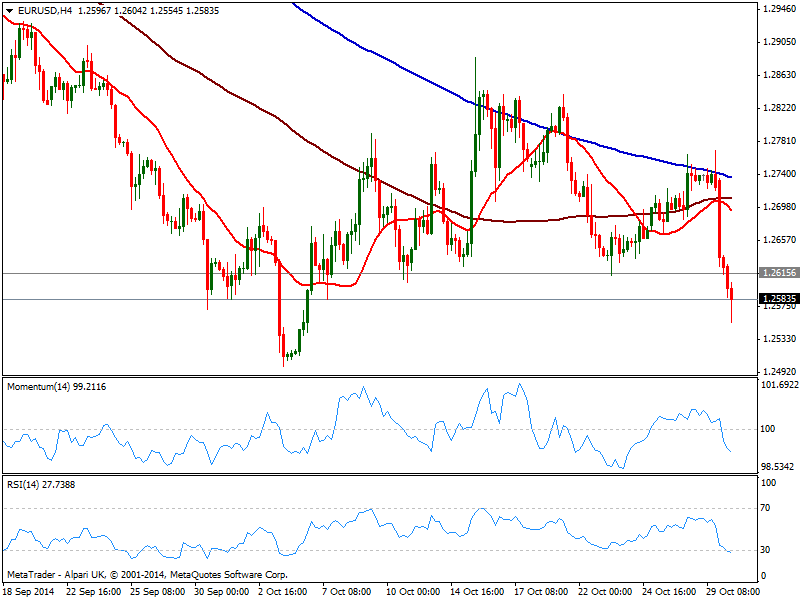

Having breached the 1.2610/20 price zone, the technical outlook has turned now strongly bearish, and the level will likely attract sellers if reached. Later on the day, the US will release the Advanced GDP for the third quarter, expected at 3.1%. Previous quarter was revised up to 4.6%, so a better than expected number should boost the greenback, yet a not so good one needs to be extremely disappointing, something below 2% to actually reverse latest dollar gains.

Technically, the 4 hours chart shows indicators still heading south despite in oversold territory, with 20 SMA now turning south well above current price, in the 1.2680 level. A break below 1.2550 should lead to a downward extension towards 1.2500, this year low, whilst a break below exposes 1.2440 as next probable bearish target. Price needs to advance above 1.2620 to begin an upward move, eyeing then a probable move up to 1.2660/80 area, next selling level on pullbacks.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.