Easy title for a complicated scenario: the EUR heads towards the ends of April easing against most of its rivals, as over the past few weeks, market players have been listening ECB officials bluffing on the benefits of a rate cut, and pricing it in. Market players already expect the Central Bank to take rates down from current 0.75% to 0.50%, a measly 0.25% cut.

With the economy on recession, and the OTM program accumulating dust, one should wonder how beneficial could be such rate cut. In fact, there are more chances that investors will take it as a last ditch effort, and will hardly provide support to EUR or increase the confidence in the ECB. A larger rate cut however, may provide some short term support to the common currency, but in the long run will do nothing to help solving the crisis, and will pass, leaving the fundamental picture unchanged.

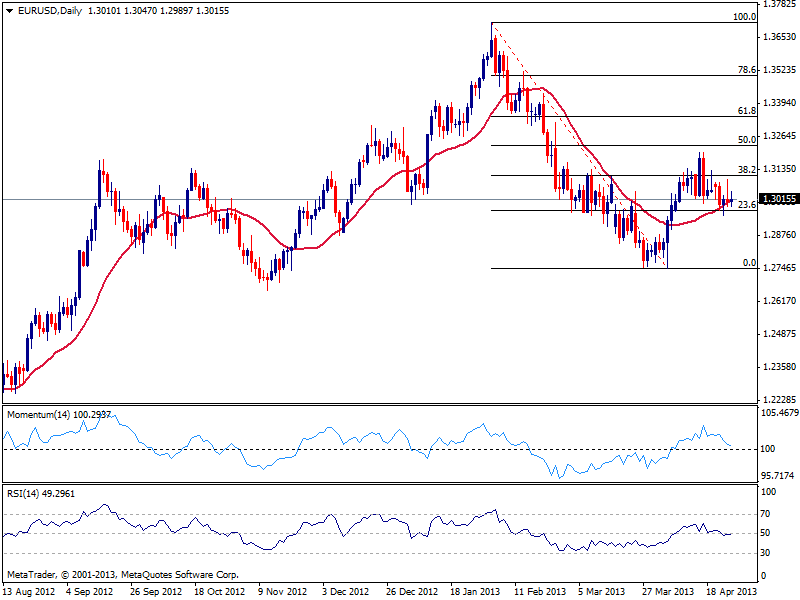

EUR/USD, range, range and more range

The EUR/USD has spent most of the last two weeks trading in a tight range, trapped in between Fibonacci levels: after a non lasting test of 1.3200, the pair retraced all the way back to the 23.6% retracement of its latest daily fall from 1.3710 to 1.2744, around 1.2970. the level has prove strong these last days, attracting buyers on dips that anyway, have been unable to reverse the heavy tone the pair has. Latest spike higher missed the 1.3100 area, leaving a daily chart fulfilled of lower lows.

Odds are now to the downside in the pair, with a break below the 1.2970 Fibonacci level opening doors for a quick test of key 1.2880, strong static midterm support. Once below this last, the slide could easily extend towards 1.2740/50 area next week, but if this last gives up, then get ready for a run towards sub 1.26 level this May.

To revert actual bearish tone, price needs to establish above the 1.3115 resistance, 38.2% of the same Fibonacci rally, with scope then for a retest of 1.3200. However, only steady gains above 1.3230, will provide basis for a bullish midterm case, with 1.3510 then at sight.

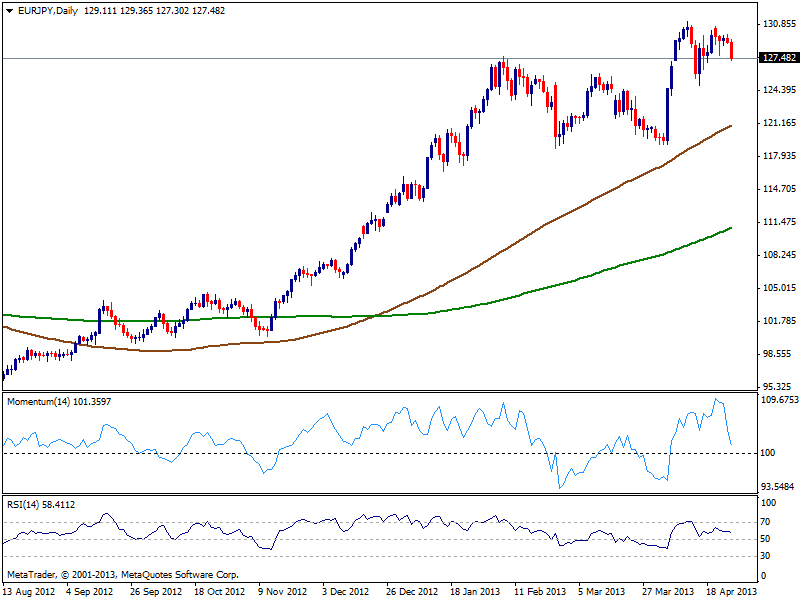

EUR/JPY, or the battle of the less weak

The EUR/JPY, along with many other yen crosses, has lost its bullish shine. At this point, seems failure in USD/JPY to take over psychological 100.00 level weights on investors’ decisions when it comes to all of yen pair. Ending the week below 128.00, the pair holds to its monthly gains, trading far above the opening around 119.10. But the bearish potential increase as players take profits out of the table and EUR tumbles: the daily chart shows momentum indicator heading almost vertically south and near its 100 level, pointing for more slides next week, towards 125.80 area, immediate midterm support.

Further yen strength may see the pair even approaching 124.86, April 16th daily low, and breakpoint: buyers determination will be tested if price reaches this area, and either the pair presents a strong bounce and a return of the bulls, or breaks lower, leading to further unwind. In this case, 120.00 area seems a probable target before price finally stabilizes.

A recovery should extend minimum above 129.00 to erase the negative bias and see the pair attempting further recoveries up to 131.10, this year high. Then again, the best barometer will be USD/JPY and its ability to overcome 100.00.

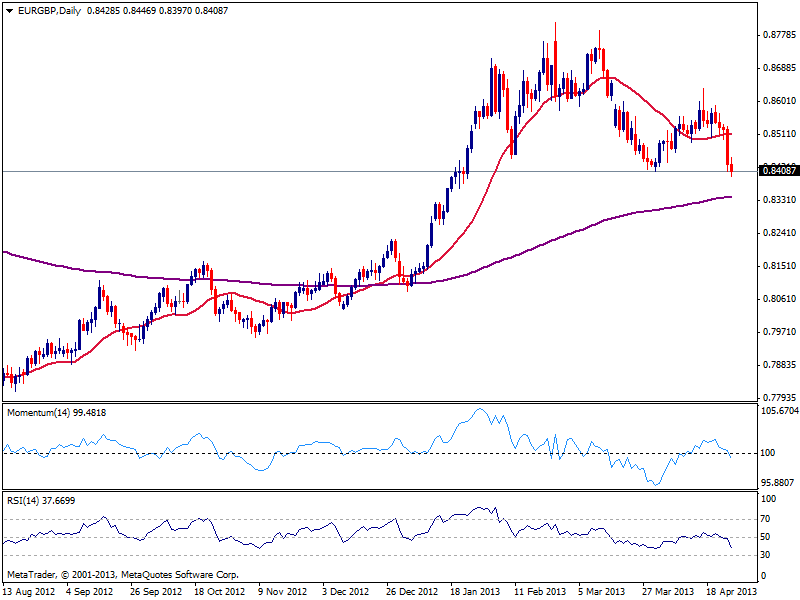

EUR/GBP, after UK GDP

The United Kingdom seems to have avoided a triple dip recession: latest GDP figures impressed to the upside, giving back Pound some of its lost charm: the cable has soared across the board, outperforming most of its rivals, and sending EUR/GBP to a fresh 1 month low. The pair trades around 0.8400, with the daily chart pointing for a strong downward continuation as indicators gain bearish momentum below their midlines, with scope to test 0.8360 now, next strong support.

Whether Pound will be able to continue advancing will depend mostly on upcoming fundamental readings in the UK: with further signs of recovery, the pair will likely extend current bearish trend eyeing 0.8220, December 2012 highs.

Current downward trend will be in trouble if the pair regains the 0.8500 level over the next few days, although buying interest won’t be strong enough to send the pair back towards 0.8800 highs, but likely limited to and advance towards 0.8635, April 17th high.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.