EUR/USD Price Forecast: Sellers take control and aim for lower lows

EUR/USD Current price: 1.1082

- The Eurozone Harmonized Index of Consumer Prices rose 1.8% in the year to September.

- Multiple Federal Reserve officials will hit the wires during American trading hours.

- EUR/USD is bearish in the near term, may extend its slide towards 1.1000.

The EUR/USD pair falls for a third consecutive day, trading below the 1.1100 ahead of Wall Street's opening. The US Dollar (USD) benefits from a sour market mood and comments from Federal Reserve (Fed) Chair Jerome Powell. Powell cooled down expectations for another 50 basis points (bps) interest rate cut on Monday, as he said the central bank is in no hurry to cut rates quickly.

In the meantime, the Eurozone published the preliminary estimate of the September Harmonized Index of Consumer Prices (HICP), which rose 1.8% in the twelve months to September, down from the 2.2% posted in August. On a monthly basis, the index was down 0.1%. Softer-than-anticipated inflation figures allow the European Central Bank (ECB) to proceed with additional monetary loosening, weighing on the Euro.

Across the Atlantic, the United States (US) has a busy session, as it will publish the Job Openings and Labor Turnover Survey (JOLTS) and the ISM Manufacturing Index for September. Additionally, multiple Fed officials will be on the wires.

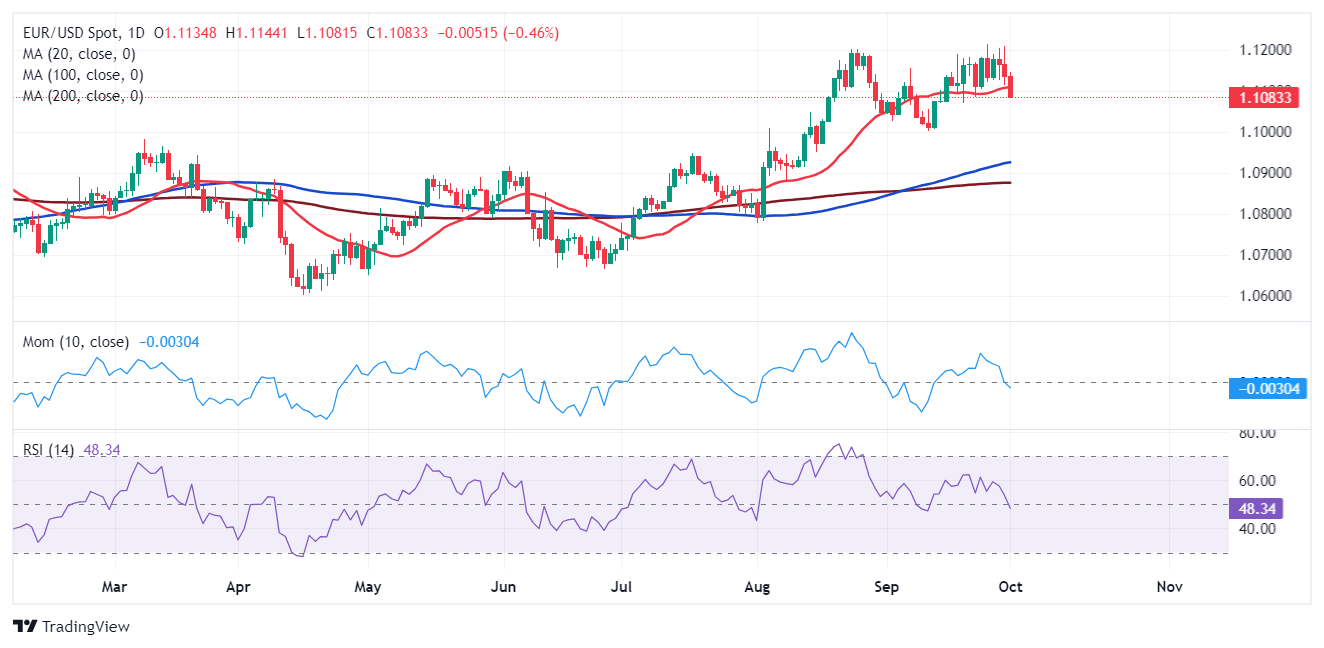

EUR/USD short-term technical outlook

From a technical point of view, the EUR/USD pair seems poised to extend its slump. In the daily chart, the pair has broken below its 20 Simple Moving Average (SMA) now providing dynamic resistance at around 1.1105. At the same time, the pair holds above the 100 and 200 SMAs, which limits the bearish potential. Finally, technical indicators have turned south, reflecting persistent selling interest. The Relative Strength Index (RSI) indicator stands at around 48, already within negative levels and in line with lower lows ahead.

In the near term, and according to the 4-hour chart, the bearish case is even clearer. The EUR/USD pair is currently developing below all its moving averages, with intraday sellers now aligned around the 100 SMA in the 1.1110 price zone. Technical indicators, in the meantime, head firmly lower within negative levels, anticipating another leg south.

Support levels: 1.1075 1.1040 1.1000

Resistance levels: 1.1110 1.1150 1.1200

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.