The common currency is in retreat mode this Tuesday, with the EUR/USD pair sliding to fresh lows in the 1.1130 region during the European morning. There was plenty of data coming from Germany, albeit the focus is still on Greece. The country has announced yesterday that it won't be able to pay the IMF the €1.6 billion due today, whilst the first polls on whether to accept or not the institutions conditions are showing the "NO" is up in between 53-55%. Indeed, the results of the polls are weighing on the common currency and local share markets, trading strongly down.

German figures were far from encouraging, with Retail Sales in May growing 0.5%, but down 0.4%% compared to a year before. German unemployment declined for a ninth month in June, but less than actually forecast. Besides, the EU inflation estimates for June resulted slowly below as expected, down to 0.2%.

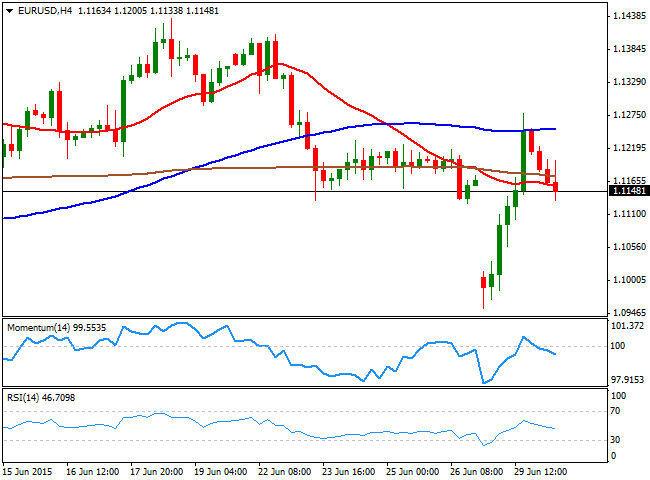

View live chart of the EUR/USD

The EUR/USD trades a few pips above its daily low, presenting a technical bearish stance, as in the 4 hours chart, the price is extending below a bearish 20 SMA, whilst the technical indicators are crossing their mid-lines into negative territory, still unable to confirm a stronger decline due to a limited momentum.

Should the price accelerate below the 1.1120 level, the immediate support, further declines should be expected, with the next intraday supports at 1.1080 and 1.1050. The upside is now being limited by the 1.1200 figure, meaning it will take a clear recovery above it to take out the bearish pressure and favor an intraday recovery up to 1.1245 first, and yesterday's highs around 1.1280 later on in the day.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.