EUR/USD Forecast: Winter wave weighs on the euro, but Moderna Powell may power it up

- EUR/USD has been under pressure as coronavirus is raging on both sides of the Atlantic.

- Speeches by central bankers and new vaccines can change the picture.

- Thursday's technical graph is painting a mixed picture.

The days are getting darker – even if there is a light at the end of the tunnel. After several days of coronavirus hopes, the virus's rage is now weighing on markets.

The euro is suffering as German COVID-19 deaths continue increasing despite a stabilization in cases while Italy is under growing pressure to impose a nationwide lockdown. France and Spain – the other two large economies – also continue struggling.

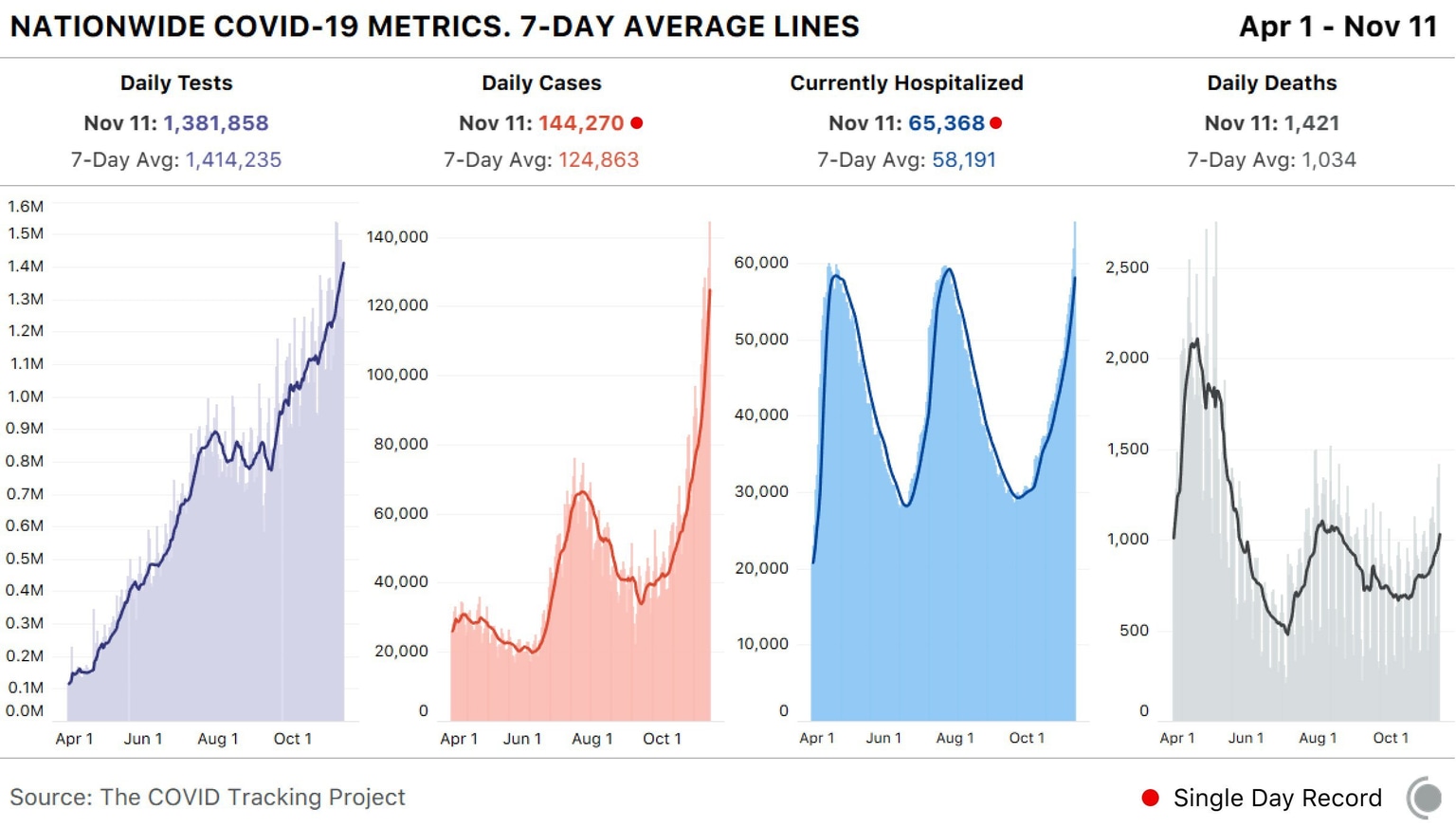

On the other side of the pond, the safe-haven dollar is gaining ground amid the retreat in stocks and the rapidly deteriorating covid situation in the US. Daily infections have hit new highs above 144,000 and hospitalizations topped 65,000 – also a record.

Source: Covid Tracking Project

The markets have changed heart once and can flip again. It is essential to remember that Pfizer is not alone in pursuing a coronavirus vaccine. Dr. Abnthony Facui, America's leading epidemiologist, said that he would be surprised if Moderna – which uses the same mRNA approach – does not report similar results.

The Massachusets-based company said that it could publish results sometime next week. The increase in covid cases exposed more participants in its Phase 3 trial to the disease. If another immunization project proves successful, the market mood could improve rapidly. Johnson&Johnson and AstraZeneca are also conducting advanced tests and could publish results later on.

EUR/USD is also set to move in response to a panel including European Central Bank President Christine Lagarde and Federal Reserve Chairman Jerome Powell. Lagarde and ECB officials have explicitly indicated it is set to expand its bond-buying scheme in December. However, the Fed has only opened a small crack in that direction.

Will Powell indicate more Quantitative Easing? That would send stocks higher and the safe-haven dollar down. The greenback gained ground alongside rising US Treasury yields. The bank could purchase more bonds at this juncture. Any such hint from the Fed Chair could also turn EUR/USD higher.

In the political scene, President-elect Joe Biden continues working on his transition plans while President Donald Trump refuses to concede and claimed "we will win." While a manual recount is held in Georgia, the Trump campaign failed to provide any evidence of fraud.

Lawmakers and investors alike are eyeing the Georgia Senate runoffs on January 5 – critical for control of the upper chamber. It seems that Republicans are trying not to anger Trump's base ahead of the vote. Democrats also want to maintain their centrist approach ahead of the event.

US weekly jobless claims are set to show an ongoing decrease, albeit at a moderate pace. Consumer Price Index statistics will likely show inflation remains under control.

See US Initial Jobless Claims and CPI Previews: The linkages are gone

Overall, the recent slide in EUR/USD may prove temporary.

EUR/USD Technical Analysis

Euro/dollar is trading above the 50, 100 and 200 Simple Moving Averages on the four-hour chart – but only just. Momentum has turned to the downside, while the Relative Strength Index is stable. All in all, the picture is stable.

Some resistance is at the daily high of 1.1790, followed by 1.1835, which capped EUR/USD on Wednesday. The next lines to watch are 1.1860 and 1.19.

Support is at 1.1740, the daily low, followed by 1.17 that held it back in late October. The next lines to watch are 1.1650 and 1.1620.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.