Key Highlights

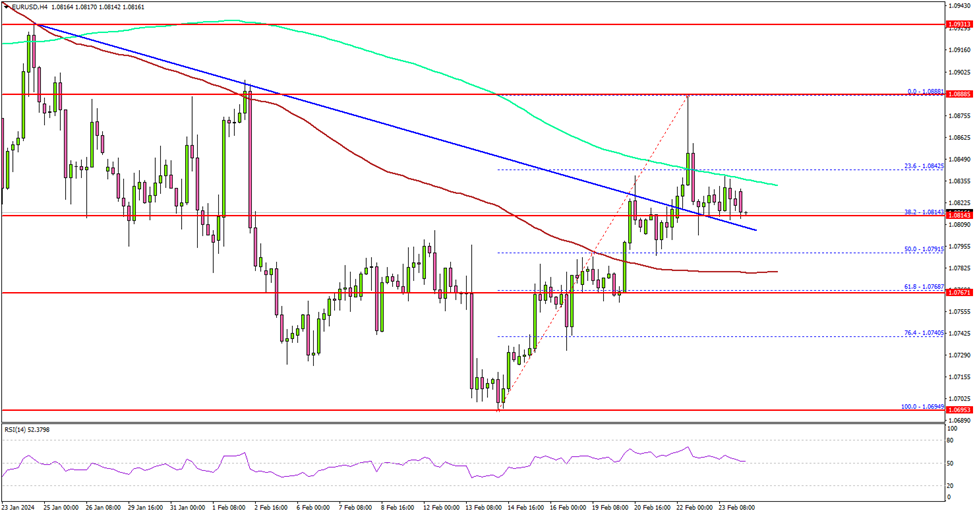

- EUR/USD is attempting a fresh increase toward the 1.0930 resistance.

- It broke a major bearish trend line with resistance at 1.0815 on the 4-hour chart.

EUR/USD Technical Analysis

Looking at the 4-hour chart, the pair traded above a major bearish trend line with resistance at 1.0815. There was a move above the 1.0850 level, but the bears faced resistance near the 1.0885 level. A high was formed near 1.0888 and the pair is now well above the 100 simple moving average (red, 4-hour).

However, the pair failed to settle above the 200 simple moving average (green, 4-hour). On the upside, the pair is facing resistance near the 1.0840 level.

A close above the 1.0840 zone could open the doors for more upsides. The next stop for the bulls might be 1.0885. Any more gains might send EUR/USD toward 1.0930.

Immediate support is near the 1.0800 level. The first major support sits near the 1.0780 level and the 100 simple moving average (red, 4-hour). The next major support sits at 1.0765, below which the pair might gain bearish momentum. In the stated case, the pair could even visit the 1.0720 support level.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.