The possibility of a Greece default, was fueled by a local newspaper, saying that the New Democracy party believes that a Greek exit is possible, and by German Finance Minister Wolfgang Schaeuble who ruled out further concessions to Greece, saying it’s up to the Greek government to commit to the reforms needed to release aid. ECB's Mario Draghi, said pretty much the same on Wednesday in the Central Bank economic policy meeting, when asked by a journalist.

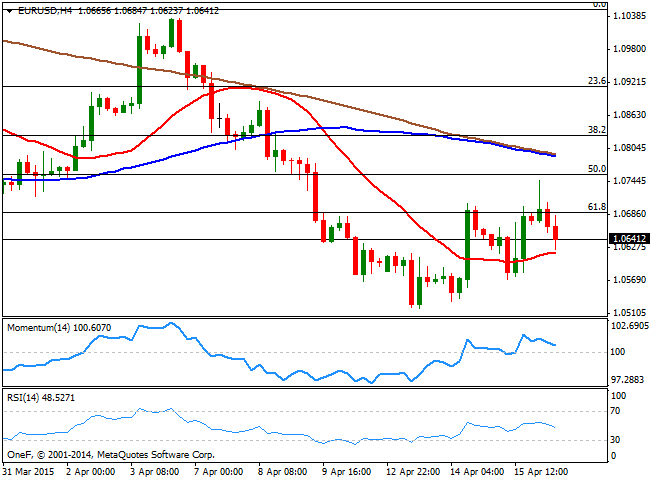

The technical picture shows that, in the 4 hours chart, the pair has failed to sustain gains above the 61.8% retracement of its latest bullish run, and trades in the 1.0640 region, with the immediate support is at 1.0620, where the pair has established its daily low and where the 20 SMA aims slightly higher in the mentioned time frame. The technical indicators present a nice bearish slope, but remain above their mid-lines, suggesting additional declines below the mentioned 1.0620 level are required to confirm a new leg lower, towards 1.0550, next strong static support level. A break below it should lead to an approach to the 1.0500 figure. To the upside, the immediate resistance comes at 1.0690, the 61.8% retracement of the latest bullish rally, with some gains above it favoring a retest of the 1.0750/60 price zone.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.