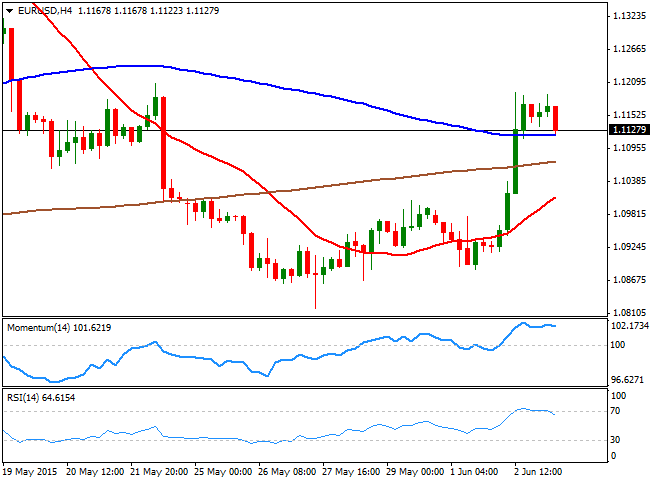

Nevertheless, the readings were enough to trigger a tepid bounce in the pair that anyway trades in the red. According to the 4 hours chart, the pair may move south today, as the technical indicators are looking exhausted in overbought levels, signaling a bearish corrective movement ahead. However, the ECB decision will define the upcoming moves today. The focus will be on Draghi's words, with a positive assessment of the higher inflation and upward reviews of GDP and inflation forecast, favoring further advances in the common currency: a break through 1.1200 then, should see the pair extending its rally up to 1.1260 in the short term, with chances to extend up to 1.1300 if US data, released alongside with the speech, results disappointing.

Should the ECB president focus on the Greek ongoing woes, or express its concerns over the rising exchange rate of the EUR, the risk will turn towards the downside, with a downward acceleration below 1.1120 signaling a bearish continuation towards the 1.1050 price zone.

View live chart of the EUR/USD

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.