EUR/USD: There is still a lack of buying intent on euro dollar [Video]

![EUR/USD: There is still a lack of buying intent on euro dollar [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/euro-or-dollar-3353142_XtraLarge.jpg)

EUR/USD

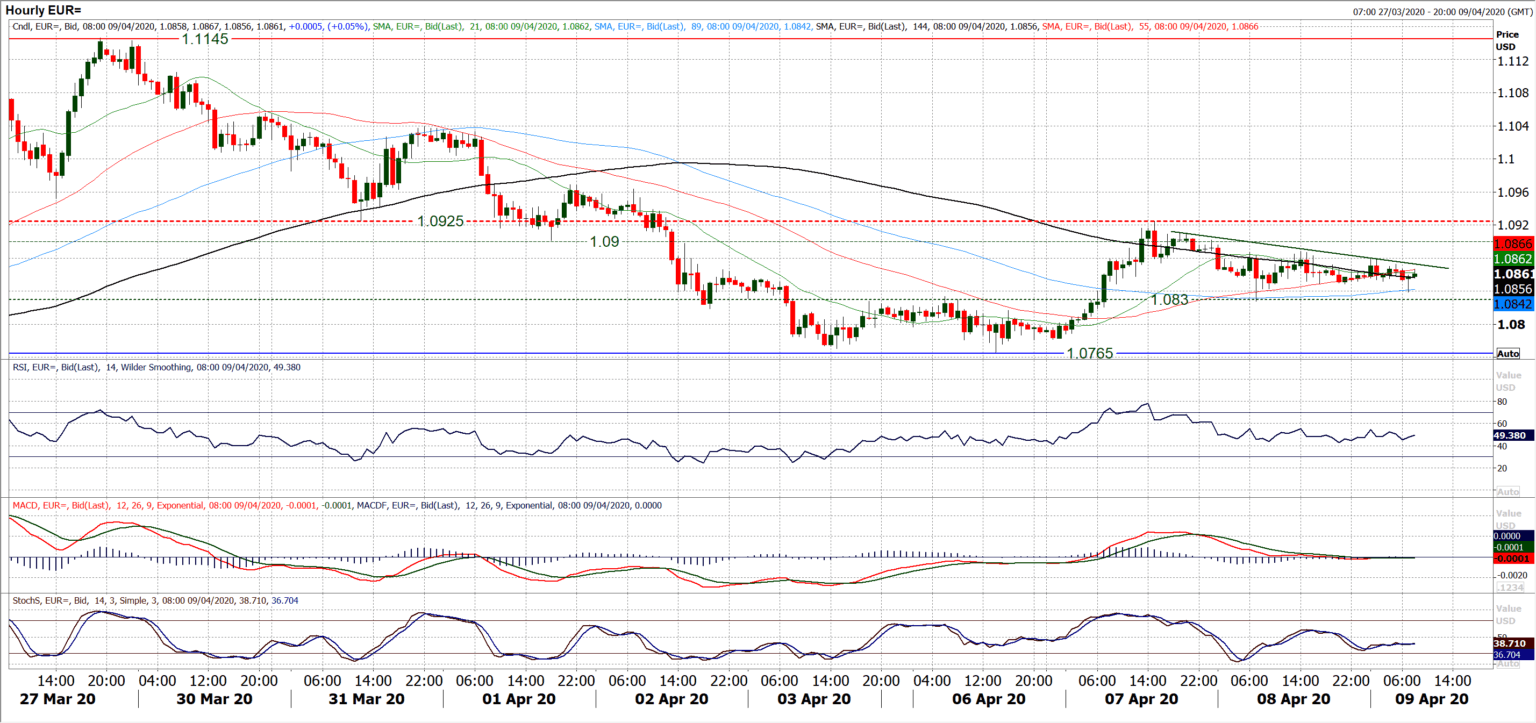

The recovery impetus that could have been garnered from Tuesday’s strong bull candle has ebbed away in the past 36 hours. Although the selling pressure has been curbed this week, it is also true to say that there is still a lack of buying intent on EUR/USD. This is tempering momentum indicators where there is a calming within a continued negative bias. All indicators are flattening under their neutral points, whilst the market is consolidating under all the falling moving averages. Perhaps there is an element of calm ahead of a Thursday storm (EuroGroup meeting to discuss debt mutualisation, and US Weekly Jobless Claims), but looking on the hourly chart there is a clear consolidation now between $1.0830/$1.0925. The resistance overhead is sizeable near term as a big band of overhead supply sits between $1.0900/$1.0970, but the bulls have also held on to the support of a near term breakout around $1.0830. We still favour downside pressure below $1.0830 for another test of $1.0765 in due course, but for now the market sits in wait.

Author

Richard Perry

Independent Analyst