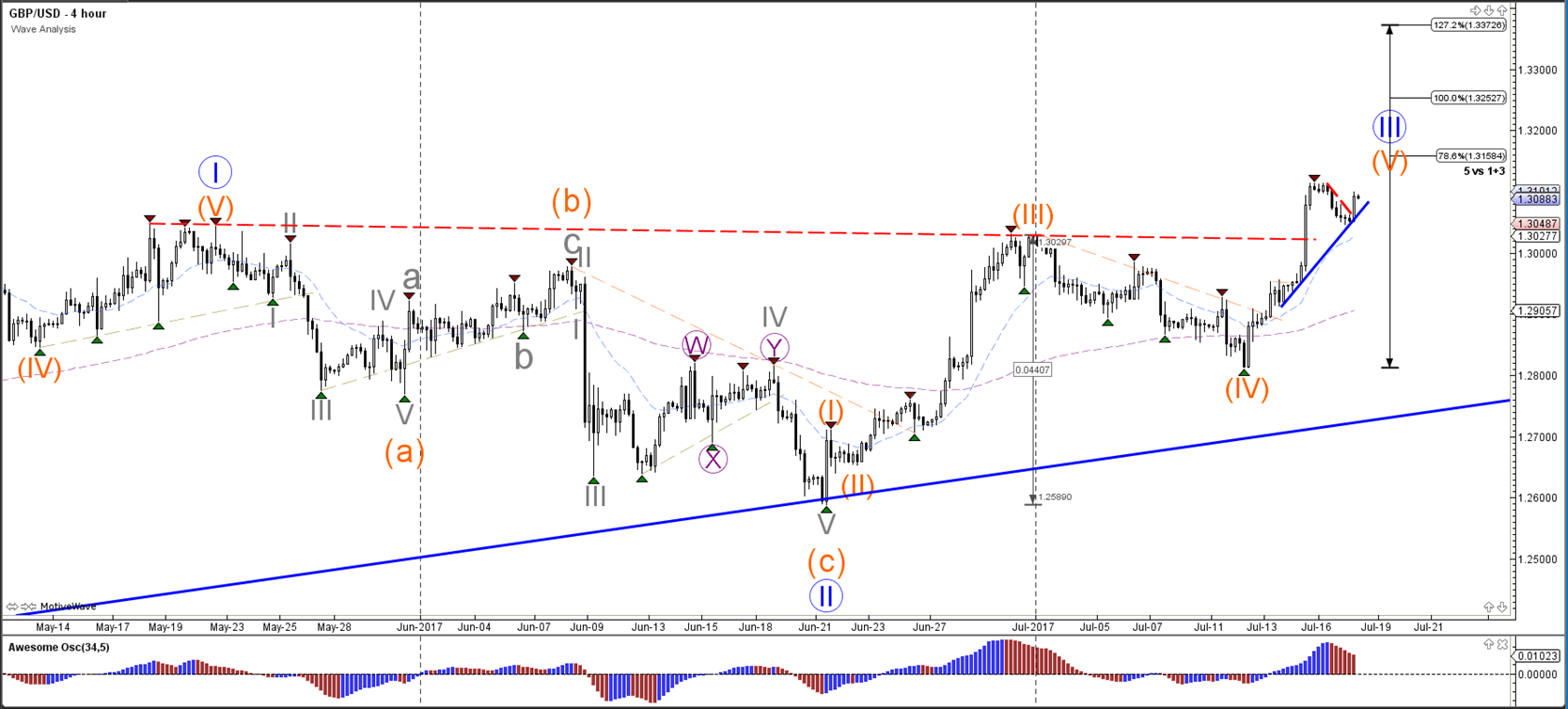

4 hour

The GBP/USD is continuing with the uptrend after the break above the 1.30 resistance level (dotted red). The Fibonacci levels of wave 5 (orange) are the next targets.

1 hour

The GBP/USD completed a retracement to the 338.2% Fibonacci support level of wave 4 vs 3 (purple) and used the support for a bullish bounce. The bullish breakout above resistance (dotted red) will probably start the wave 5 (purple) of wave 3 (grey).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.