EUR/USD Weekly Forecast: Attention remains on inflation… and Trump

- EUR/USD retreats to two-year lows near 1.0330.

- The US Dollar appears unstoppable and reaches new top.

- Next data of note in the euro area will be flash inflation data.

It was an awful week for EUR/USD. In fact, the fourth quarter has been dreadful so far for the European currency. Since late September’s yearly highs, above 1.1200, the pair has closed with gains in just one week. The Fiber has retreated nearly 8% since then or more than eight cents.

The Euro has had a rough ride lately, with much of its weakness amplified by a resurgent US Dollar (USD). The Greenback has gained fresh momentum, fueled by the sudden resurgence of geopolitical tensions — particularly in the Russia-Ukraine conflict — as well as the revival of the so-called "Trump trade." Against this backdrop, the US Dollar Index (DXY) surged to a new cycle high, climbing above the 108.00 mark for the first time since early November 2022.

Why parity is back on the table

Considering the same scenario, if EUR/USD lost eight big figures in nearly two months, a “meagre” three-cent drop could seem even more likely.

Aside from the current oversold condition of the single currency, there’s little to suggest a near-term rebound — let alone a sustainable recovery.

The prospects for a stronger US Dollar dominate sentiment and are only occasionally tempered by technical corrections as investors are expected to back the “Trump trade” throughout most of 2025.

On the domestic front, preliminary indicators of business activity in both Germany and the broader Euroland are far from encouraging. Adding to this, the bleak outlook for the German economy — exacerbated by visible political instability and stagnant economic activity across the bloc — doesn’t bode well for the Euro.

And that’s without even considering the performance of the US economy.

Looking ahead, the specter of renewed tariffs on European or Chinese goods under a possible Trump administration could stir up inflation in the US. If the Fed continues its cautious approach — or even tilts hawkish in response — the USD could strengthen further, keeping EUR/USD under pressure.

A looser ECB, a cautious Fed

On the monetary policy front, the Federal Reserve (Fed) cut its benchmark interest rate by 25 basis points at its November 7 meeting, bringing the Fed Funds Target Range (FFTR) to 4.75%-5.00%. This widely expected move is part of the Fed’s ongoing effort to steer inflation closer to its 2% target. However, cracks are beginning to appear in the labour market, even as unemployment rates remain near historic lows.

Fed Chair Jerome Powell struck a cautious tone in his latest remarks, signalling that the central bank is in no rush to lower rates further. This has dampened speculation about a December rate cut while simultaneously providing additional support for the Dollar.

Other Fed officials, notably Governor Michelle Bowman, echoed Powell’s sentiment, emphasising the need for restraint when considering future rate reductions.

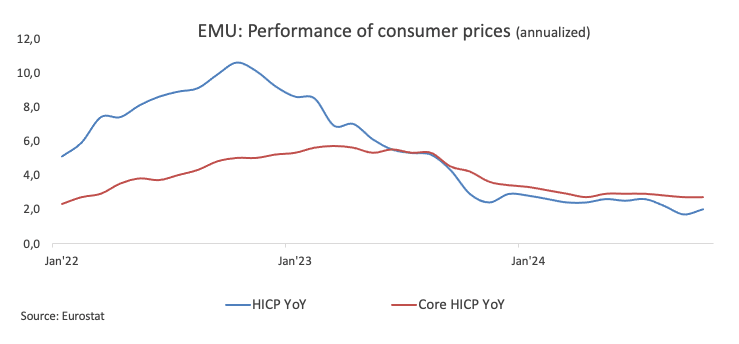

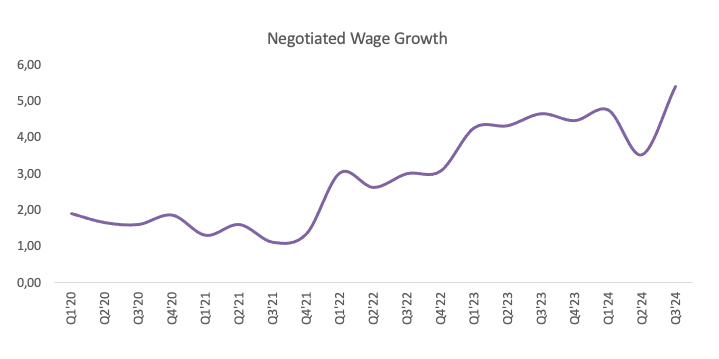

Meanwhile, across the Atlantic, a dovish narrative continues to dominate among European Central Bank (ECB) policymakers, despite October’s uptick in the Harmonised Index of Consumer Prices (HICP) and higher Negotiated Wage Growth in the third quarter.

So far, markets are pricing in approximately 75 basis points of easing by the Fed over a 12-month horizon, compared to around 150 basis points of rate reductions expected from the ECB within the same period.

Techs on EUR/USD

Further losses could push EUR/USD down to its 2024 low of 1.0331 (November 22). The breakdown of this level could open the door to a probable visit to the weekly lows of 1.0290 (November 30 2022) and 1.0222 (November 21).

On the upside, there is minor resistance at the weekly top of 1.0606 (November 18), seconded by the critical 200-day Simple Moving Average (SMA) at 1.0857.

It is worth noting that the short-term technical outlook remains bearish as long as the pair stays below the latter.

Furthermore, the daily Relative Strength Index (RSI) entered the oversold region near 16, while the Average Directional Index (ADX) at nearly 49 indicates a strong trend.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.80% | 0.66% | 0.20% | 0.14% | 0.37% | 0.72% | 0.93% | |

| EUR | -0.80% | -0.13% | -0.60% | -0.66% | -0.43% | -0.08% | 0.13% | |

| GBP | -0.66% | 0.13% | -0.45% | -0.52% | -0.29% | 0.05% | 0.26% | |

| JPY | -0.20% | 0.60% | 0.45% | -0.07% | 0.16% | 0.49% | 0.72% | |

| CAD | -0.14% | 0.66% | 0.52% | 0.07% | 0.22% | 0.58% | 0.79% | |

| AUD | -0.37% | 0.43% | 0.29% | -0.16% | -0.22% | 0.35% | 0.56% | |

| NZD | -0.72% | 0.08% | -0.05% | -0.49% | -0.58% | -0.35% | 0.21% | |

| CHF | -0.93% | -0.13% | -0.26% | -0.72% | -0.79% | -0.56% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.