Investors however, are now considering that maybe they moved too fast towards the greenback on hopes of a rate hike, as if the reading comes actually negative, the rate hike will again be delayed, giving the EUR room to recover further.

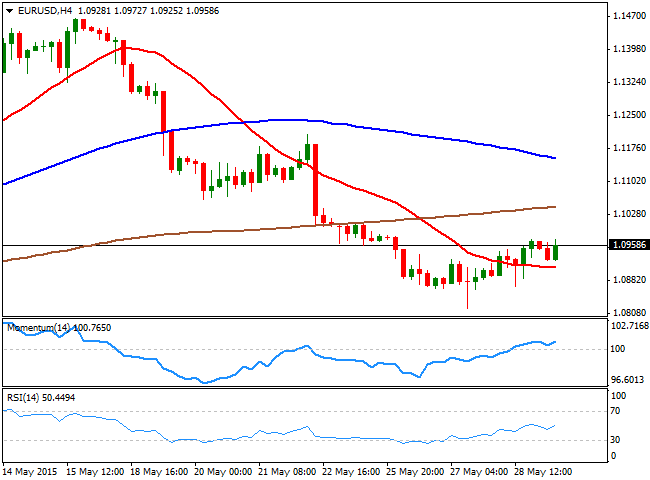

Technically, the 4 hours chart shows that the technical readings are biased higher, with the price above its 20 SMA and the technical indicators head north above their mid-lines. The immediate resistance comes now at 1.1000, with a break above it probably signaling a quick spike up to the 1.1050 region. If the price extends beyond this last, the pair will likely close the week near 1.1100. On the other hand, the immediate support comes at 1.0940/50, with a better-than-expected reading favoring a break below it, towards 1.0890/1.0900. Should the price extend below this last, 1.0850 is next, in route to the weekly low around 1.0820.

View live chart of the EUR/USD

Recommended Content

Editors’ Picks

EUR/USD clings to small gains above 1.0700 ahead of data

EUR/USD trades marginally higher on the day above 1.0700 on Tuesday after EU inflation data for April came in slightly stronger than expected. Market focus shifts to mid-tier US data ahead of the Fed's policy announcements on Wednesday.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. Investors await macroeconomic data releases from the US.

Gold extends daily slide toward $2,310 ahead of US data

Gold stays under bearish pressure and declines toward $2,310 on Tuesday. The benchmark 10-year US Treasury bond yield holds steady at around 4.6% ahead of US data, making it difficult for XAU/USD to stage a rebound.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.