EUR/USD Forecast: Heading toward 1.1000

EUR/USD Current Price: 1.1029

- EU Consumer Confidence down to -11.6 in March, German inflation retreated.

- The dollar corrects after plummeting last week, fear still rules.

- EUR/USD at risk of accelerating its decline on a break below 1.0990.

The EUR/USD pair is trading at daily lows, nearing the 1.1100 figure, as the dollar is in recovery mode after collapsing at the end of the previous week. News over the weekend were no good, as the coronavirus pandemic keeps growing exponentially, particularly in the US and Europe. Social isolation to curve contagion has one-third of the world in lockdown, hence, economic activity is frozen. Furthermore, several major economies included the US and the UK have taken measures too late to contain the outbreak, and are now paying the price. Still, the largest death toll remains within Europe, as Italy and Spain have largely surpassed the number of cases reported by China.

In this scenario, the market started the week in risk-off mode, with Asian shares falling and European indexes following their lead. These last, however, have managed to bounce from lows, although they continue to trade in the red. Wall Street is set to open modestly up. Meanwhile, US Treasury yields hover around Friday’s closing levels, depressed near record lows.

In the data front, March EU Consumer Confidence came in as expected at -11.6 from -6.6 previously. Germany released the preliminary estimate of March inflation, which resulted at 1.3% YoY, harmonized with that of the EU. Later today, the US will release February Pending Home Sales and the March Dallas Fed Manufacturing Business Index, foreseen at 6.2 from 1.2 previously.

EUR/USD short-term technical outlook

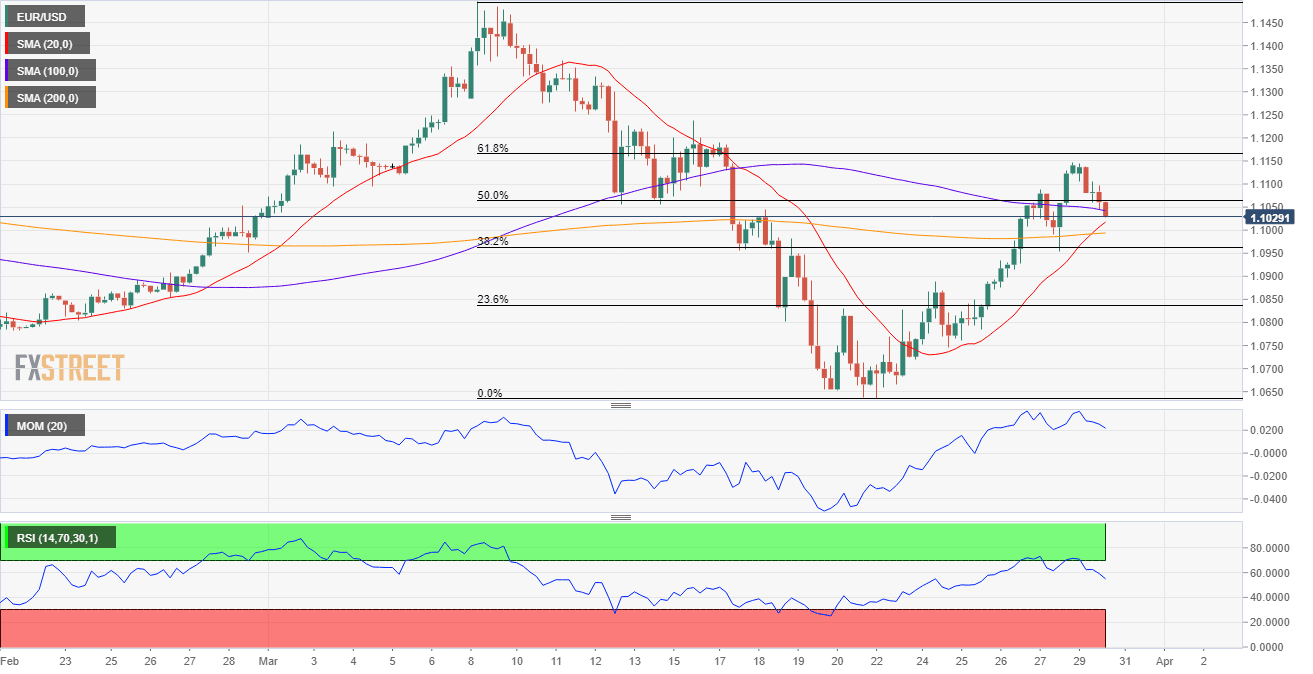

The EUR/USD pair has fallen below the 50% retracement of its March slump, after flirting with the 61.8% retracement of the mentioned decline last week. The 4-hour chart shows that the pair has fallen below its 100 SMA, but also that the 20 SMA keeps advancing now converging with the 200 SMA at around 1.0990. Technical indicators are easing from overbought levels, and while holding above their midlines, they head firmly lower, skewing the risk to the downside.

Support levels: 1.0990 1.0950 1.0920

Resistance levels: 1.1060 1.1100 1.1145

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.