EUR/USD Price Forecast: Some consolidation appears likely ahead of data

- EUR/USD bounced to weekly highs near the 1.1100 hurdle.

- Further easing of the US labour market hurt the Dollar.

- Markets’ attention now shifts to ADP and weekly Claims.

EUR/USD faced renewed upward pressure and rose to levels just shy of 1.1100 the figure on Wednesday, bolstered by the resurgence of strong selling pressure in the US Dollar (USD) in response to disappointing results in the US labour market.

In fact, the US Dollar Index (DXY) came under pressure and flirted with four-day lows near 101.20 after JOLTs Job Openings missed expectations in July, showing further easing in the labour market and fanning the flames of a potential larger interest rate cut by the Federal Reserve (Fed) at its meeting on September 18.

On the latter, investors are carefully monitoring hints about the size of the Fed's anticipated interest rate cut this month, particularly after Fed Chair Jerome Powell suggested it might be time to adjust monetary policy in his comments at the Jackson Hole event, adding that, barring unexpected events, the labour market is unlikely to significantly add to inflationary pressures soon. He also emphasized that the Fed does not want to see further cooling in labour market conditions.

Also dragging on the greenback, Atlanta Federal Reserve President Raphael Bostic cautioned on Wednesday that if the Fed keeps interest rates too high for too long, employment might suffer considerably.

In light of this, the upcoming US Nonfarm Payrolls (NFP) report will be particularly crucial following the Fed's shift from focussing on fighting inflation to preventing job losses, as the employment data could shape the extent of the expected rate cut by the Fed.

According to the CME Group's FedWatch Tool, there is around a 57% chance of a 25 bps rate cut in September, from nearly 70% just a few days ago.

Across the street, the European Central Bank's (ECB) latest Minutes revealed that policymakers did not see a compelling reason to cut interest rates last month, though they warned that this could be reconsidered in September due to the ongoing effects of high rates on economic growth.

However, recent reports suggest growing divisions among ECB policymakers regarding the growth outlook, which could affect future rate cut discussions. Some are worried about a possible recession, while others are focused on ongoing inflationary pressures.

Furthermore, Governing Council member Kazaks reiterated that interest rates need to be lowered and mentioned that the debate is focused on the pace and magnitude of the cuts. Executive Board member Cipollone cautioned that there is a genuine risk of the current policy stance becoming too restrictive. Governing Council member Stournaras remarked that even after rate cuts, the policy would still remain restrictive. Meanwhile, Governing Council member Simkus indicated that there is a strong case for a rate cut in September but highlighted that cutting rates in October or by more than 25 bps is quite unlikely.

That said, lower-than-expected flash CPI data for August in Germany and the Eurozone could challenge the cautious approach of some officials, possibly opening the door for the central bank to consider another rate cut at its meeting on September 12.

In summary, if the Fed decides on additional or larger rate cuts, the policy gap between the Fed and the ECB could narrow in the medium to long term, potentially benefiting EUR/USD. This is particularly likely as markets expect two more rate cuts from the ECB this year.

However, over the longer term, the U.S. economy is projected to outperform Europe's, which could limit any prolonged weakness in the dollar.

Finally, speculators (non-commercial traders) have increased their net long positions in the Euro (EUR) to levels not seen since January, while commercial players (such as hedge funds) have boosted their net short positions to multi-month highs, driven by a notable rise in open interest.

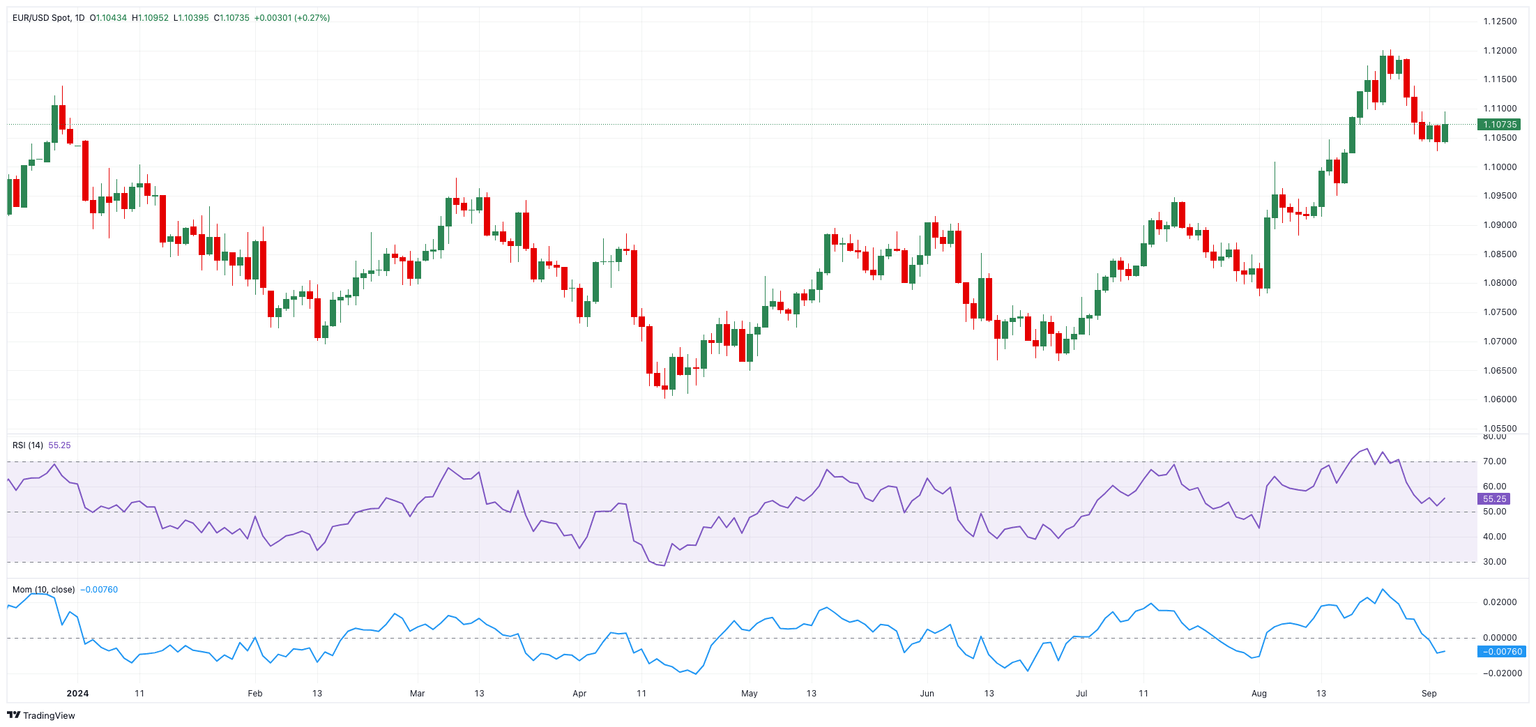

EUR/USD daily chart

EUR/USD short-term technical outlook

Further north, the EUR/USD is expected to challenge its 2024 high of 1.1201 (August 26), followed by the 2023 top of 1.1275 (July 18) and the round level of 1.1300.

The pair's next downward target is the preliminary 55-day SMA at 1.0910, which is ahead of the weekly low of 1.0881 (August 8) and the critical 200-day SMA at 1.08554. The weekly low of 1.0777 (August 1) comes next, followed by the June low of 1.0666 (June 26) and the May bottom of 1.0649 (May 1).

Meanwhile, the pair's rising trend is expected to continue as long as it is above the important 200-day SMA.

The four-hour chart shows a return to positive sentiment. Initial resistance comes at 1.1095, prior to the 55-SMA at 1.1106 and then 1.1139. Instead, there is immediate support at 1.1026, ahead of the 200-SMA of 1.0978, and then 1.0949. The relative strength index (RSI) rose to around 51.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.