EUR/USD Forecast: The hunt for 1.1000 has begun

- EUR/USD consolidates its bullish appetite around 1.0900.

- The US Dollar melted on poor US CPI prints.

- US Producer Prices should keep the focus on the inflation issue.

The US Dollar (USD) accelerated its downward trend big time on Thursday, dragging the USD Index (DXY) to multi-week lows near the 104.00 neighbourhood in the wake of the publication of lower-than-estimated US inflation figures gauged by the CPI.

The steep decline in the Greenback motivated EUR/USD to revisit the 1.0900 hurdle for the first time since early June, always against the backdrop of further repricing of the start of the easing cycle by the Federal Reserve (Fed) in September.

Following the US CPI data, the CME Group's FedWatch Tool suggests a nearly 93% chance of interest rate cuts in September, increasing to around 99% by December.

But then again, that’s the market speaking.

Against that backdrop, it is worth remembering that Chief Jerome Powell indicated he was not yet convinced that inflation was sustainably decreasing to 2%, though he showed "some confidence" it was trending in that direction. On Thursday, Federal Reserve Bank of St. Louis President Alberto Musalem argued that the consumer price data released earlier in the day is moving in the right direction. Musalem remarked that recent inflation data "has slowed and is consistent" with more price-sensitive consumers. He also expressed his belief that monetary policy is currently in the right place and mentioned that he is monitoring the data to see if inflation continues to moderate back to the 2% target.

Her colleague Mary Daly, President of the San Francisco Federal Reserve Bank, remarked that recent cooler inflation readings are a "relief," and she anticipates further easing in both price pressures and the labour market, which would justify interest rate cuts. She noted that while inflation is likely to cool further, the progress may be "bumpy." Daly indicated that the economy appears to be moving towards a scenario where one or two interest rate cuts this year, as projected in the June Fed policymaker forecasts, "would be the appropriate path."

In the meantime, the macroeconomic landscape remained stable on both sides of the Atlantic. The European Central Bank (ECB) is considering further rate cuts beyond the summer, with markets anticipating two additional cuts by year-end, while debate continues among investors about whether the Fed will implement one or two (or three?) rate cuts this year, despite the Fed's current projection of a single cut, likely in December.

The ECB's rate cut in June, along with the Fed's decision to maintain rates, has widened the policy divergence between the two central banks, potentially leading to further weakening of EUR/USD in the short term.

However, economic recovery prospects in the Eurozone, combined with signs of cooling in key US economic indicators, may mitigate this disparity and occasionally support the pair in the near future.

Looking ahead, market participants should closely monitor the release of further US inflation data gauged by Producer Prices on Friday as well as the advanced Michigan Consumer Sentiment print.

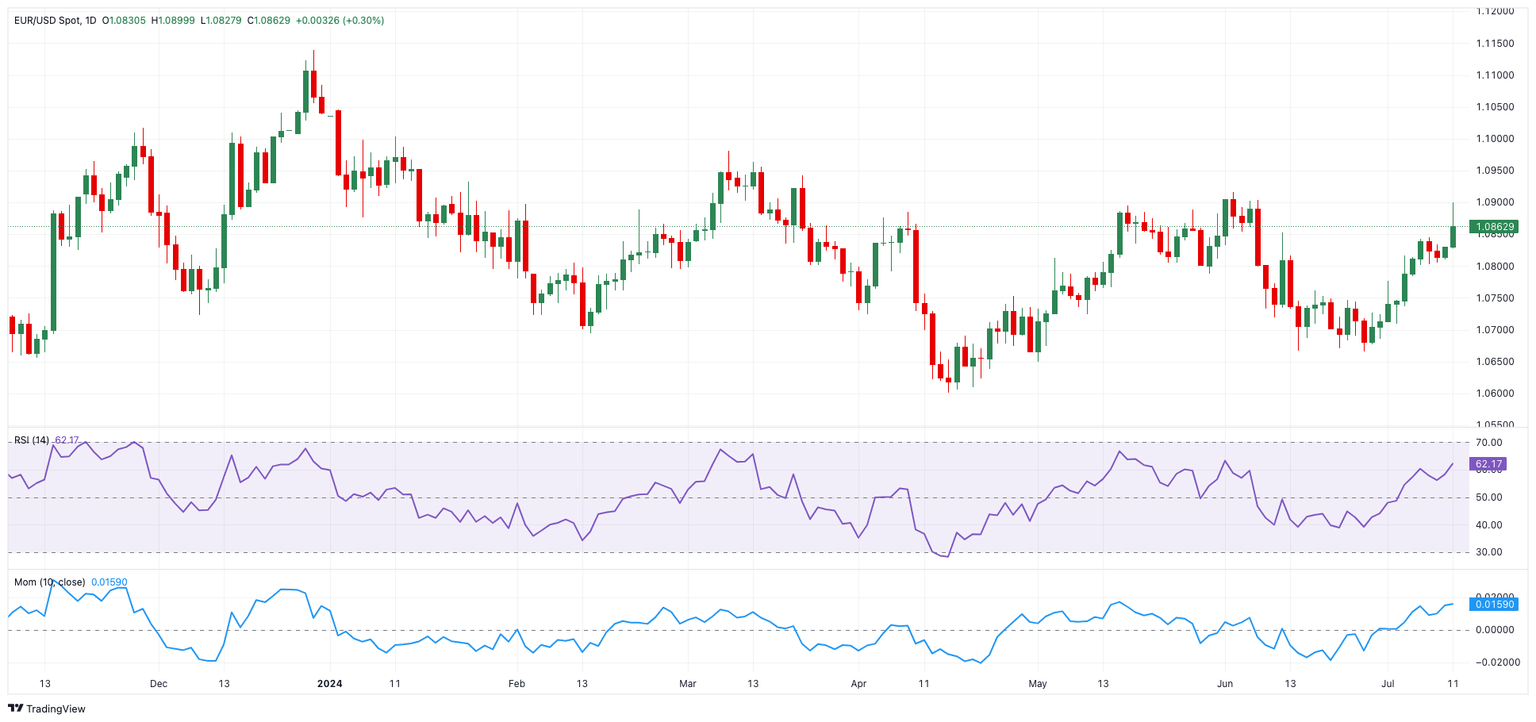

EUR/USD daily chart

EUR/USD short-term technical outlook

EUR/USD is expected to meet the next up-barrier at the July peak of 1.0900 (July 11), followed by the June peak of 1.0916 (June 4). If the pair rises over this level, it may bring the March peak of 1.0981 (March 8) back into focus, followed by the psychological 1.1000 barrier.

If bears get the upper hand, spot might touch the 200-day SMA at 1.0802 before sliding to a low of 1.0666 on June 26. From here, the May low of 1.0649 (May 1) leads to the 2024 bottom of 1.0601 (April 16).

Looking at the larger picture, it looks that further gains are on the way if the key 200-day SMA is routinely surpassed.

So far, the 4-hour chart indicates a modest improvement in the upside momentum. Initial resistance comes at 1.0900 ahead of 1.0916. On the flip side, the 55-SMA at 1.0798 comes first ahead of the 200-SMA at 1.0784 and ultimately 1.0709. The Relative Strength Index (RSI) has dropped below 65.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.