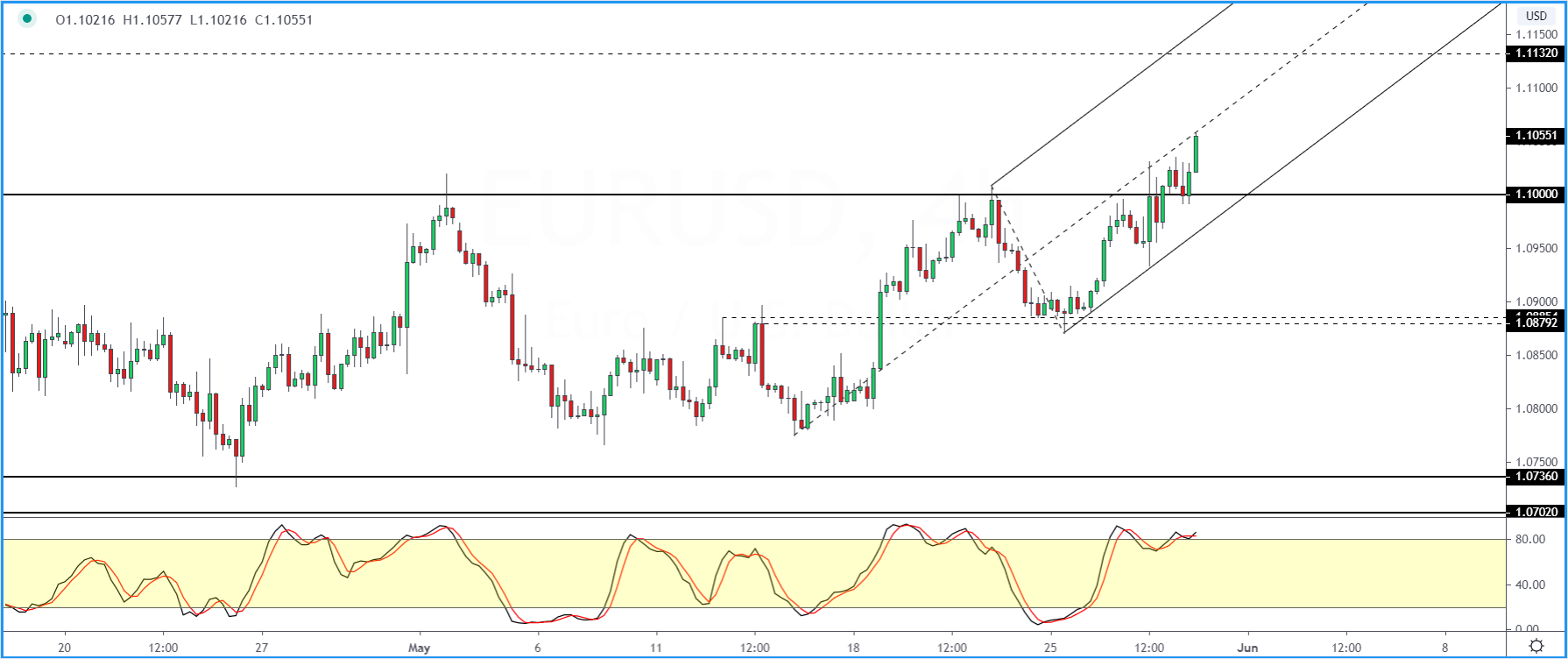

EUR/USD Finally Breaks Past 1.1000 Level

The euro is trading above the 1.1000 level for the first time in two months.

The gains came about on the Eurozone stimulus.

The current gains will now see the upside rising towards 1.1132 where there is a strong chance of resistance to form.

In the near term, watch for a potential pullback to the current gains.

Forming support near 1.1000 will potentially validate the upside bias.

But for the moment, the price level near 1.1000 remains vulnerable.

A close below this level once again will put EURUSD back into its old sideways range.

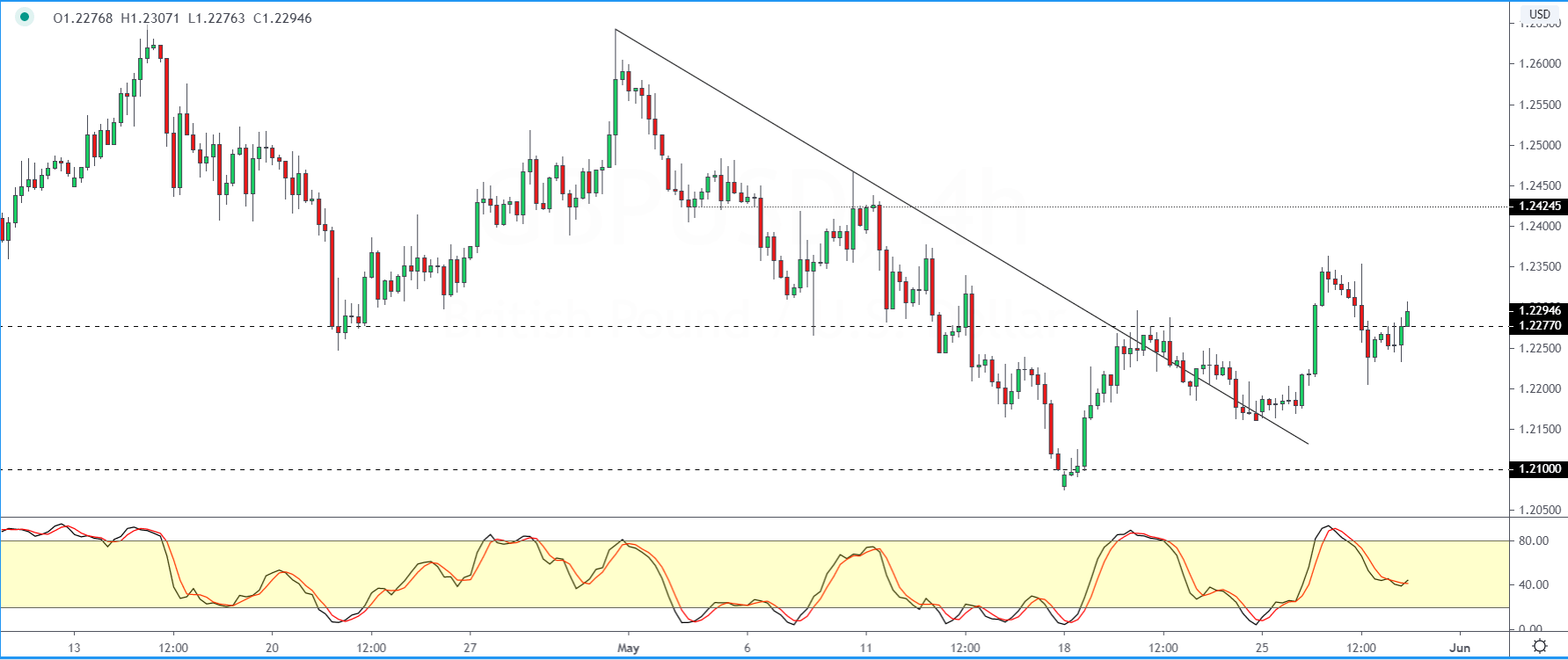

GBP/USD Attempts to Recover After A Pullback

The GBPUSD currency pair is looking somewhat bullish after the initial pullback looks to be complete.

Price action fell back to the price level of 1.2277 after a brief rise initially.

The current recovery will confirm the potential upside for the currency pair.

We expect GBPUSD to rise to 1.2424 in the near term. This will push prices up to the 8 th of May highs.

Further gains will likely happen only on a breakout above this level.

In the meantime, we expect GBPUSD to remain in a holding pattern within these new levels.

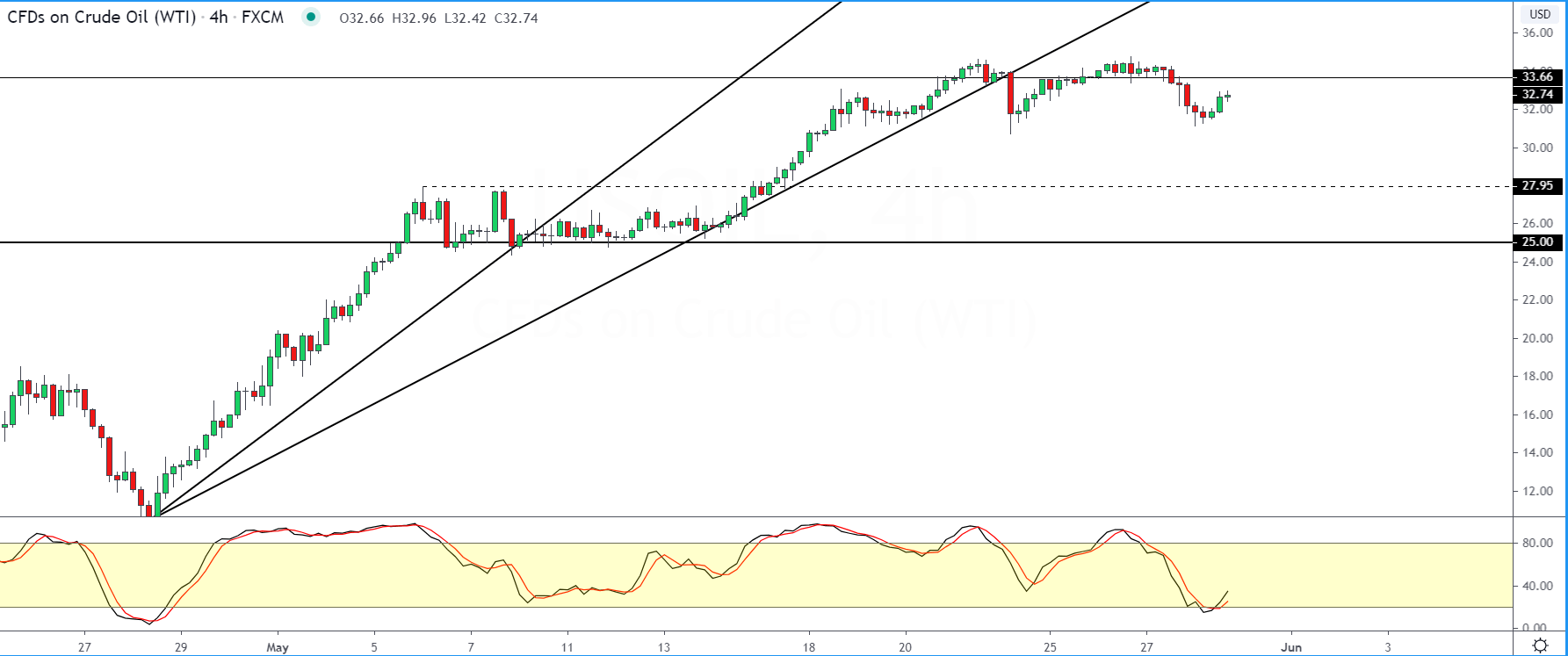

Oil Prices Slip Below $33.66 Once Again

WTI Crude oil prices are finding it difficult to break past the 33.66 level.

After briefly trading above this level, oil prices are back below this handle once again.

But as a result, a soft double bottom pattern is forming near 31.72. This puts the upside bias toward a target of 37.00.

Given that oil prices remain vulnerable to the fundamentals, there is potential that prices could pullback lower.

Furthermore, prices have failed to establish any lower support which also adds to this view.

Therefore, if oil fails to breakout above 33.66, then we could see the downside risks building up.

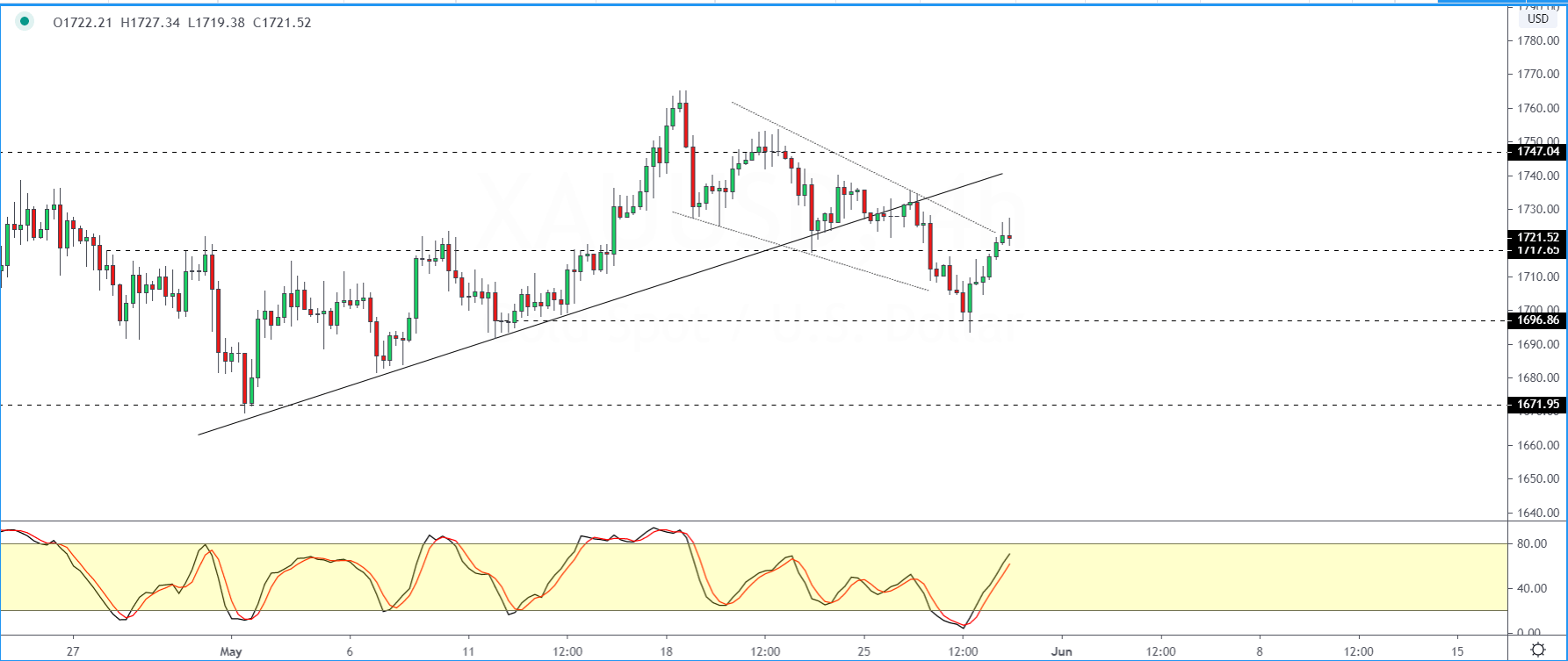

XAU/USD Consistently Posting Lower Highs

The precious metal is trading somewhat bullish as it attempts to recover the losses from the previous two sessions.

However, the intraday charts show a consistent lower high forming, alongside lower lowers.

This is indicative of a downtrend that is not that significant just yet. For now, prices are back above the 1717.65 level.

A breakdown here could see price slipping to previous lows of 1696.86.

Only a strong close below this level will confirm further downside which could come around the 1671.95 level.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.