European Central Bank Preview: Three charts show why Lagarde could send EUR/USD tumbling

- The ECB is set to leave rates unchanged but hint of additional stimulus due to the virus.

- Forward-looking indicators are already pointing to a significant slowdown.

- Recent inflation figures paint a worrying picture for the bank.

All eyes are on Europe again – and for the wrong reason. COVID-19 cases are surging in the old continent with governments taking action to curb the spread of the disease, with restrictions that take an economic toll, with a double-dip recession looking more certain by the day.

Will the European Central Bank jump to keep the recovery alive? ECB President Christine Lagarde may open the door to action in December and weigh on the euro. Here are three charts that reflect the severity of the situation:

1) Covid calamity

Source: FT

Coronavirus cases are surging in Europe and have surpassed the US when adjusted for population. France's daily caseload topped 50,000, Spain declared a state of emergency and Belgium warned that Intensive Care Units may be exhausted.

Italy, which seemed to escape the second wave, is suffering a quick catch up with its neighbors and also Germany – which was praised for its testing – is also struggling. Chancellor Angela Merkel warned that the situation is getting out of control.

The rapid spread of the disease is deterring consumers even before authorities impose restrictions – and they are growingly doing so.

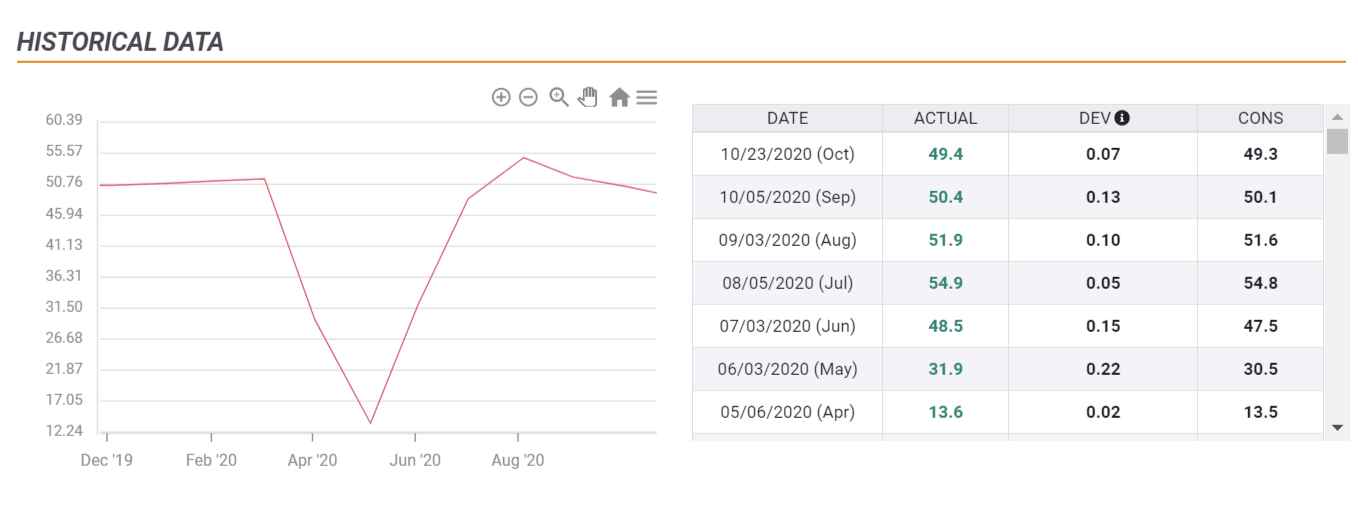

2) Business confidence is falling

Not only consumers may shy away from buying, but also companies. Markit's preliminary purchasing managers' indexes for October have extended their slide, pointing to lower investment sentiment and growing fear.

Source: FXStreet

The composite index for the eurozone dropped under 50, indicating a shift from expansion to contraction – also alerting that the recovery may end abruptly. The German IFO Business Climate also dropped.

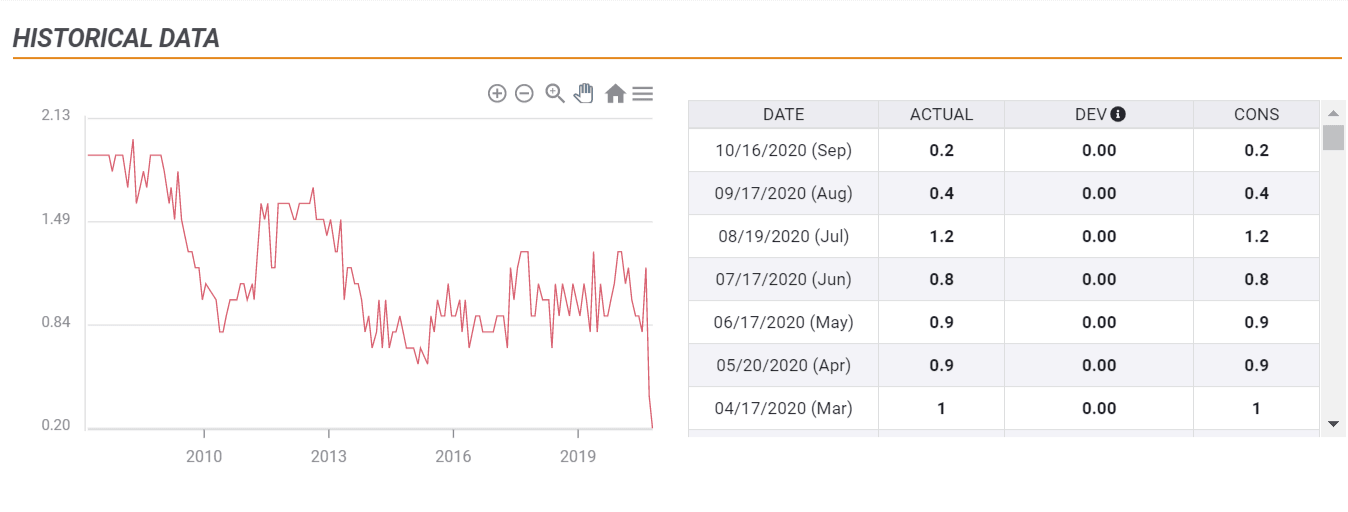

3) Deflation risk

Even if the ECB focuses on its narrow inflation goal – 2% or close to 2% – it is missing big time. The "single needle on the compass" as then-president Jean-Claude Trichet called it, is pointing in the wrong direction.

While the headline Consumer Price Index often fluctuates in response to swinging oil prices, core CPI has been relatively stable and even encouraging. That is no longer the case, as underlying inflation decelerated to 0.2% in the preliminary release for October:

Source: FXStreet

Overall, the ECB may find itself obliged to act. But how?

Christine Lagarde, President of the European Central Bank, is about to complete one turbulent year at the helm. She kicked off her term by pledging a strategic review and has pushed that aside as the pandemic struck. In the months that passed, her peers at the US Federal Reserve completed their own overhaul and presented a more dovish policy. The Fed announced it is prioritizing full employment over price stability, meaning it would tolerate higher inflation.

Will Lagarde drive the Frankfurt-based institution in that direction? She would certainly face opposition from German and other northern central bankers that fear hyperinflation and see it as an overriding priority.

Nevertheless, if Lagarde lays the ground for allowing higher inflation, the euro could retreat. With current levels of consumer prices, markets would mostly see it as a theoretical exercise rather than an imminent policy change and only push the common currency gently lower.

The ECB could also hint that a rate cut is coming. However, the bank has limited room to act. Its deposit rate stands at -0.50% and any deeper dive into negative territory would have little impact on the economy with some unnecessary pain for the banks.

An easier path to walk would be expanding and extending its recent bond-buying scheme, the Pandemic Emergency Purchase Program (PEPP). It is set to expire in June and announcing a longer and larger program could lower borrowing costs for governments, households, and businesses.

In the previous PEPP announcements, the euro advanced instead of falling. Printing more euros reduced its value in the pre-pandemic era, and changed in March – as investors saw monetary stimulus as a precursor to government relief that would boost the economy.

Will recent history repeat itself, turning an announcement of more bond-buying into a buy signal for the euro? Probably not. Governments are already acting, either by taking advantage of the rock-bottom borrowing costs or via the funds made available by the European Commission's ambitious relief plan. Investors will likely return to the old reaction function of selling a currency in response to printing more of it.

Conclusion

Rising covid cases, fears of a double-dip recession, and fear of deflation could push the ECB to action – either immediately or via a hint of stimulus in its next meeting. President Lagarde could announce a long-term change, cutting rates, or most likely, more bond-buying – and all could bring EUR/USD down.

More 2020 Elections: Seven reasons why this is not 2016, time to focus on the Senate

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.