EUR/USD Price Forecast: Bears retain control near YTD low, around 1.0600 ahead of US CPI

- EUR/USD drifts lower for the fourth straight day and is pressured by a combination of factors.

- The political uncertainty in the Eurozone’s largest economy continues to undermine the Euro.

- The USD stands firm near a multi-month top amid optimism over Trump’s proposed policies.

- Traders now look to the US CPI for Fed rate-cut cues and before placing fresh directional bets.

The EUR/USD pair trades with a negative bias for the fourth straight day on Wednesday and is placed just above its lowest level since November 2023 touched the previous day. The downfall is sponsored by a bullish US Dollar (USD), which stands firm near a multi-month peak amid the optimism over strong economic growth under a second Trump presidency and turns out to be a key factor weighing on the currency pair. Meanwhile, US President-elect Donald Trump's proposed expansionary policies should put upward pressure on inflation and restrict the Federal Reserve (Fed) from cutting interest rates more aggressively. The bets were reaffirmed by comments by Fed officials, which remain supportive of elevated US Treasury bond yields and continue to boost the buck.

Richmond Fed President Tom Barkin said on Tuesday that inflation might be coming under control, though the path remains uncertain and that the core gauge might give a signal that it risks getting stuck above the central bank's 2% target. Separately, Minneapolis Fed President Neel Kashkari noted that any upside surprise in inflation in the weeks leading up to the December FOMC meeting could encourage the central bank to pause interest rate cuts. Hence, the market focus will remain glued to the release of the US Consumer Price Index (CPI) report due later today. The headline CPI is expected to have risen by 0.2% in October and by 2.6% over the past 12 months, up from 2.4% in the prior month, while the core CPI is anticipated to remain steady at the 3.3% YoY rate.

Heading into the key data risk, a softer risk tone is seen as another factor underpinning the Greenback's relative safe-haven status. Against the backdrop of the underwhelming response to China's fiscal stimulus, worries over Trump's promised trade tariffs and their impact on the global economy temper investors' appetite for riskier assets. Apart from this, the collapse of the governing coalition in Germany – the Eurozone's largest economy – adds a layer of uncertainty, which continues to weigh on the shared currency and contributes to the offered tone surrounding the EUR/USD pair. This, in turn, suggests that the path of least resistance for spot prices is to the downside and supports prospects for an extension of the post-US election fall witnessed over the past week or so.

Technical Outlook

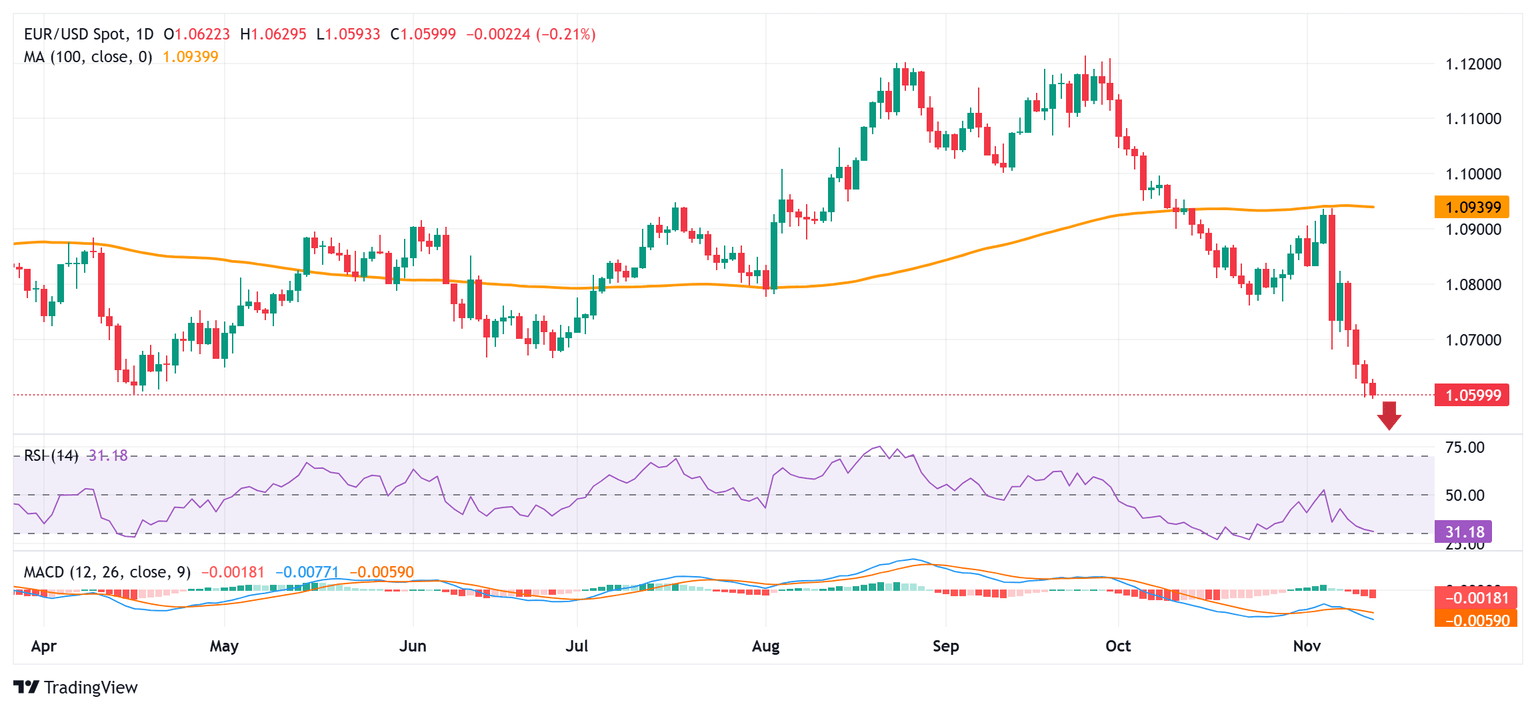

From a technical perspective, the Relative Strength Index (RSI) on the daily chart has moved on the verge of breaking into the oversold zone. This, along with the overnight failure to find acceptance below the 1.0600 mark, warrants some caution for bearish traders. Hence, it will be prudent to wait for some near-term consolidation or a modest rebound before positioning for any further losses.

In the meantime, any attempted recovery beyond the 1.0625-1.0630 immediate hurdle is likely to confront resistance near the overnight swing high, around the 1.0660-1.0665 region. Some follow-through buying should allow the EUR/USD pair to reclaim the 1.0700 mark. Any further move up, however, might be seen as a selling opportunity and remain capped near the $1.0760-1.0765 area.

On the flip side, sustained weakness below the 1.0600 mark has the potential to drag the EUR/USD pair further towards the 1.0565-1.0560 intermediate support en route to the 1.0500 psychological mark. Some follow-through selling could accelerate the downfall further towards challenging the 2023 yearly swing low, around the 1.0450-1.445 region.

EUR/USD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.