The EUR/USD pair traded as high as 1.1280 early Tuesday, extending its advance during the Asian session amid a continued decline in equities' markets.

View the Live chart of the EUR/USD

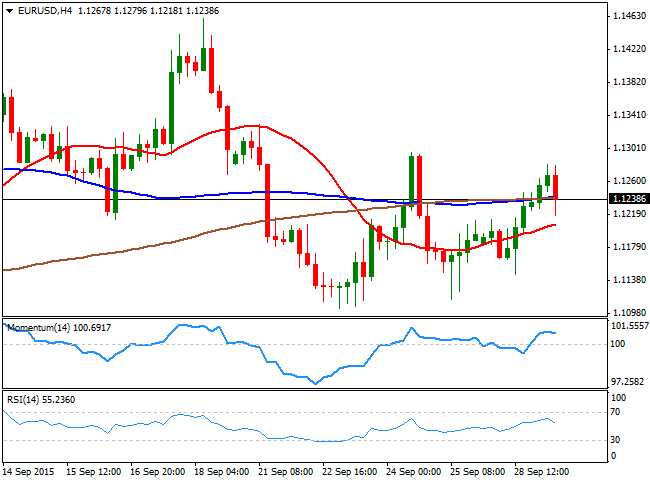

The EUR/USD pair fell down in the short term to 1.1218, finding buying interest around the former resistance. The 4 hours chart shows that the technical indicators are losing strength and turning south in positive territory, whilst the 20 SMA presents a mild bullish slope around 1.1200, being the level to break to confirm an intraday decline towards the 1.1160 level, while further declines below this last, expose the 1.1120 price zone.

A recovery above 1.1245 on the other hand, should lead to a retest of the highs at 1.1280, whilst further gains should lead to a test of 1.1335, a strong static resistance level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD drops below 1.0850, focus shifts to US ISM PMI

EUR/USD is on the defensive below 1.0850 in the European session on Monday. A broad-based US Dollar rebound acts as a headwind to the pair, as attention turns toward the US ISM PMI due later in the American morning.

GBP/USD stays weak near 1.2700 ahead of US ISM PMI

GBP/USD is under moderate selling pressure near 1.2700 in the European trading hours on Monday. A modest US Dollar uptick weighs on the pair, despite an upbeat mood. Investors await the US ISM Manufacturing PMI data for fresh guidance.

Gold rolls over, failing to sustain PCE-related spike

Gold (XAU/USD) slides lower to trade in the $2,320s on Monday as a positive risk-on environment inherited from the Asian session lowers safe-haven demand for the metal.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin’s momentum poise to propel crypto market

Bitcoin price consolidates in a symmetrical triangle pattern, showing directional bias. Ripple also follows BTC’s footsteps as it continues on its 50-day consolidation streak. Ethereum price, on the other hand, shows signs of an incoming correction.

Bumper week of event risk ahead

Featuring two central bank updates – the Bank of Canada and the European Central Bank – a slew of job numbers out of the US and Aussie GDP growth data, the first full week of June is poised to be eventful.