The EUR/USD pair trades within a 40 pips range this Thursday, as investors are waiting for the first major event of the week: the ECB will have its economic policy meeting, including economic forecasts and a statement, in a couple of hours.

Additionally, Chinese markets have been closed due to a local holiday, and will remain closed until next week, which means the main risk factor that has been moving the markets these days is temporarily of. In Europe, stocks are strongly up supported by the latest manufacturing and services PMIs in the region that suggest the EU recovery is proceeding at pace. The EU Markit composite for August rose to 54.4 from previous 54.3, with only the French reading missing expectations.

Despite growth seems to be picking pace, the problem continues to be depressed inflation readings, which may force ECB's President, Mario Draghi a generally dovish stance, and remark that the Central Bank is willing to do whatever it takes to reach its 2.0% target.

View live chart of the EUR/USD

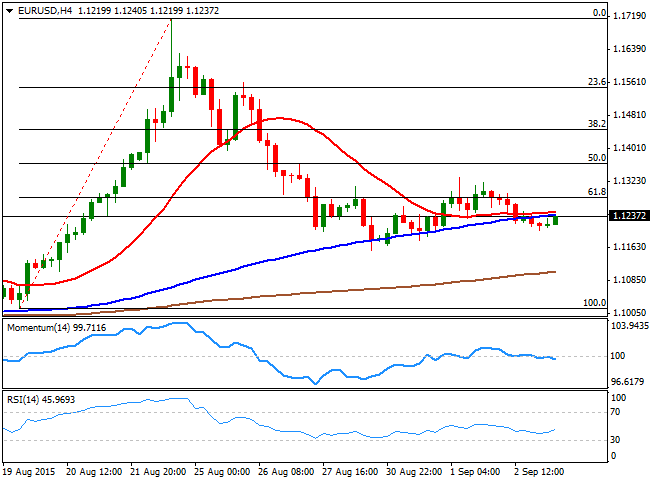

Technically, a slightly negative tone prevails, as the price is developing below its 20 SMA in the 4 hours chart, whilst the technical indicators present a neutral-to-bearish stance, standing slightly below their mid-lines. Nevertheless, upcoming movements will depend on how the market understands Draghi's words.

The main resistance level comes at 1.1280, 61.8% retracement of the past two weeks rally. An advance beyond the level should see the price spiking towards the weekly high around 1.1330, while beyond this last, the rally can extend up to 1.1360, 50% retracement of the same rally.

Below 1.1200 on the other hand, the risk turns towards the downside, with scope to test the 1.1160 region. A break below this last, exposes the pair to a decline down to 1.1120 a strong static support level.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.