The euro finished the week on a negative note, having fallen temporarily below 1.0800 as the European Central Bank left the door open to further easing in March.

In a press conference ECB President, Mario Draghi said Thursday that the ECB will possibly reconsider monetary policy stance at next meeting as downside risks have increased. He added there are “no limits” on how far ECB is prepared to act, raising speculation the bank is laying the ground for further stimulus measures at its next meeting.

Despite the dovish comments from the ECB, euro’s downside seems limited given the predominant risk aversion environment, from which the shared currency has benefited lately as it maintains a strong inverse correlation with equities. That same correlation has prevented the euro to benefit from a weaker US dollar seen by the end of the week.

On the other side of the pond, next week the Federal Reserve will meet for the first time this year after deciding to raise rates in December. The FOMC is expected to keep policy unchanged and to take a cautious stance, given recent developments, with mixed economic data in the US and fears of economic slowdown abroad.

The Fed will have to send a strong signal that, despite global turmoil, it could possibly raise rates one of two meetings in the future to give the US dollar a significant boost.

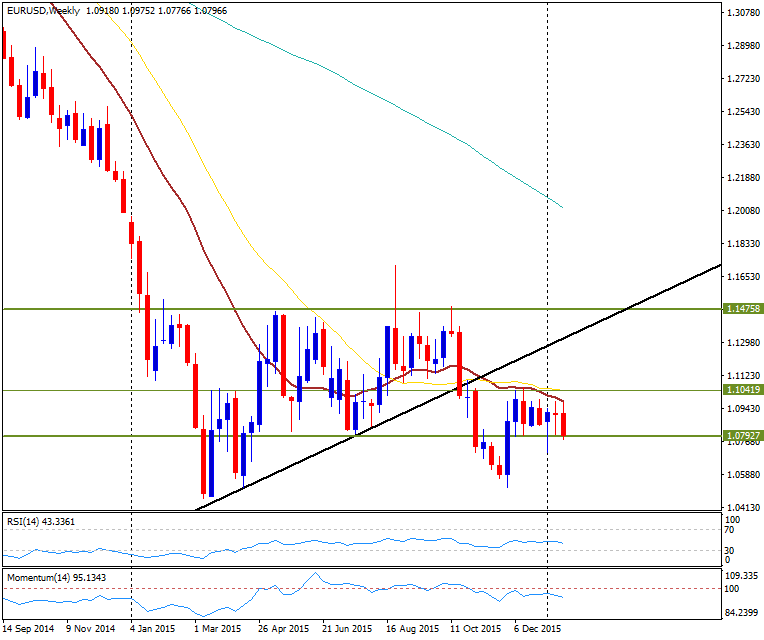

EUR/USD technical view

View the Live chart of the EUR/USD

The US dollar was poised to end the week higher against the euro thanks to Draghi. However, movements continued to be limited and in ranges, with the euro technical outlook weakening further day by day, but still in consolidation mode from a wider perspective. Not even US data nor the ECB changed the main sideways tone.

EUR/USD points lower, but still remains within key levels

The weekly chart shows the pair maintains a bearish outlook, but so far holding above a key support area around 1.0800, that was tested on Friday. A decisive break below 1.0800 could pave the way for a slide toward 1.0700 first; below this latter, the next strong support is seen at 1.0500/20 ahead of 2015 lows at the 1.0460 area.

The upside remains capped by the 20-week moving average (brown line) and the 1.1000 - 1.1050 zone, where the 100- and 200-day SMAs reinforce the resistance area. Any rally toward that region could be seen as a selling opportunity, but if the euro breaks above 1.1050 and holds, a quick advance to 1.1150 would be expected, with an extension up to 1.1300 - 1.1330 on the cards.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.