EUR/USD Forecast: Euro could extend recovery on improving mood

- EUR/USD seems to have settled above 1.1300 early Thursday.

- Falling US Treasury bond yields cap the dollar's upside.

- Recovery remains technical in nature in the absence of fundamental drivers.

EUR/USD has managed to close above 1.1300 and seems to have gone into a consolidation phase in the early European session on Thursday. The technical outlook suggests that the recovery could continue but the pair remains at the mercy of the dollar's valuation.

The benchmark 10-year US Treasury bond yield, which gained more than 10% since the US inflation data on November 10, fell nearly 3% on Wednesday and caused the greenback to lose interest. Currently, the yield is holding below 1.6% and unless it manages to reclaim that level, the dollar could find it difficult to regather its strength.

Additionally, US stock futures are trading in the positive territory, suggesting that risk flows could support EUR/USD on Thursday.

Nevertheless, sellers are unlikely to give up easily on the possibility of the pair falling further. European Central Bank (ECB) Governing Council Member Isabel Schnabel said that the ECB's decision to continue to buy bonds was a sign that a rate hike was not imminent. Schnabel further added that the rise in inflation was a welcome development.

There won't be any high-tier macroeconomic data releases in the remainder of the day and market participants will remain focused on the US T-bond yields and the risk perception.

EUR/USD Technical Analysis

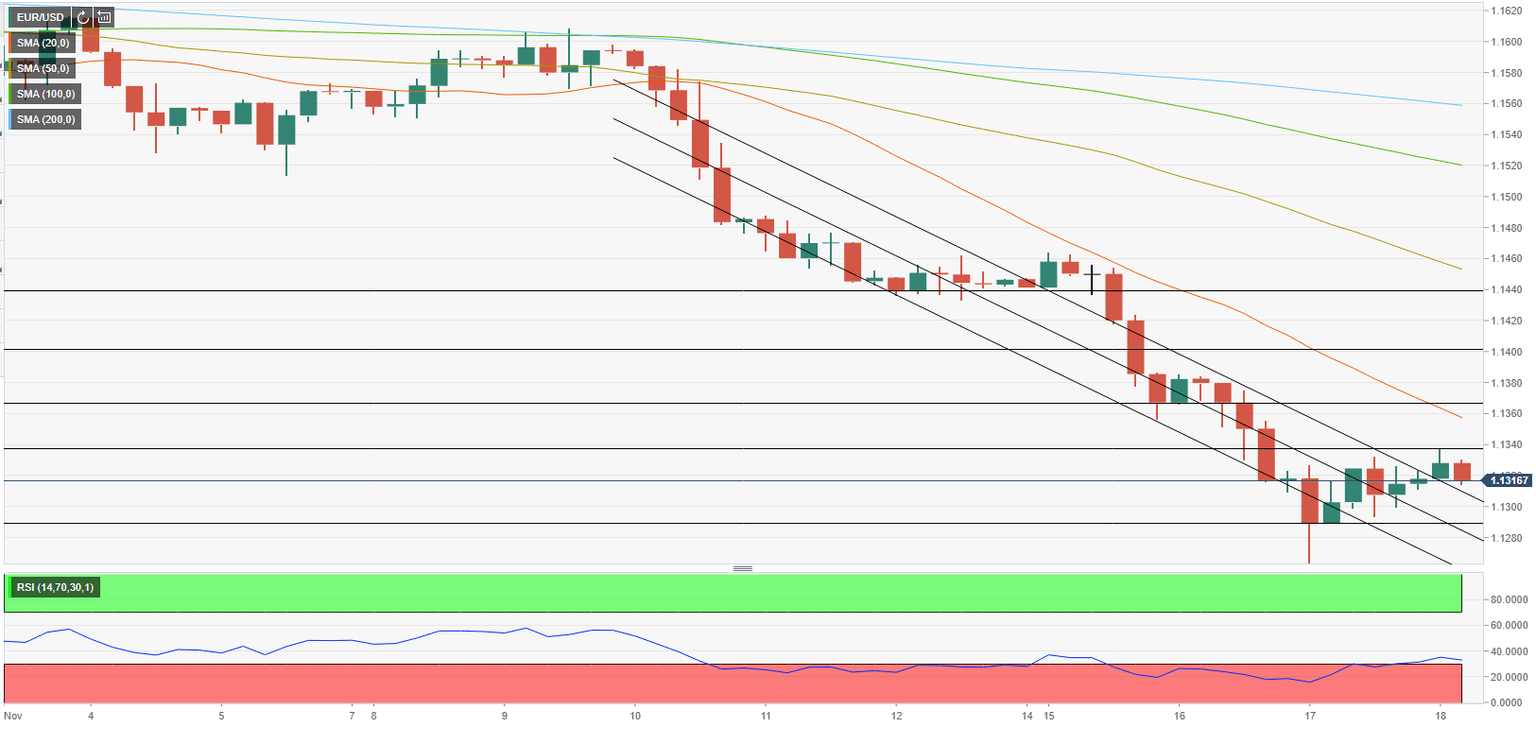

Following the sharp decline witnessed earlier in the week, the Relative Strength Index (RSI) indicator on the four-hour chart rose above 30, which could be seen as an encouraging sign for the bulls. Additionally, EUR/USD is currently trading above the descending regression channel coming from November 9. In case sellers fail to bring the pair back within that channel, additional recovery gains could be witnessed.

1.1340 (static level) aligns as initial resistance before the 1.1350/60 area (static level, 20-period SMA). With a daily close above the latter, EUR/USD could target 1.1400 in the near term.

On the downside, 1.1300 (psychological level, descending regression channel) could be seen as the first support ahead of 1.1260 (16-month low) and 1.1200 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.