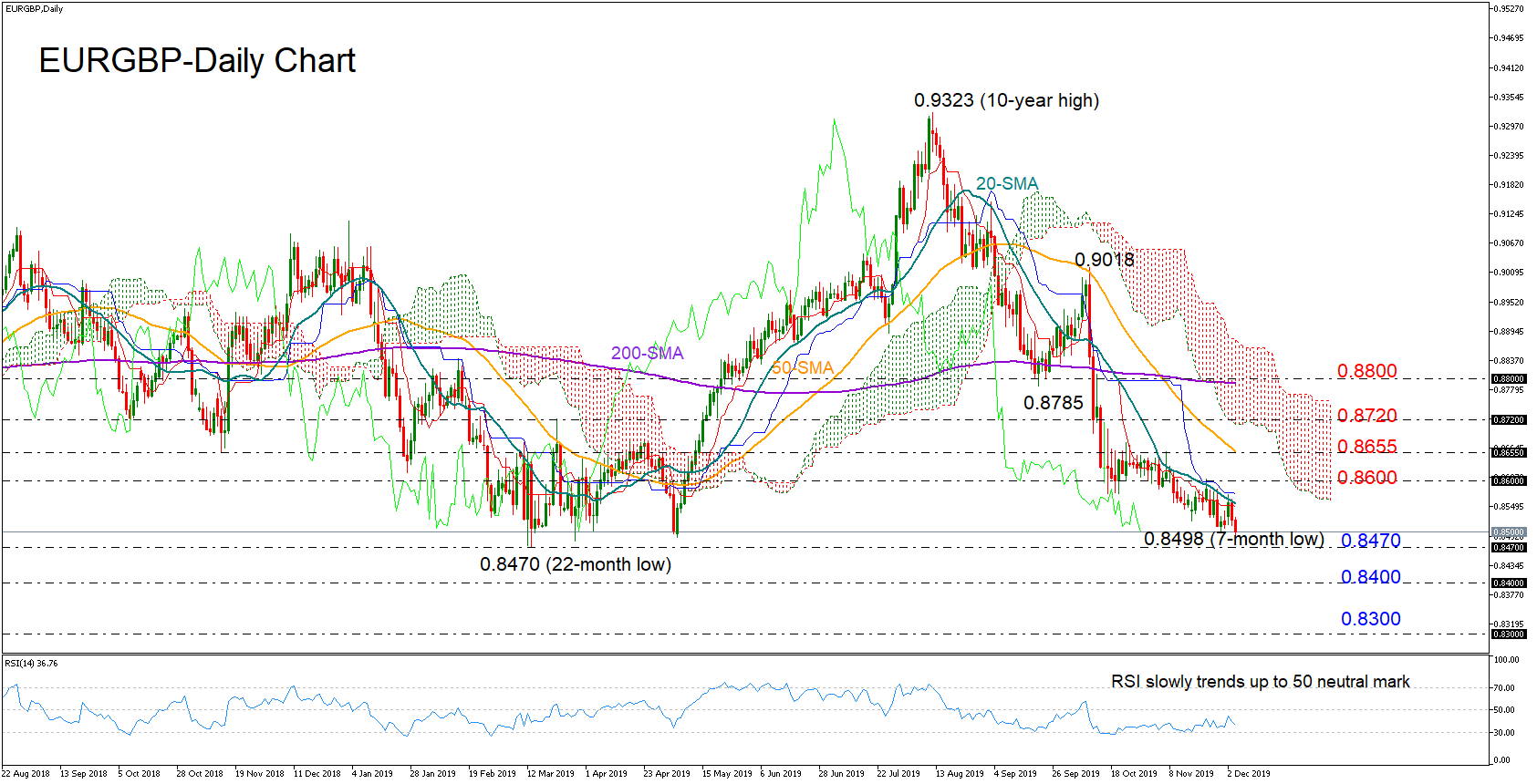

EURGBP started the month on the downside as buyers could not close above the 20-day simple moving average (SMA) that has been restricting upside corrections over the past four weeks.

The short-term bias is currently viewed as bearish-to-neutral as the RSI looks to be distancing itself from its 30 oversold mark to reach its 50 neutral mark, while in Ichimoku indicators, the red Tenkan-sen line is stabilizing slightly below the blue Kijun-sen.

On the downside there is a strong support between 0.8498 and 0.8470. Should the price fail to rebound within this area, the door would open for the 0.8400 round level, a break of which could then shift attention towards the 0.8300 mark.

In the positive scenario, a decisive close above the 20-day SMA and preferably above the 0.8600 barrier could bring a stronger obstacle near 0.8655 back into view. Moving higher and above the 50-day SMA, the bullish action could pick up steam towards 0.8720, where any violation would push resistance up to 0.8800.

Turning to the medium-term picture, the fourth-month old downtrend off the 10-year high of 0.9323 continues to keep the outlook negative, with the latest bearish cross between the 50- and the 200-day SMAs reducing the odds for an outlook reversal.

In brief, EURGBP is expected to trade bearish-to-neutral in the short-term, with traders likely waiting for a clear close above the 20-day SMA in order to place buying orders.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.