The EUR/USD pair remained within a 150 pips range these past few days, stuck around the 1.0700 level for a second week in-a-row. The pair has, however, established a lower low for the month at 1.0616, weighed once again by the imbalance between both Central Banks, as both, the FED and the ECB had released the minutes of their latest meetings this week.

Nevertheless, neither offered something new. Is clear that Mario Draghi and Co at the ECB is determinate to keep the EUR lower, by repeating time after time that more easing can and will be applied next December, to achieve the 2.0% inflation target. Additionally, Draghi addressed the European Banking Congress in Frankfurt, and while starting its comments by asserting that the policy measures have worked, he also said that growth momentum remains weak, and therefore anticipated again more stimulus steps before the year end.

As for the US Federal Reserve, the minutes released last Wednesday showed that most members consider it could be appropriate to lift rates in December should the economic data continues to improve. There was a slight change in the wording, with policymakers opening doors for a rate hike albeit without actually confirming it.

View the Live chart of the EUR/USD

Overall, the macroeconomic background remains the same ever since late October, with investors holding their breath until next December, when one Central Bank is expected to ease further, and the other begin tightening. Whether they act or not, indeed December is going to be a "Dec-bacle" across the financial markets. In the meantime, investors will continue pricing in any piece of data in accordance to how it could affect economic policy decisions.

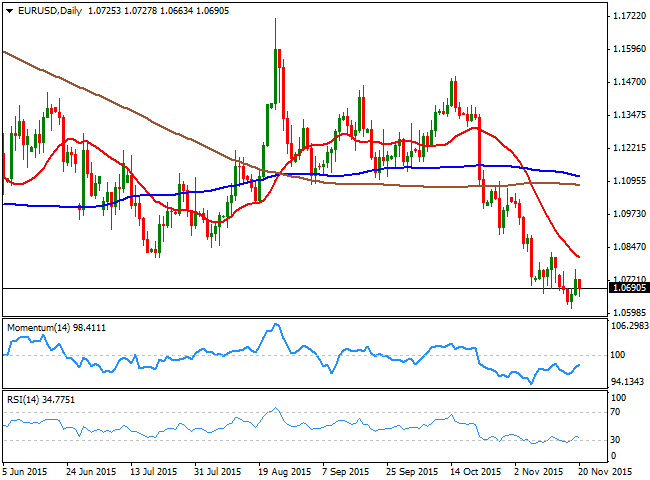

Technically, the pair maintains a clear bearish tone, as the daily chart shows that the price is well below a bearish 20 SMA, whilst the decline extended further below the 100 and 200 SMAs, both lacking directional strength around 1.1100. In the same chart, the technical indicators have bounced from oversold levels, but the RSI is losing upward strength and turning back south around 35, in line with a continued decline. In the weekly chart, the technical indicators presents a strong bearish momentum well below their mid-lines, pointing for a retest of the year low of 1.0460 during the upcoming days, particularly on a break below 1.0600. Should the price extend its decline, the next bearish target for this week comes at 1.0250/60, e route to parity, not yet seen, but likely in December, if both Central Banks do as promised.

Approaches to the 1.0800 level are still seen as selling opportunities, with a recovery above it anticipating an upward corrective movement up to 1.0940. Even up to this last, the longer term bearish outlook will remain bearish, and selling interest will likely be stronger if the price approaches to this last.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.