- EUR/USD has been consolidating its recent gains which stemmed from USD weakness.

- Weak euro-zone inflation figures are indicating a cautious stance from the ECB on Thursday and concerns about Italy weigh.

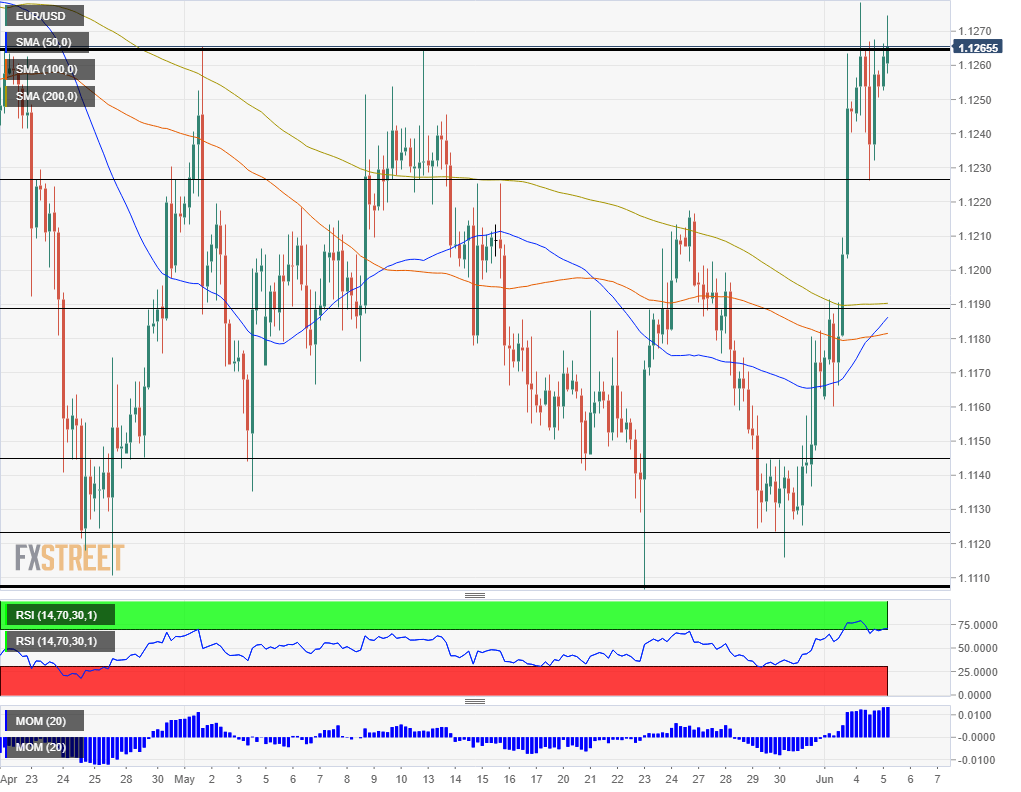

- Wednesday's four-hour chart is pointing to overbought conditions.

The subtlest of hints of a Fed rate cut has been all that markets had been waiting for – stocks surged and the US dollar extended its falls. Fed Chair Jerome Powell said that the Fed "will act as appropriate" in response to the risks that trade tensions pose to the US economic outlook.

The powerful central banker has deviated from his previous stance that advocated patience – which meant leaving rates unchanged for a long time. The tweak in his wording has been echoing and remains the main theme of the day.

Powell has had considerable reasons to lose his patient stance – there is no let up in the trade wars. China has fined Ford's Chinese unit for a violation of an anti-monopoly law while the US is examining alternative suppliers of rare earth products – it is currently reliant on China. Rare earth materials are critical in various industries and the world's second-largest economy has hinted it may curb exports.

On the positive side, US Treasury Secretary Steven Mnuchin will meet the head of China's central bank Yi Gang at the gathering of G-20 finance ministers and central bankers in Japan over the weekend. While expectations are low, just holding the high-level meeting has been a source of comfort to markets.

Draghi and Italy

In the old continent, preliminary inflation figures for May have disappointed – 1.2% year on year in headline consumer price index (CPI) and 0.8% on Core CPI. The European Central Bank meets tomorrow for a critical decision and the data may force president Mario Draghi and his colleagues to lower forecasts and take a dovish stance on interest rates. The anticipation of the event has limited EUR/USD gains.

See ECB Preview: Three things that may tilt EUR/USD to the downside

And while traders will have to wait until Thursday to hear from Draghi, developments in his home country may take center stage. The Italian government is on a collision course with the EU once again. According to Italian media, the European Commission will initiate an infringement process against Italy over its fiscal policy.

Matteo Salvini, Italy's Deputy PM and the de-facto head of state, is buoyed by his victory in the European elections and is set to deepen the country's budget deficit. His Economics Chief Claudio Borghi said the talks with Brussels "must not end with a compromise similar to last autumn" – referring to Italy's climbdown that was triggered by Rome's rising borrowing costs.

Critical US data

And while the euro holds in breath ahead of the ECB gathering, top-tier US data awaits traders. The ADP Non-Farm Payrolls has served as a critical hint to last month's jobs report and the upcoming release for May is set to draw attention.

See ADP Employment Preview: Moderating but healthy

The ISM Non-Manufacturing PMI is due shortly after. The forward-looking survey for the services sector may show a slowdown – following the footsteps of the manufacturing sector data released on Monday. Apart from the headline number, the employment component will be closely watched as a hint of hiring in America's largest sector.

See US Services PMI Preview: Down but not out

Overall, EUR/USD is set to move by further developments around Italy and US data – which helps to shape Fed expectations.

EUR/USD Technical Analysis

EUR/USD has been battling the former triple-top of 1.1265 that it only temporarily conquered on Tuesday. While momentum remains positive, the relative strength index is just above 70 – indicating overbought conditions. It seems that the currency pair will continue struggling for a direction for some time.

Resistance awaits at 1.1280 which was served as support in mid-April. Next up, we find 1.1305 that held the currency pair down in a recovery attempt later that month. 1.1325 was the high point in April and is the next line to watch.

Looking down, 1.1225 was a swing low on Tuesday and works as support. 1.1190 is where the 50 and 100 simple moving averages converge. Further down, 1.1145 capped EUR/USD in late May and 1.1125 cushioned it around the same time.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.