EUR/USD Price Forecast: Strong resistance emerged just above 1.1200

- EUR/USD failed once again to extend the uptrend beyond 1.1200.

- The US Dollar rebounded markedly and tested two-day highs.

- Fed’s Chair Powell sees an extra 50 basis points of easing this year.

EUR/USD added to Friday’s retracement, surrendering nearly a cent from daily tops past the 1.1200 barrier and receding to the 1.1110 region towards the end of the NA session on Monday.

The marked decline in the pair came in response to an equally strong bounce in the US Dollar (USD), which managed to reverse an initial drop to the 100.15 region when gauged by the US Dollar Index (DXY). Accompanying the move in the Greenback, US yields rose across the spectrum, reaching the upper end of the recent range.

In the meantime, the risk-linked galaxy failed to gather extra steam despite the recent announcements of a stimulus package in the Chinese economy, which should help that economy finally pick up some pace.

In terms of monetary policy, market participants continued to anticipate further easing from the Federal Reserve (Fed) during its November and December meetings, all in tandem with the still unabated optimism for a soft landing for the US economy.

Following the FOMC meeting, uncertainty remains regarding whether the September rate cut will be repeated. The updated "dot plot" points to an additional 50 basis points of cuts this year. Fed Chair Jerome Powell emphasized that the recent rate cut was not a response to panic, clarifying the rationale behind the decision.

On Monday, Federal Reserve Chair Jerome Powell argued that the US economy seems positioned for a continued slowdown in inflation, which would allow the Fed to reduce its benchmark interest rate and eventually reach a neutral level that no longer constrains economic activity. His remarks did not signal a specific inclination toward speeding up or slowing down the pace of rate cuts.

Meanwhile, the European Central Bank (ECB) decided to ease monetary policy at its September gathering, influenced by its assessment of inflation and economic conditions. Although the ECB did not signal a rate cut for October, it acknowledged that domestic inflation remains elevated. ECB President Christine Lagarde highlighted that the diminishing impact of restrictive monetary policy could benefit the economy, with inflation expected to return to 2% by 2025, though she maintained a cautious stance on further actions.

Still around the central bank, President Christine Lagarde expressed growing confidence that inflation will return to the bank’s 2% target, a development that is expected to be reflected in the ECB's October policy decision.

Looking ahead, should the Fed proceed with additional rate cuts, the policy gap between the Fed and the ECB may narrow, potentially supporting EUR/USD. This scenario appears likely as markets anticipate two more rate cuts from the ECB and between 100 and 125 basis points of easing from the Fed over the next 12 months.

However, the long-term outlook suggests that the US economy is expected to outperform the European economy, which may limit any substantial or prolonged weakness in the dollar.

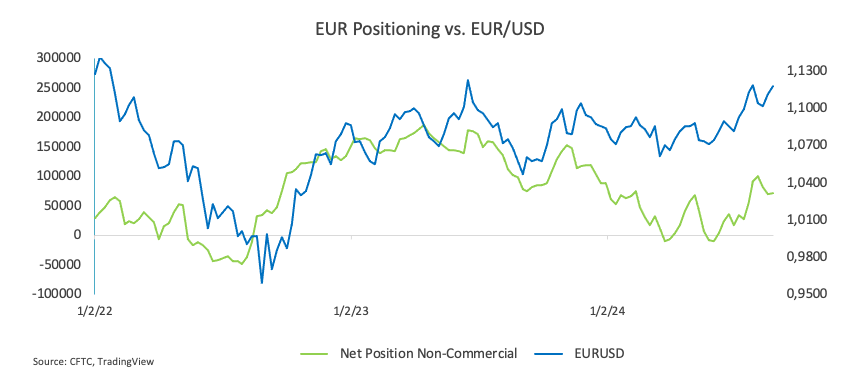

On another front, Non-commercial net long positions in the Euro climbed to their highest level in two weeks, with commercial players maintaining almost unchanged net short positions and a slight increase in open interest. EUR/USD moved in a volatile manner, though it exhibited a modest upward trend in the upper 1.1100 range during the time under scrutiny.

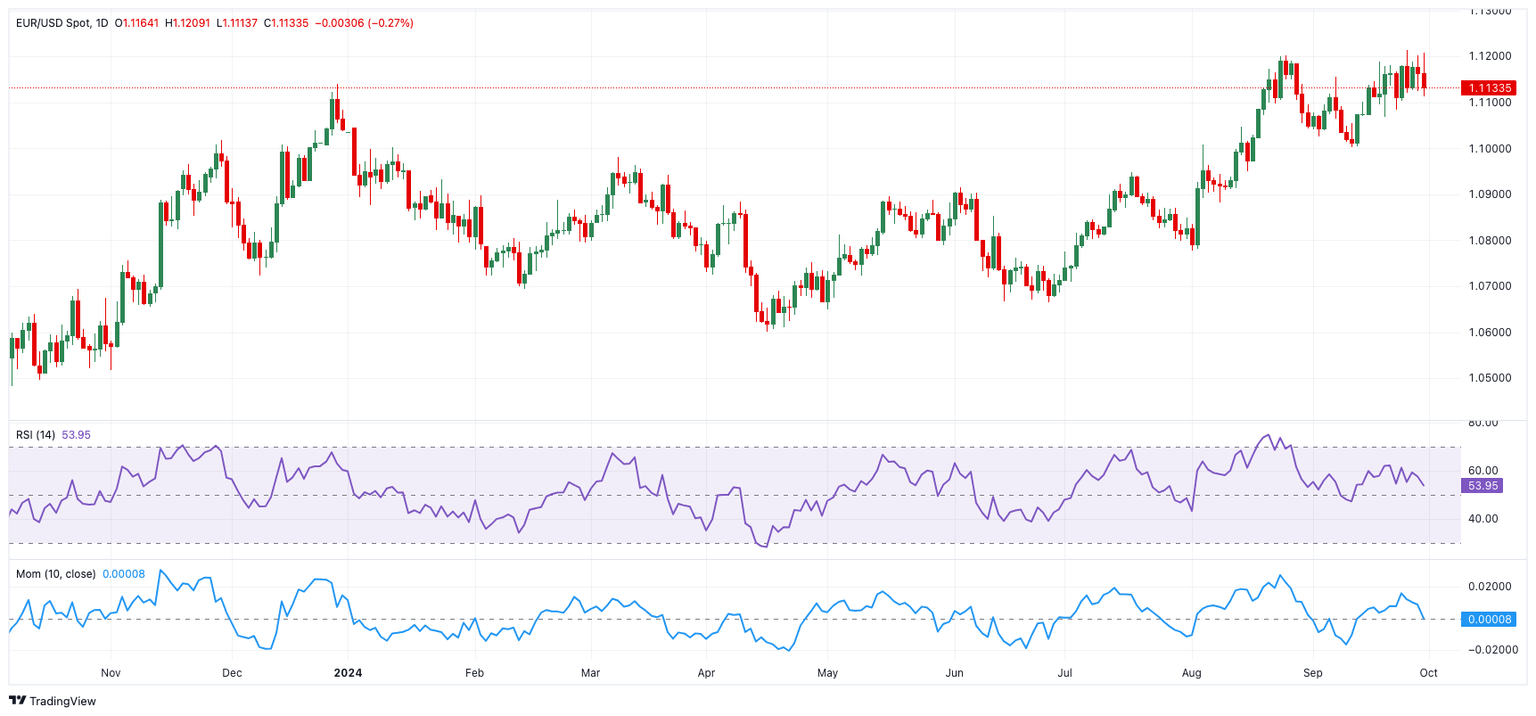

EUR/USD daily chart

EUR/USD short-term technical outlook

Further EUR/USD increases are expected to encounter initial resistance at the 2024 top of 1.1214 (September 25), followed by the 2023 peak of 1.1275 (July 18).

The pair's next downward target is the provisional 55-day SMA at 1.1019, prior to the September low of 1.1001 (September 11), and the weekly low of 1.0881 (August 8).

Meanwhile, the pair's upward trend is projected to continue as long as it remains above the key 200-day SMA at 1.0874.

The four-hour chart indicates a resurgence of the negative tendency. The initial resistance level remains at 1.1214, then 1.1275. On the other side, initial contention is at 1.1113, followed by the 200-SMA at 1.1101 and then 1.1082. The relative strength index (RSI) tumbled to around 45.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.