EUR/USD Forecast: Next on tap comes 1.0900 and above

- EUR/USD reversed the recent downtrend and regained 1.0800.

- The US Dollar came under pressure after the US CPI surprised to the downside.

- The Federal Reserve kept its rates unchanged, as broadly expected.

The US Dollar (USD) continued its strong retracement on Wednesday, this time on the back of disheartening US inflation figures tracked by the CPI in May, lending fresh legs to EUR/USD beyond the key 1.0800 barrier, or three-day highs.

It was all about the US CPI and the FOMC event on Wednesday, as EUR/USD seems to have temporarily set aside fresh political concerns on the old continent, particularly those reignited following the European parliamentary elections over the weekend.

Meanwhile, ECB Vice President de Guindos argued on Wednesday that the bank should proceed "very slowly" with reducing interest rates due to considerable uncertainty surrounding the inflation outlook.

In what was the salient event of the day, the Federal Reserve maintained interest rates steady and suggested that rate cuts may not begin until December. They projected a single quarter-percentage-point reduction for the year, reflecting rising inflation estimates. The end-of-year inflation projection has been revised to 2.6%, up from the previous 2.4%. Discussions suggest that the neutral interest rate may be higher than previously estimated, placing it more than a quarter of a percentage point above its level at the end of 2023.

Furthermore, Chair Powell argued at his press conference that a single quarter-percentage-point rate cut would not significantly impact the US economy, emphasizing that the overall policy trajectory is more crucial.

The CME Group's FedWatch Tool now indicates nearly a 95% probability of lower interest rates by the December 18 gathering.

In the short term, the ECB's recent rate cut vs. the Fed’s on-hold stance has widened the policy gap between both central banks, potentially exposing EUR/USD to further weakness. However, in the longer term, the emerging economic recovery in the Eurozone, combined with perceived slowdowns in the US economy, should help mitigate this disparity, offering some support to the pair.

In the meantime, US inflation is expected to remain in the limelight ahead of the release of Producer Prices on June 13.

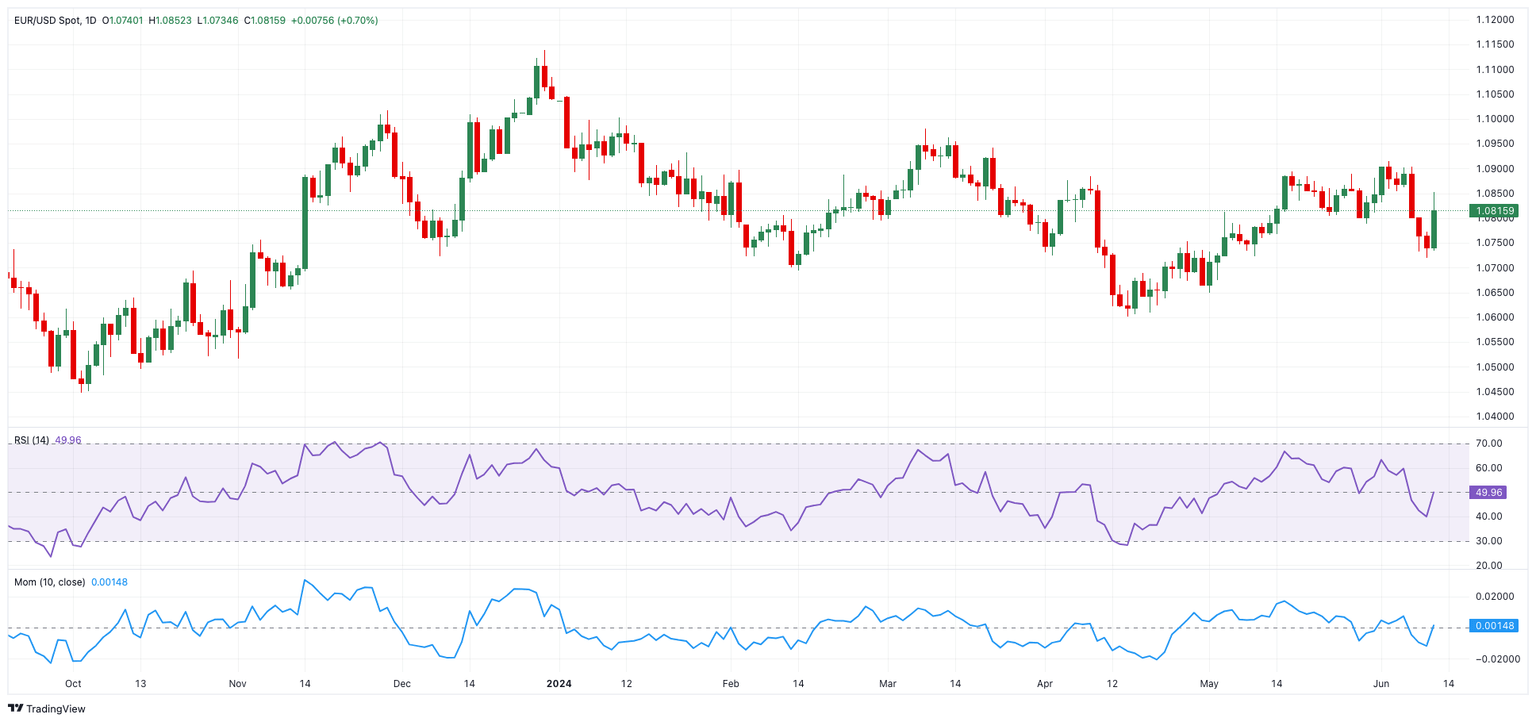

EUR/USD daily chart

EUR/USD short-term technical outlook

If the bearish tone continues, EUR/USD may first hit the June low of 1.0719 (June 11), followed by the May low of 1.0649 (May 1) and the 2024 low of 1.0601 (April 16).

If bulls reclaim the lead, there is an immediate up-barrier at the weekly high of 1.0852 (June 12) ahead of the June top of 1.0916 (June 4) and the March peak of 1.0981 (March 8). Further north, the weekly high of 1.0998 (January 11) appears before the important 1.1000 threshold.

So far, the 4-hour chart shows an important bounce. That said, initial hurdle comes at 1.0852 prior to 1.0916 and 1.0942. Southwards, there is immediate contention at 1.0719 ahead of 1.0649 and 1.0516. The relative strength index (RSI) retreated below 55.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.