EUR/USD Forecast: Eyeing a modest corrective decline

EUR/USD Current Price: 1.2144

- The EU May Sentix Investor Confidence surged to 21 in May from 13.1 previously.

- The greenback remained under selling pressure ahead of critical US inflation data.

- EUR/USD is overbought in the near-term but retains its longer bullish stance.

The American currency kept falling on Monday on the back of a poor US Nonfarm Payroll report released on Friday. The EUR/USD pair reached 1.2177, its highest since last February, to later trim intraday gains to settle in the 1.2140 price zone. Most action took place during the Asian session, while the mixed tone of European and American equities prevented the pair from advancing further.

The shared currency was also supported by the EU May Sentix Investor Confidence, which surged to 21 from 13.1, largely surpassing the expected 14. On Tuesday, the focus will be on the German ZEW survey, with the Economic Sentiment seen improving in the country and the Union in May. The US won’t publish relevant data until Wednesday when the country will release April inflation figures.

EUR/USD short-term technical outlook

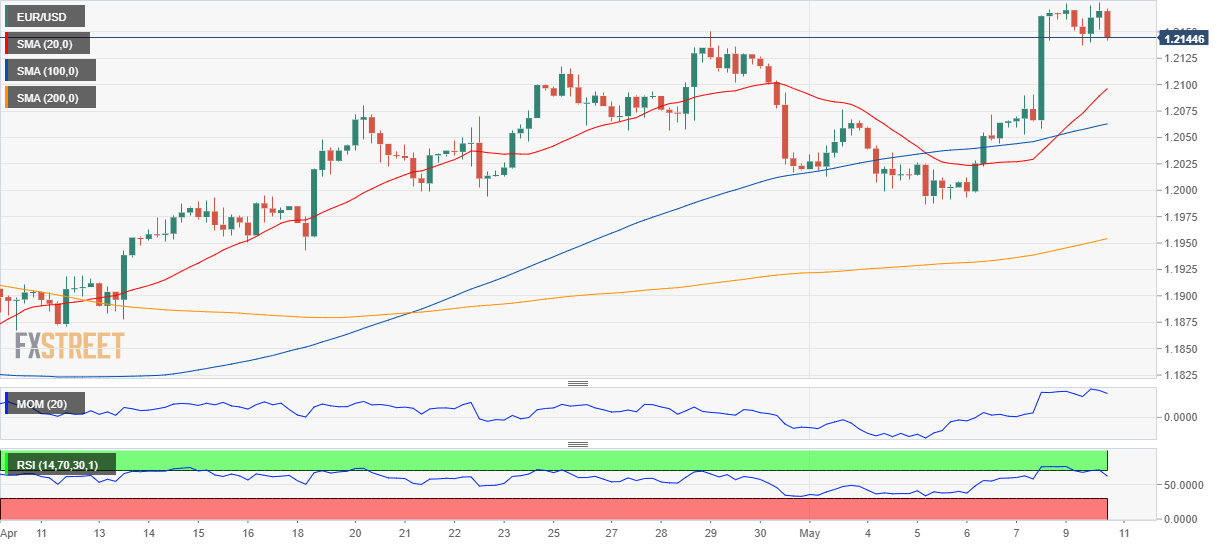

The EUR/USD pair is holding on to gains, although the risk of a bearish corrective decline in the near-term has increased. In the 4-hour chart, technical indicators are correcting extreme overbought conditions, with the Momentum maintaining its bearish slope but the RSI stabilizing around 68, suggesting limited selling interest. In the meantime, the 20 SMA has advanced above the longer ones, all of them below the current level.

Support levels:1.2110 1.2070 1.2020

Resistance levels: 1.2190 1.2240 1.2285

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.