EUR/USD Price Forecast: Needs to find acceptance above 1.1165-70 for bulls to regain control

- EUR/USD attracts some dip-buyers following Monday’s dismal Eurozone PMIs-inspired slide.

- Dovish Fed expectations prompt fresh USD selling and offer some support to the currency pair.

- The upside seems limited as traders are likely to wait for more cues about the Fed’s rate-cut path.

The EUR/USD pair edges higher on Tuesday and for now, seems to have stalled the previous day's downfall that followed the disappointing data, which showed that the Eurozone business activity contracted more than expected in September. In fact, S&P Global's PMI flash Composite Eurozone PMI contracted for the first time in seven months and sank to 48.9 in September from the previous month's final print of 51.0. The survey showed that Germany and France – the currency union's two largest economies – were largely responsible for the slump. This, in turn, lifted bets for a cut of at least 25 basis points (bps) at the European Central Bank's (ECB) October meeting and weighed heavily on the shared currency, which registered its biggest daily fall against the US Dollar (USD) in more than three months.

In contrast, the US Composite PMI revealed that business activity was steady in September and came in at 54.4, slightly down from 54.6 registered in August. Additional details of the report showed that average prices charged for goods and services rose at the fastest pace in six months, pointing to a possible acceleration in inflation in the coming months. This, in turn, provided a modest boost to the Greenback and contributed to the EUR/USD pair's downfall. That said, expectations for more aggressive policy easing by the Federal Reserve (Fed) keep a lid on any meaningful USD appreciating move and assist the EUR/USD pair to regain some positive traction. According to the CME Group's FedWatch Tool, market participants are now pricing in another oversized rate cut at the November FOMC meeting.

Furthermore, the Fed is expected to lower borrowing costs by 125 bps in 2024 and the speculations were further fueled by the overnight comments by a slew of influential FOMC members. Minneapolis Fed President Neel Kashkari noted that the balance of risks had shifted away from higher inflation and toward the risk of a further weakening of the labor market, warranting a lower federal funds rate. Furthermore, Atlanta Fed President Raphael Bostic said that the recent data show convincingly that the US is on a sustainable path to price stability and that risks to the labour market have increased. Separately, Chicago Fed President Austan Goolsbee said that the labor market deterioration typically happens quickly and that keeping rates high does not make sense when you want things to stay where they are.

This, along with the underlying strong bullish sentiment across the global equity markets, undermines the safe-haven buck and acts as a tailwind for the EUR/USD pair. Traders, however, seem reluctant and might opt to wait for more cues about the Fed's rate-cut path before positioning for the next leg of a directional move. Hence, the focus will remain glued to the release of the US Personal Consumption Expenditures (PCE) Price Index on Friday. In the meantime, traders on Tuesday will take cues from a scheduled speech by Fed Governor Michelle Bowman and US macro data – the Conference Board's Consumer Confidence Index and the Richmond Manufacturing Index. Apart from this, Deutsche Bundesbank President Joachim Nagel's speech might further contribute to producing short-term trading opportunities.

Technical Outlook

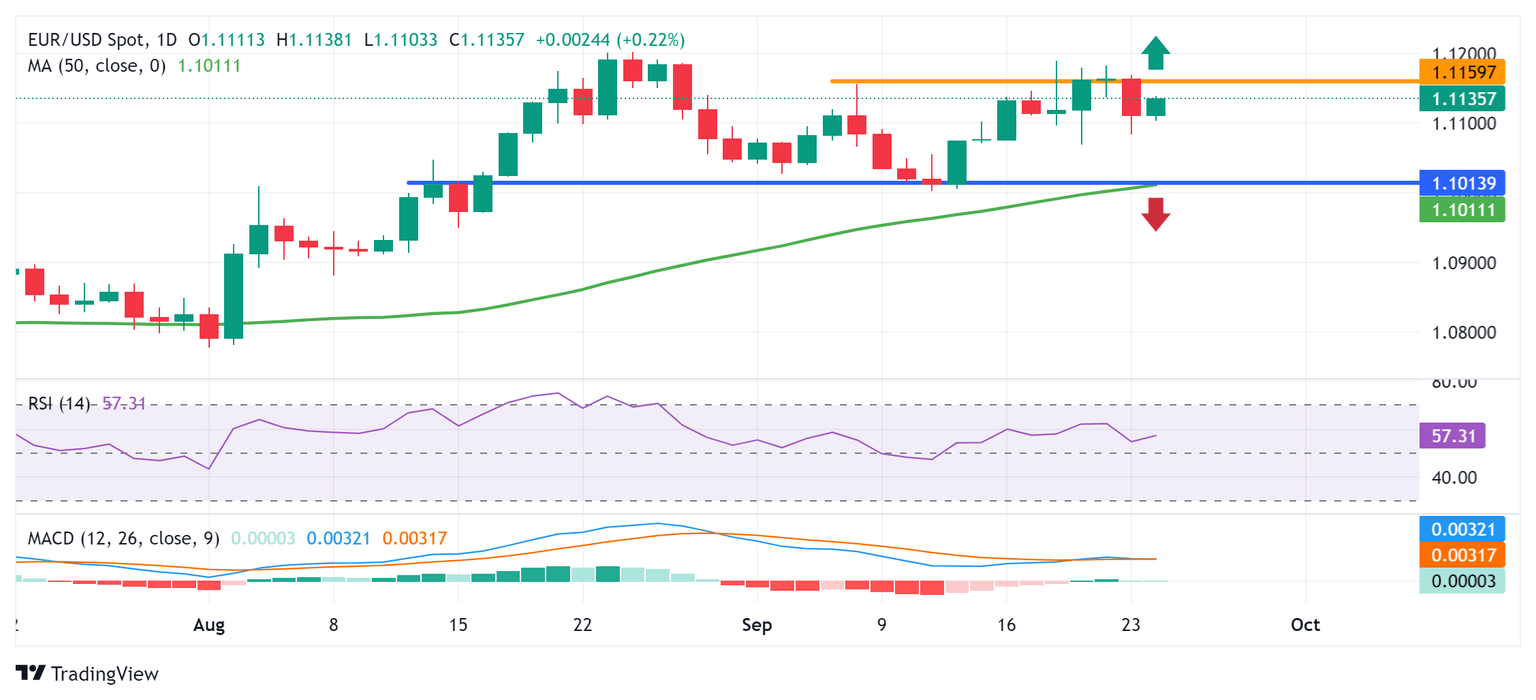

From a technical perspective, any subsequent move-up is likely to confront some resistance near the 1.1165-1.1170 supply zone. This is followed by the YTD peak, around the 1.1200 round-figure mark touched in August, which if cleared decisively will be seen as a fresh trigger for bullish traders. Given that oscillators on the daily chart – though have been losing traction – are still holding with a mild positive bias, the EUR/USD pair might then prolong its recent upward trajectory witnessed over the past three months or so.

On the flip side, the 1.1100 round figure now seems to protect the immediate downside ahead of the overnight swing low, around the 1.1085-1.1080 region. Some follow-through selling might expose the 50-day Simple Moving Average (SMA) support, currently pegged near the 1.1020 zone. This is closely followed by the 1.1000 psychological mark, which if broken decisively will suggest that the EUR/USD pair has topped out and pave the way for deeper losses. The subsequent corrective fall could drag spot prices to the 1.0950-1.0940 region.

EUR/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.