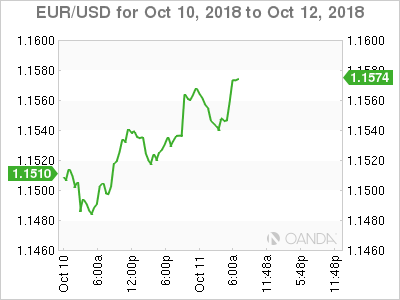

EUR/USD has edged higher in the Thursday session. Currently, the pair is trading at 1.1546, up 0.23% on the day. On the release front, French Final CPI declined 0.2%, matching the forecast. The ECB will release the accounts of the August policy meeting. In the U.S, the key indicators are CPI reports. We’ll also get a look at unemployment claims and the Treasury currency report. On Friday, Germany releases Final CPI and the eurozone publishes Industrial Production. The U.S releases UoM Consumer Sentiment.

With bonds yields continuing to rise, investors have reacted negatively and stock markets continue to spin lower. The U.S dollar often is the winner in times of crisis, providing a safe haven for nervous investors. However, the euro has weathered this latest crisis, holding its own against the greenback this week. On Thursday, German 10-year bonds fetched 0.55%, marking a 6-month high. The markets will be keeping a close eye on U.S consumer inflation data – strong numbers would likely increase the likelihood of a December rate hike in the U.S and reinvigorate the dollar.

Investors will be keeping a close eye on the ECB policy meeting accounts, looking for hints as to the timing of a rate hike next year. The ECB has stated that it will not raise rates before the “end of the summer”, which many analysts have interpreted as September 2019. However, that time period is not etched in stone, and the ECB could opt to raise rates earlier, if warranted by economic conditions. Besides inflation, ECB policymakers will have to weigh other factors such as the U.S-China trade war when deciding when to raise interest rates.

EUR/USD Fundamentals

Thursday (October 11)

-

2:45 French Final CPI. Estimate -0.2%. Actual -0.2%

-

7:30 ECB Monetary Policy Meeting Accounts

-

8:30 US CPI. Estimate 0.2%

-

8:30 US Core CPI. Estimate 0.2%

-

8:30 US Unemployment Claims. Estimate 207K

-

10:30 US Natural Gas Storage. Estimate 87B

-

11:00 US Crude Oil Inventories. Estimate 2.3M

-

13:01 US 30-year Bond Auction

-

Tentative – US Treasury Currency Report

Friday (October 12)

-

2:00 German Final CPI. Estimate 0.4%

-

5:00 Eurozone Industrial Production. Estimate 0.4%

-

8:30 US Import Prices. Estimate 0.3%

-

10:00 US Preliminary UoM Consumer Sentiment. Estimate 100.4

-

10:00 US Preliminary UoM Inflation Expectations

-

12:30 US FOMC Member Raphael Bostic Speaks

-

12th-18th US Federal Budget Balance. Estimate 71.0B

-

10:30 US FOMC Member Randal Quarles Speaks

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1190 | 1.1300 | 1.1434 | 1.1553 | 1.1637 | 1.1718 |

-

1.1434 is providing support

-

1.1553 was tested earlier in resistance and could break in the Thursday session

Further levels in both directions:

-

Below: 1.1434, 1.1300 and 1.1190

-

Above: 1.1553, 1.1637, 1.1718 and 1.1840

-

Current range: 1.1434 to 1.1553

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.