EUR/USD Price Forecast: Slides as Fed signals slower easing pace

- EUR/USD settles at 1.0317, reflecting modest losses due to the Fed's potential slowdown in monetary easing.

- US labor data outperforms with jobless claims dropping, adding to Dollar strength amid global economic uncertainties.

- European economic data disappoints, with Germany's Factory Orders and Eurozone Retail Sales lagging, pressuring the Euro.

The EUR/USD pair ended Wednesday’s session with modest losses of 0.21% as the US Federal Reserve (Fed) released its December meeting minutes. There, officials hinted that the pace of easing should be slowed. The pair trades at 1.0317.

Euro falls against a stronger Dollar after Federal Reserve minutes hint at a cautious approach to rate cuts

The minutes revealed that officials see inflation heading towards its 2% goal. Yet, they stated, "The effects of potential changes in trade and immigration policy suggested that the process could take longer than previously anticipated."

Some policymakers suggested holding rates due to “persistently elevated inflation,” but most of the FOMC Committee agreed to lower rates by 25 basis points. However, they acknowledged that they were “at or near the point at which it would be appropriate to slow the pace of policy easing.”

Data-wise, the US Department of Labor, revealed that Initial Jobless Claims for the week ending January 3 fell to 201K from 211K, below estimates of 218K. Before this report, Automatic Data Processing (ADP) revealed that private companies hired 122K people, below 140K foreseen by economists.

During the North American session, CNN revealed that US President-elect Donald Trump is considering a national economic emergency declaration, which would allow him to impose tariffs on adversaries and allies.

In the European session, Germany revealed that Factory Orders plunged 5.4% MoM in November, deteriorating further compared to a year earlier 1.7% collapse. Other data showed that Retail Sales shrank 0.6%, below the anticipated 0.5% expansion.

Meanwhile, the Eurozone revealed that Consumer Confidence held at -14.5 in December, while the Producer Price Index (PPI) rose more than anticipated in November.

Given the backdrop, the US Dollar Index (DXY), which measures the Greenback’s performance against a basket of six currencies, holds to earlier gains of 0.29% yet dropped below the 109.00 figure.

Consequently, the EUR/USD dropped as traders priced in fewer rate cuts in 2025. The December 2025 Fed funds rate futures contract suggests the Fed could cut rates by 54 basis points (bps) towards the end of the year.

This week, the Eurozone economic docket will feature Retail Sales, while US financial markets will be on holiday on Thursday.

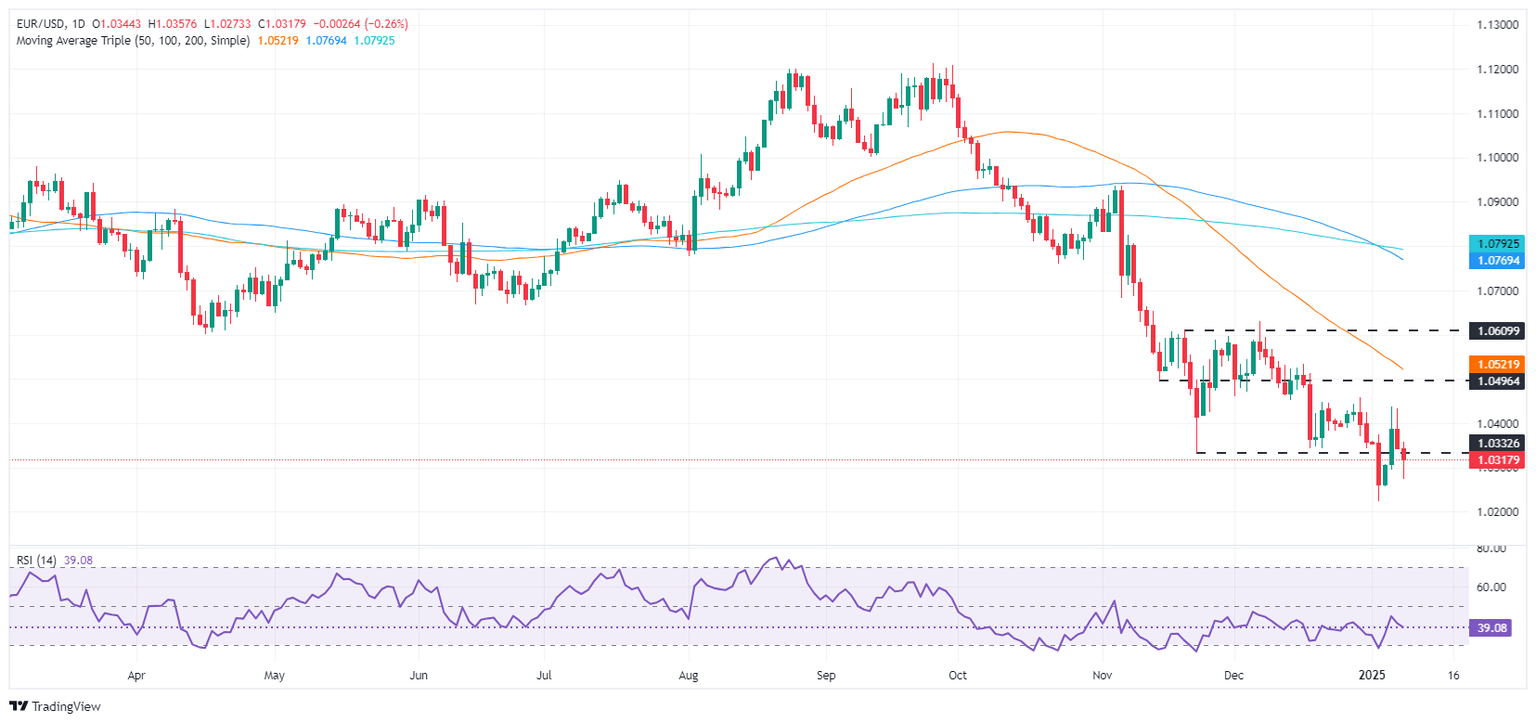

EUR/USD Technical Analysis

The EUR/USD daily chart suggests the downtrend has stalled after forming a ‘tweezers top’ chart pattern, which paved the way for printing a weekly low of 1.0272. Nevertheless, sellers failed to keep buyers beneath 1.0300, opening the door for consolidation around 1.0300 – 1.0350. A breach of the top of the range could open the door to challenging 1.0400.

Conversely, if EUR/USD drops below 1.0300, the first support would be 1.0272, followed by the January 2 swing low of 1.0222.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.