EUR/USD Current price: 1.1781

It was quite a dull week for the EUR/USD pair in terms of price action, as it closed it marginally lower at 1.1781 after spending it within previous week's range. Notable, the greenback was the best performer across the board, ending the week with gains against all of its major rivals, while the common currency was the most reluctant to give up, a sign that speculative interest is still hoping for an EUR´s rally. News from the Euro-area led the way, particularly focused on the situation in Spain and its autonomic region Catalonia, and mounting speculation on what the ECB will announce this Thursday on Monetary policy.

Catalonia has been a major risk factor for the EUR, as the region´s plans to become independent resulted in the central government triggering the art. 155 of the National Constitution, which means trimming the Catalonian autonomic powers. Over the weekend, the Catalan president, Carles Puigdemont, said that this decision is the worst attack on local institutions since Franco's dictatorship and that they won't accept the direct ruling. What prevented the common currency from plummeting, is mounting speculation that the Central Bank will announce some sort of reduction on its bond-buying program next Thursday, after trimming it from €80B to €60B earlier this year.

Another risk factor for the pair were comments from Fed's head Janet Yellen late Friday, as she repeated that the latest fall in inflation has been an unexplainable "surprise." If she can't explain the phenomenon, she will hardly be able to fix it, and therefore inflation could remain low and mean fewer rate hikes for 2018 and on.

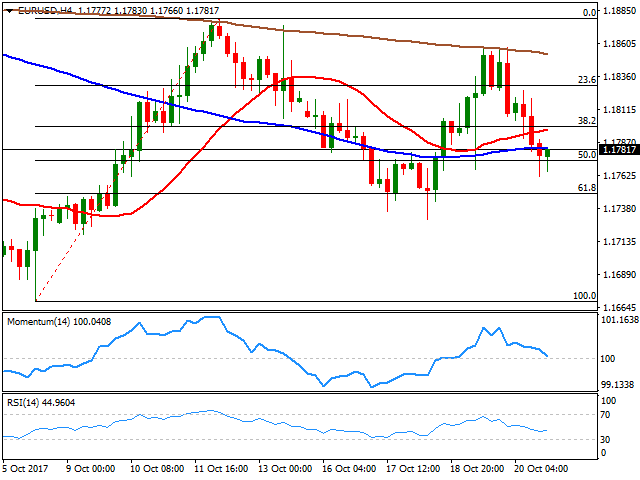

Technically, the daily chart for the pair shows that, while the upward potential has receded, a downward movement is still not confirmed, as the price hovers around a horizontal 20 DMA but above bullish 100 and 200 DMAs, this last well below the current level. Technical indicators have turned south, but the Momentum is still above its 100 level whilst the RSI is now at 46, both within neutral territory. Shorter term, and according to the 4 hours chart, the scale leans towards the downside, as the early recovery from the 61.8% retracement of its latest bullish run met selling interest around a bearish 200 SMA, with the price currently below all of its moving averages, the Momentum indicator about to cross its 100 level, and the RSI indicator directionless around 44. The pair has an immediate support at 1.1760, where it bottomed on Friday, followed by 1.1720. Below this last, the downward potential will become more serious, with scope for a downward move towards 1.1660 a major static support area.

Support levels: 1.1760 1.1720 1.1690

Resistance levels: 1.1835 1.1865 1.1890

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.