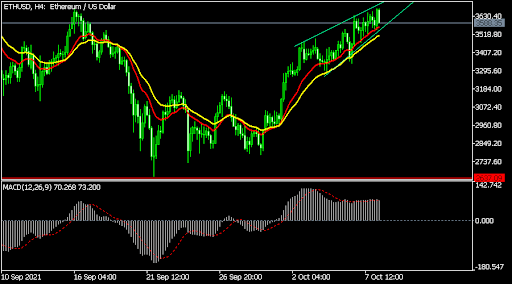

ETH/USD forms a rising wedge pattern, signalling a potential retreat

Global stocks were little changed on Friday as investors reacted to the breakthrough in the US Senate that prevented the country from running out of money in the coming weeks. The stop-gap measure will give Democrats an opportunity to come up with a reconciliation bill to expand the debt ceiling. Analysts believe that global stocks would have declined sharply if the US government had defaulted on its obligations. Stocks also rose as investors wait for the upcoming earnings season that will start next week. Some of the top companies that will publish their results next week are Blackrock, Netflix, and JP Morgan.

The price of crude oil rose sharply today as investors remained concerned about the supply and demand dynamics. Earlier this week, OPEC decided to maintain status quo, meaning that the cartel will continue adding 400k barrels per month. At the same time, many US producers have committed to growing their production at a slower pace than expected. Meanwhile, demand is expected to rise substantially as the world economy recovers. Analysts at the EIA and API expect that demand will rise to more than 100.8 million barrels per day in 2022. Therefore, some analysts believe that the price of Brent will likely rise to more than $100 soon.

The USDCAD pair declined after the latest jobs numbers from the United States and Canada. Data by the Bureau of Labor Statistics (BLS) showed that the American economy added just 194k jobs in September. The jobs numbers were worse than the adjusted 366k jobs that were added in the previous month. Meanwhile, the unemployment rate declined to 4.8% in May while wages continued to rise. Elsewhere, in Canada, the economy added 157k jobs while the unemployment rate fell to 6.9%.

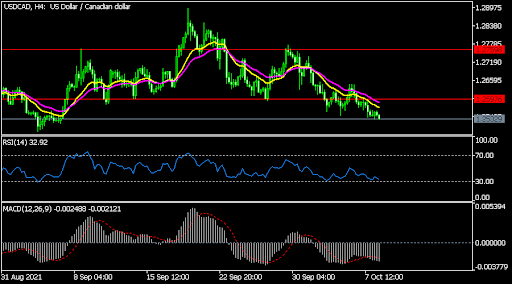

USD/CAD

The USDCAD pair declined to a low of 1.2534 after the latest jobs numbers from the US and Canada. This was the lowest level it has been since September 7. On the four-hour chart, the pair declined below the 25-day and 50-day moving averages. The pair also moved below the neckline of the head and shoulders pattern. Oscillators are also supportive of the bearish trend. Therefore, the pair will likely keep falling in the near term.

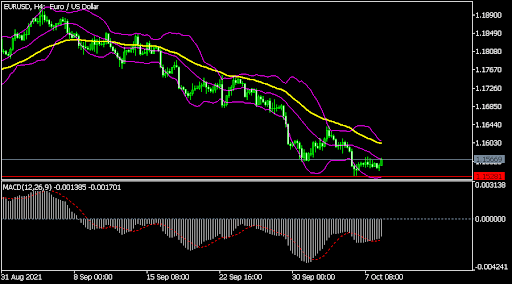

EUR/USD

The EURUSD pair tilted higher after the latest NFP data. The pair is trading at 1.1563, which was above this week’s low of 1.1528. On the four-hour chart, the price is still below the short and longer-term moving averages while the MACD is slightly below the neutral line. The pair is also forming a bearish flag pattern. Therefore, it will likely continue the bearish trend, with the next key level to watch being at 1.1500.

ETH/USD

The ETHUSD pair was little changed today. It is trading at 3,612, which is slightly below this week’s high of 3,680. On the four-hour chart, the pair is slightly above the short and longer moving averages. At the same time, it has formed a rising wedge pattern. In technical analysis, a rising wedge is usually a bearish signal. Therefore, the pair will likely break out lower during the weekend.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.