The EUR/USD pair fell down to a fresh weekly low of 1.1291 during the past Asian session, as Chinese stocks have closed in the green. The Shanghai Composite advanced 5.34%, not actually enough to confirm the turmoil is over, but at least enough to bring some relief to worldwide investors.

European stocks are also firmer, following the strong gains posted on Wednesday by Wall Street, weighing on the EUR. Earlier in the day, macro data showed that German import prices fell in July by 1.7% compared to the previous month, mostly due to oil slump. Also, EU money supply expanded in July, up 5.3% yearly basis, quite normal in the wake of ECB ongoing QE.

Later on today, the US will release its advanced GDP figures for the second quarter of the year, expected to print 3.2% compared to the final reading of the Q1 of 2.3%. Being an advanced reading, is usually a big market mover, and the American currency will probably extend its gains if the figure comes as expected or better.

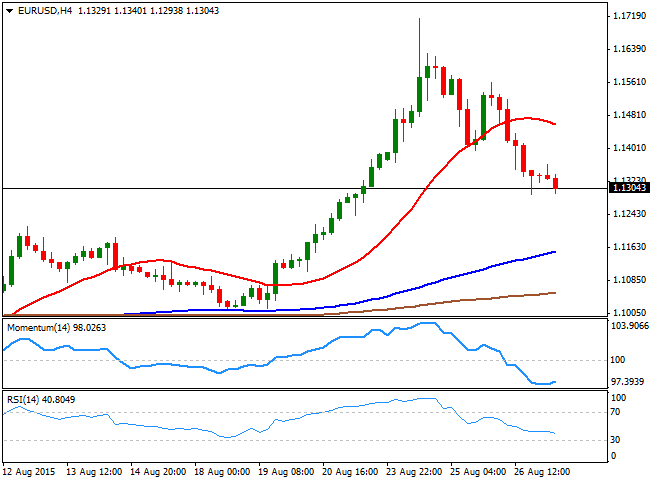

View live chart of the EUR/USD

In the meantime, the 4 hours chart shows that the price has extended its decline well below its 20 SMA, now turning bearish around 1.1480, whilst the Momentum indicator aims to bounce from oversold levels and the RSI indicator maintains its bearish slope around 41, favoring additional declines, particularly as the price remains near the mentioned low.

Investors may remain on hold ahead of the US GDP release, with a downward acceleration on a positive number then pointing for a test of 1.1250, in route to the 1.1200 figure later on in the day. The pair has set its daily high at 1.1363, which means some additional advances beyond it are required to confirm an upward movement towards the 1.1400/20 price zone.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.