Dow Bearish Flag or confirmed breakout?

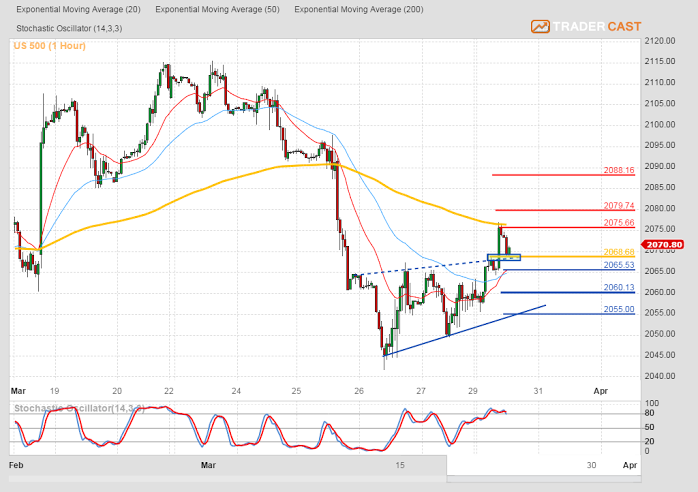

Important point of control is at 2068.68 level.

Confirmed support at that level could target further upside resistance at 2075.66 followed by 2079.74 and 2088.16.

Downside support is at 2065.53 followed by 2060 and 2055.

S&P

Important point of control is at 2068.68 level.

Confirmed support at that level could target further upside resistance at 2075.66 followed by 2079.74 and 2088.16.

Downside support is at 2065.53 followed by 2060 and 2055.

Any discussions held, views and opinions expressed and materials provided during TraderCast sessions are the views, opinions and materials of Phillip Konchar alone. All information and materials provided are not independent investment research and are provided for general information purposes only and does not take into account your personal circumstances or objectives. These sessions or any materials provided are not and shall not be construed as financial promotion, nor are they (or should be construed to be) financial, investment or other advice upon which reliance should be placed. Phillip Konchar’s trading strategies do not guarantee any return and Phillip Konchar shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Spread trading is a leveraged product and carries a high level of risk to your capital as prices may move rapidly against you. It is possible to lose more than your initial investment and you may be required to make further payments. It may not be suitable for all customers therefore ensure you understand the risks and seek independent advice.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.