EUR/USD Price Forecast: The outlook should shift to bearish below 1.0873

- EUR/USD extended its bearish move to fresh lows near 1.0880 on Tuesday.

- The US Dollar gathered further upside traction, always above 103.00.

- The ECB is largely expected to reduce its policy rate by 25 basis points.

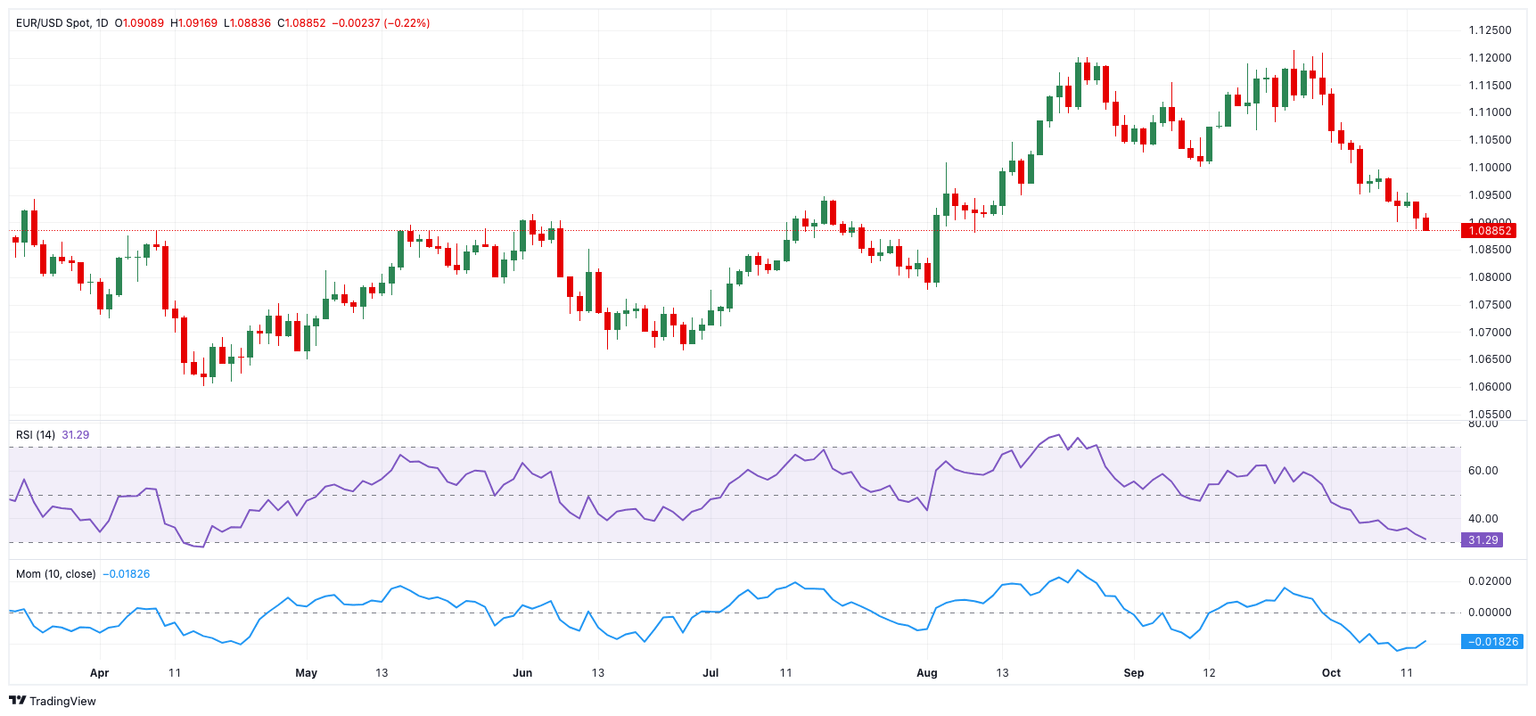

EUR/USD extended its losses on turnaround Tuesday, dipping to fresh two-month lows near 1.0880, just pips away from the critical 200-day Simple Moving Average (SMA).

Simultaneously, the US Dollar (USD) continued to strengthen, albeit modestly, encouraging the US Dollar Index (DXY) to keep its business around multi-week highs north of the 103.00 hurdle.

Supporting the greenback's rally in past weeks were the Minutes from the Federal Open Market Committee (FOMC) meeting on September 18. The minutes revealed that a "substantial majority" of policymakers favoured easing monetary policy with a 50-basis-point cut, but without committing the Federal Reserve to a specific timeline for future cuts.

Many Federal Reserve (Fed) policymakers are leaning toward a 25 basis point rate cut next month, though some dissenting views have been expressed by FOMC Governor Michelle Bowman and Atlanta Fed President Raphael Bostic, who suggested the Fed might skip a cut in November.

Meanwhile, the CME Group’s FedWatch Tool indicates that markets are currently pricing in an 88% probability of a 25-basis-point cut next month.

On the other side of the Atlantic, the European Central Bank (ECB) has taken a more cautious approach. In her latest remarks, ECB President Christine Lagarde acknowledged that while inflation remains elevated in the Eurozone, the impact of restrictive monetary policies is beginning to ease, which could support economic growth. The ECB aims to bring inflation down to its 2% target by 2025.

Recently, ECB board member Yannis Stournaras advocated for two rate cuts this year, with further easing expected by 2025. François Villeroy also hinted at a possible rate cut soon, while Peter Kazimir urged caution, preferring more data before making decisions in December. Gabriel Makhlouf warned of inflation risks driven by wage growth and sustained service-sector inflation, despite expectations of inflation easing to 2% by late next year.

Eurozone inflation, measured by the Harmonized Index of Consumer Prices (HICP), fell to 1.8% year-over-year in September, below the ECB's target. Coupled with stagnant GDP growth in the region, this has further reinforced the case for extra ECB rate cuts.

As both the Fed and ECB consider additional rate moves, the EUR/USD outlook will hinge on macroeconomic trends. The US economy is anticipated to outperform the Eurozone, potentially bolstering the USD further.

In terms of market positioning, speculators have reduced their net long positions in the EUR to an eight-week low of around 39K contracts, while commercial traders have increased net short positions to levels unseen since late July. Additionally, open interest has fallen for the second week in a row.

EUR/USD daily chart

EUR/USD short-term technical outlook

Further declines might push the EUR/USD to its October low of 1.0883 (October 15), which aligns with the weekly low of 1.0881 (August 8).

On the upside, the 55-day SMA at 1.1039 acts as a temporary hurdle before the 2024 high of 1.1214 (September 25), followed by the 2023 top of 1.1275 (July 18) and the 1.1300 round mark.

Meanwhile, the pair's outlook could shift to bearish on a sustained breakdown of the critical 200-day SMA of 1.0873.

The four-hour chart currently indicates a deteriorating downward trend. Against this, early support is at 1.0883, just ahead of 1.0881 and 1.0777. On the upside, there is interim hurdle at the 55-SMA at 1.0960 ahead of 1.0996 and the 100-SMA of 1.1039. The relative strength index (RSI) dropped to about 33.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.