EUR/USD Price Forecast: Bears becoming more courageous

EUR/USD Current price: 1.0281

- The ECB monetary policy meeting accounts were dovish, weighing on the Euro.

- Tepid United States data backed risk aversion and benefits the Greenback.

- EUR/USD could retest the year low on a break below 1.0260.

The EUR/USD pair traded lifeless a handful of pips below the 1.0300 mark on Thursday, as investors see no benefit in adding EUR longs. Tepid European data and a dovish European Central Bank (ECB), keep the upside in check, regardless of recent US Dollar (USD) weakness.

Data-wise, Germany confirmed that the December Harmonized Index of Consumer Prices (HICP) rose by 2.8% year-on-year (YoY), as expected. The index was up 0.7% on a monthly basis, also matching the market forecast.

The ECB released the Minutes of the December meeting, which showed that members were increasingly confident that inflation would return to target in the first half of 2025. However, the document also showed that geopolitical and economic policy uncertainty had become more pronounced since the last governing council meeting, while some members considered a 50 basis points (bps) interest rate cut.

Other than that, the sentiment was mostly optimistic, as investors lifted bets for a Federal Reserve (Fed) interest rate cuts following encouraging inflation figures. Asian shares were up, while most European indexes trade in the green.

As for the United States (US), the country published December Retail Sales, which rose a modest 0.4%, below the 0.6% expected and the previously revised 0.8%. At the same time, the US reported that Initial Jobless Claims for the week ended January 10 increased by 217K, worse than the 210K expected. The poor figures spurred risk aversion, providing the USD with fresh legs.

EUR/USD short-term technical outlook

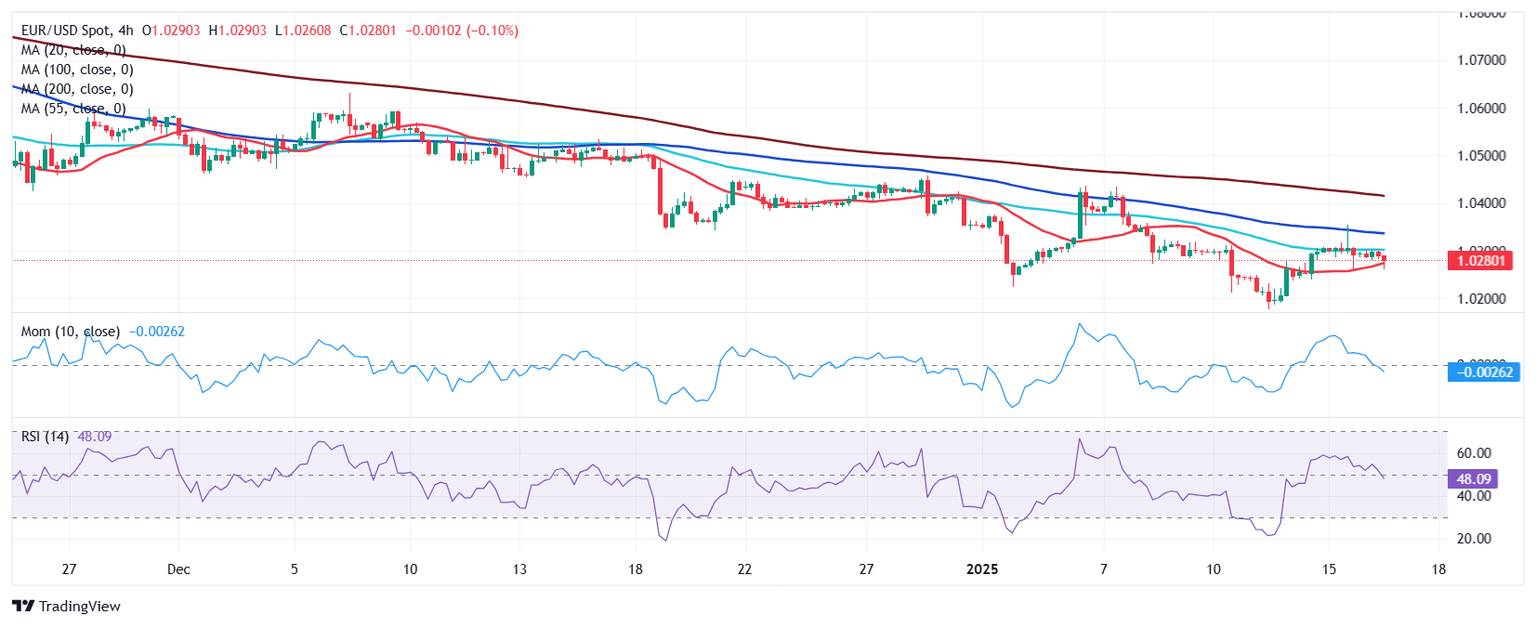

The EUR/USD pair is bearish, according to technical readings in the daily chart. The pair is currently developing below all its moving averages , with the 20 Simple Moving Average (SMA) providing dynamic resistance at around 1.0340. At the same time, the 100 SMA accelerates south below the 200 SMA, both far above the current level. Finally, technical indicators resumed their slides within negative levels, reflecting increased selling interest.

In the near term, and according to the 4-hour chart, EUR/USD is neutral. A mildly bullish 20 SMA provides support around the current level, while a bearish 100 SMA caps advances 1.0340. Meanwhile, technical indicators turned lower but remain within neutral levels, lacking directional strength. The intraday low at 1.0260 is the immediate support level, followed by the 1.0210 price zone.

Support levels: 1.0260 1.0210 1.0175

Resistance levels: 1.0340 1.0385 1.0410

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.