The EUR/USD pair starts the week with a slight positive tone, having advanced up to 1.1261 during the Asian session. A stronger Japanese Yen drove the dollar lower across the board, amid falling stocks.

Chinese equities are once again under pressure, down 1.5%, as last week intervention optimism seems to be fading. European indexes are struggling around their opening levels, with an increasing bearish potential that should weigh on the greenback if it continues. Germany released its Retail Sales for July, up 1.4% in the month, and 3.3% compared to a year before, which also supported the advance in the EUR.

View live chart of the EUR/USD

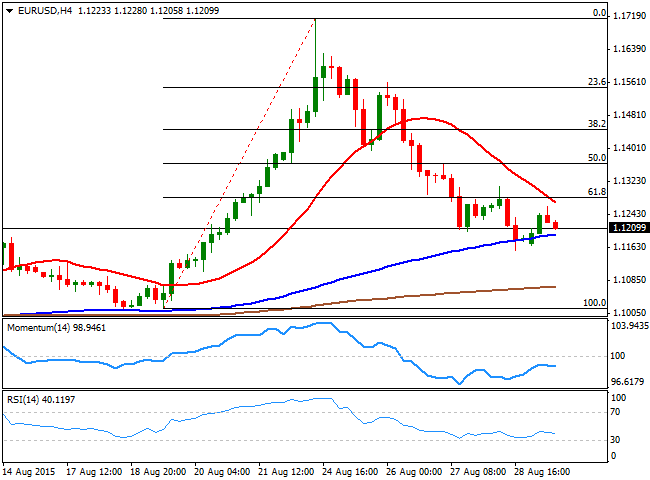

Nevertheless the technical picture is still bearish for the EUR/USD, as the 4 hours chart shows that the intraday recovery stalled below the 61.8% retracement of these last two weeks rally around 1.1280, whilst the 20 SMA maintains its sharp bearish slope around it. In the same chart, the technical indicators are grinding lower in negative territory, supporting a downward continuation for the upcoming hours. The immediate support comes around 1.1160, with a break below signaling a downward continuation towards the 1.1120 price zone.

Only above 1.1280, the mentioned Fibonacci resistance, the pair may revert its negative intraday tone, and be able to recover up to the 1.1330 price zone.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

AUD/USD holds positive ground above 0.6500 on weaker US Dollar

The AUD/USD pair extends recovery around 0.6525 during the early Asian session on Thursday. The Federal Reserve held its interest rates steady at 5.25–5.50% at its meeting on Wednesday, citing a “lack of further progress” in getting inflation back down to its 2% target.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.