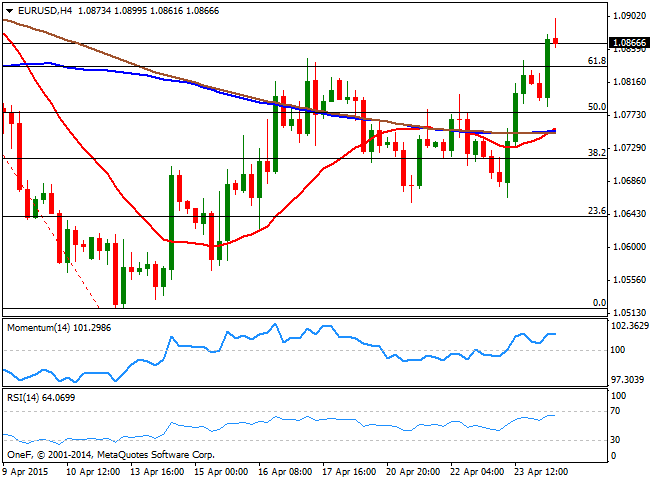

The 4 hours chart shows that the price retraces from its daily high at 1.0899, but remains well above the immediate support at 1.0840, the 61.8% retracement of its latest daily decline. In the same chart the 20 SMA aims higher below the current level, but converges with the 100 and 200 SMAs, reflecting the latest lack of direction. In the same chart, the technical indicators are losing their upward strength but holding in positive territory, also limiting the downside. Stops should be large above the 1.0900 figure, which means a price acceleration above it should lead to an advance up to the 1.0950 price zone, the immediate short term resistance. Further advances beyond this last, should lead to an approach to the 1.1000 figure.

Should the price break below 1.0840 on the other hand, the pair will lose its upward potential, eyeing then a bearish movement down to the 1.0740/60 price zone.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.