Despite Friday’s pullback, EUR/USD is on track to post its third consecutive weekly gain and with April as its first monthly gain since June 2014. The euro benefited from the decision of Greek Prime Minister Alexis Tsipras to sideline Yanis Varoufakis in the negotiations team with creditors and from short-covering.

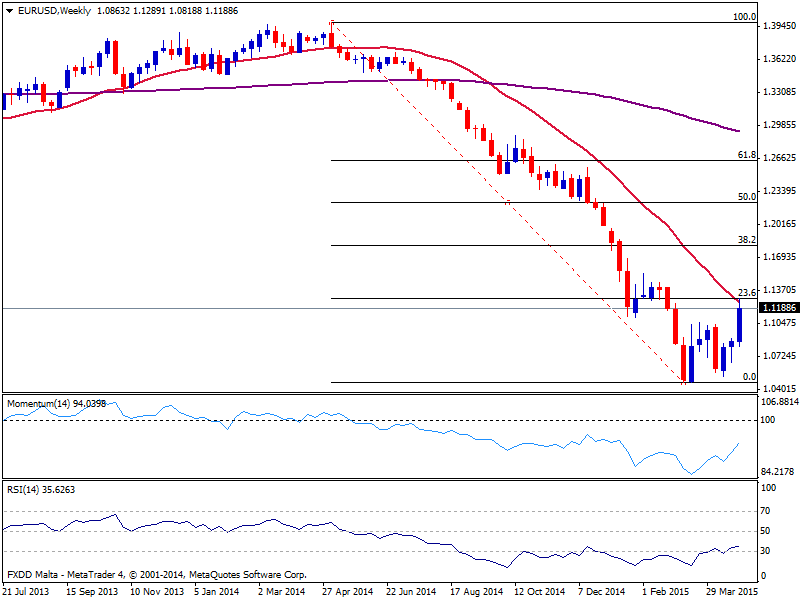

The pair scored a 2-month high of 1.1289 before turning lower, but the euro failed to break above the 23.6% retracement of the broader 1.3992-1.0461 drop at 1.1295.

Technically speaking, EUR/USD maintains the bullish tone in weekly charts, suggesting there is more upside room. However, in smaller time frames, indicators are near overbought levels which could limit gains in the upcoming days.

Next week, the nonfarm payrolls report will be the key event driving markets. A batch of disappointing US data has kept the dollar on the defensive during the the past weeks. On Wednesday, Q1 GDP confirmed fears the American economy is slowing as it printed a 0.2% rise, versus 1.0% expected and down from 2.2% in Q4.

Even though the Federal Reserve left options open to the timing of the “lift-off”, blaming on bad weather and “transitory factors” for the growth slowdown, June seems less and less likely at this point, with expectations turning to September for the Fed’s first rate hike in over a decade.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.