EUR/USD Outlook: Upside potential seems limited amid banking sector woes, ECB in focus

- EURUSD regains some positive traction on Thursday and recovers a part of the overnight slump.

- Easing fears of an imminent banking crisis undermines the USD and lends support to the major.

- Expectations that the ECB will deliver a 50 bps rate hike also contribute to the intraday uptick.

- The mixed fundamental backdrop warrants some caution before placing aggressive bullish bets.

The EUR/USD pair is seen building on the previous day's late rebound from the 1.0515 area, or its lowest level since January and gaining some positive traction during the Asian session on Thursday. Fears of an imminent banking crisis eased after Swiss bank Credit Suisse said that it will exercise an option to borrow up to $54 billion from the Swiss National Bank (SNB) to shore up liquidity. This leads to a modest recovery in the global risk sentiment, which undermines the safe-haven US Dollar. Apart from this, reports that European Central Bank (ECB) policymakers are still leaning towards a 50 bps rate hike later today lend some support to the major.

It is worth mentioning that investors had begun to doubt if the ECB will stick to its commitment for another big rate hike after last week's collapse of two mid-size US banks - Silicon Valley Bank and Signature Bank. However, a source close to the ECB's rate-setting Governing Council said there was no fundamental change in the outlook as the Eurozone economy is picking up strength and inflation is expected to remain high for years. This turns out to be another factor acting as a tailwind for the EUR/USD pair amid some repositioning trade ahead of the key central bank event risk - the highly-anticipated ECB policy decision due later this Thursday.

Investors, meanwhile, remain concerned about a broader systemic crisis and fresh turmoil in the European banking sector. This, along with fears that any further tightening in lending conditions could trigger a deeper global economic downturn, should keep a lid on any optimism in the markets. Apart from this, reviving bets for at least a 25 bps rate hike by the Federal Reserve at its upcoming meeting on March 21-22 should continue to lend support to the Greenback and cap the upside for the EUR/USD pair. This, in turn, warrants some caution for aggressive bullish traders and before positioning for any meaningful appreciating move for the major, at least for now.

Technical Outlook

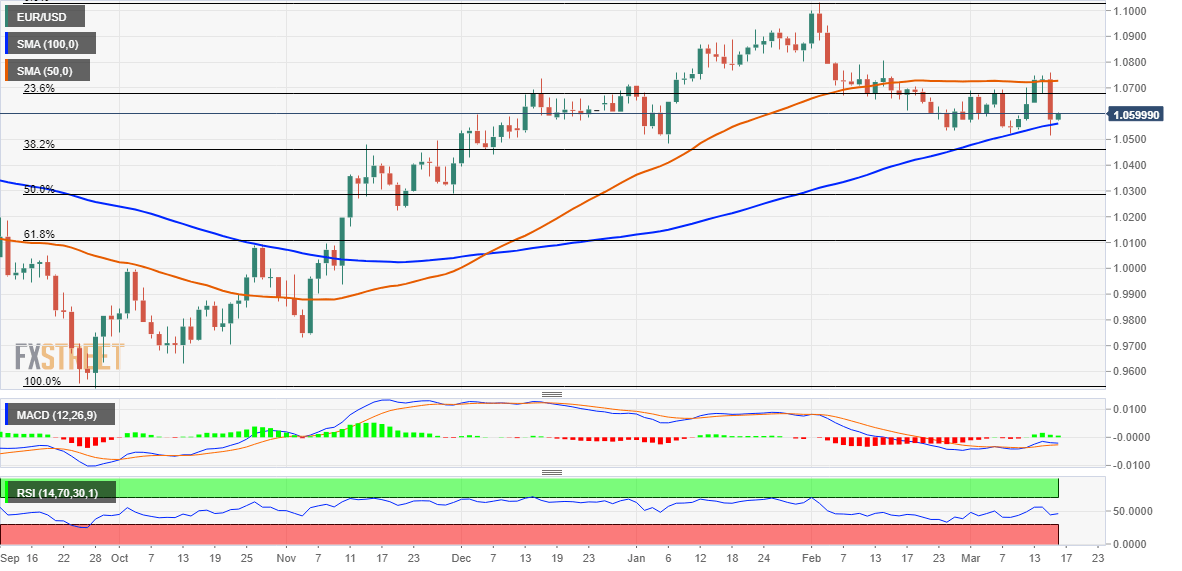

From a technical perspective, the overnight slump - marking the biggest daily loss in almost six months - and this week's failed attempt to build on the momentum beyond the 50-day Simple Moving Average (SMA) could be seen as a fresh trigger for bears. Spot prices, however, showed some resilience below the 100-day SMA on Wednesday. This makes it prudent to wait for some follow-through selling below the overnight swing low, around the 1.0515 region, before positioning for any further depreciating move. The EUR/USD pair might then accelerate the fall towards the 1.0460-1.0455 support, representing the 38.2% Fibonacci retracement level of September 2022 to February 2023 rally. A convincing break below the latter should pave the way for a fall towards the 1.0400 round figure en route to sub-1.0300 levels, or the 50% Fibo.

On the flip side, any further recovery beyond the 1.0600 mark now seems to confront stiff resistance near the 1.0675-1.0680 zone, or the 23.6% Fibo. level, ahead of the 50-day SMA, currently around the 1.0725 region. This is closely followed by the monthly peak, around the 1.0750 area, which if cleared decisively will negate any near-term negative bias and allow the EUR/USD pair to reclaim the 1.0800 round figure. The momentum could get extended further towards the 1.0860-1.0865 static barrier en route to the 1.0900 mark and the next relevant hurdle near the 1.0925-1.0930 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.