The EUR/GBP pair trades at 0.7257 after the Bank of England left key policy instruments unchanged as expected.

GBP favored in the previous session

The British Pound has seen a solid rise in volatility owing to election uncertainty and due to the deal between Royal Dutch Shell and BG group. The GBP/USD pair had shot higher to 1.4971 on Tuesday as the deal is a cash-and-share offer.

Meanwhile, the EUR/USD pair continued to decline as Greece issue dominated market sentiment. Moreover, in the absence of a major data across the Eurozone and/or UK, the markets focus on the divergent monetary policies adopted by the ECB and the BOE. Consequently, the EUR/GBP cross dipped to a low of 0.7225 in the previous session.

Slight uptick in the EUR/GBP today

As mentioned in the morning report, the strength in currency due to M&A deal usually does not last long and leads to a bull trap of sorts. The GBP/USD pair dropped to a low of 1.4763 before recovering to trade at 1.4829. The EUR/USD pair also followed suit, despite of an upbeat German economic data – industrial production and trade surplus.

Both the EUR and the GBP were hit by the FOMC minutes, which brought back June rate hike talks. However, the GBP erased M&A gains, while the EUR remained somewhat supported on Greece making payment to the IMF. Thus, the EUR/GBP pair ticked higher to 0.7278 levels, before giving up part of its gains to trade at 0.7260.

EUR/GBP could drop to 0.7200

The British Pound remained resilient despite of a sharp rise in the trade deficit in February. Furthermore, we have also seen the GBP erase its M&A gains. Attention now shifts to the UK industrial production data due for release tomorrow. Month-on-month, both industrial production as well as the manufacturing production is expected to bounce back into the positive territory.

Meanwhile, we do not have any major economic data due for release out of the Eurozone on Friday. Thus, the focus is likely to be on Greece. The good news – Grece confirms payment – failed to have any major positive impact on the pair. The EU has provided one week’s time to Greece in order to review its reforms. The Greek government is engaged in difficult talks to renegotiate the terms of its EU-IMF bailout, and as a result has received no money left in the multi-billion loan package. The uncertainty surrounding Greece is likely to keep the EUR under pressure.

Thus, in case of a disappointing US weekly jobless claims data, we are likely to see a sharp rebound in the British Pound. On the other hand, the EUR is likely to under perform.

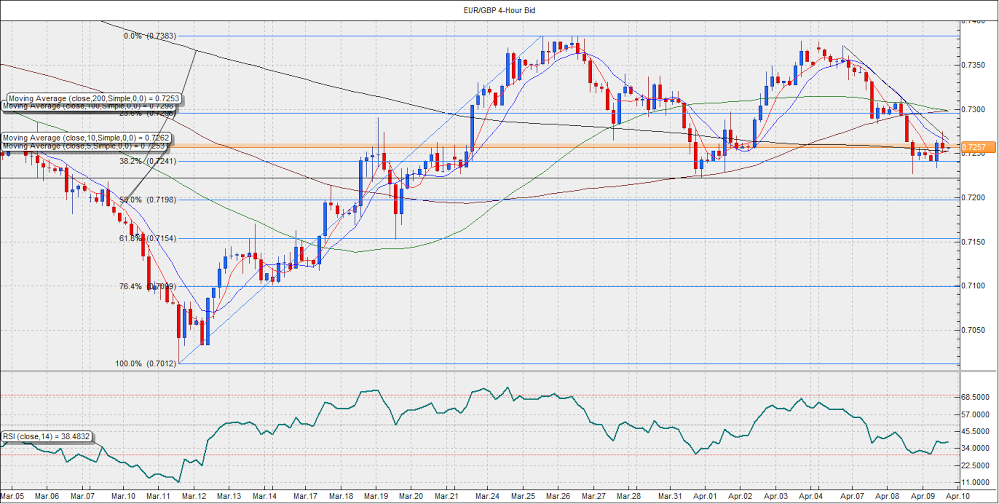

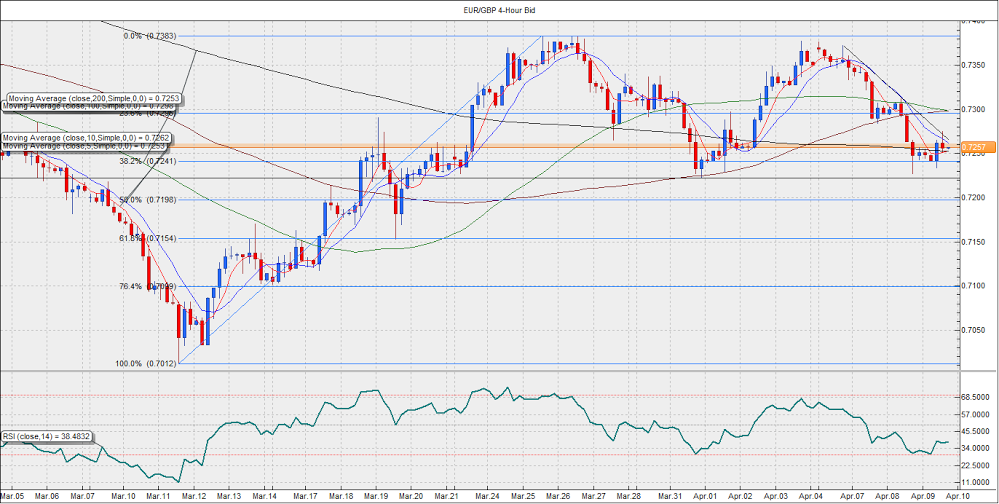

EUR/GBP- Technicals

On the hourly charts, we see the pair has been rejected at the falling trend line resistance earlier today. The EUR is being offered in 0.7260-0.7270 range. At 0.7254 levels, the pair currently bearish as per the daily, hourly and 4-hour RSI.

More EUR offers await below the 200-MA on 4-hourly located at 0.7253. The immediate support is seen at 0.7221 (double top neckline), under which losses could be extended to 0.72-0.7198 (50% Fib retracement of 0.7012-0.7383).

38.2% Fib retracement at 0.7241 has acted as strong support earlier today, although a fresh drop below 200-MA on 4-hourly located at 0.7253 could breach the support at 0.7241.

Meanwhile, the immediate upside appears capped at the falling trend line resistance now located at 0.7266.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.