In our previous analysis GBPUSD: Cable`s Short Term Road-map! the main count expected Cable to make new lows, however Cable continued moving downwards and as you are all aware we had that downwards movement under the microscope and have been tracking this downwards movement on a daily basis down to the hourly chart.

With the recent downwards movement Cable has entered an uncharted price territory that has not been visited for the past 5 years.

This week`s main count expects Cable to continue moving downwards while the alternate count expects that Cable has one last push upwards before resuming its downtrend. It is worth mentioning that the alternate count`s target does not provide a practical trading target, however, it should only be used as a guide.

As always we will wait for either counts confirmation point to be reached to determine the highly probable count.

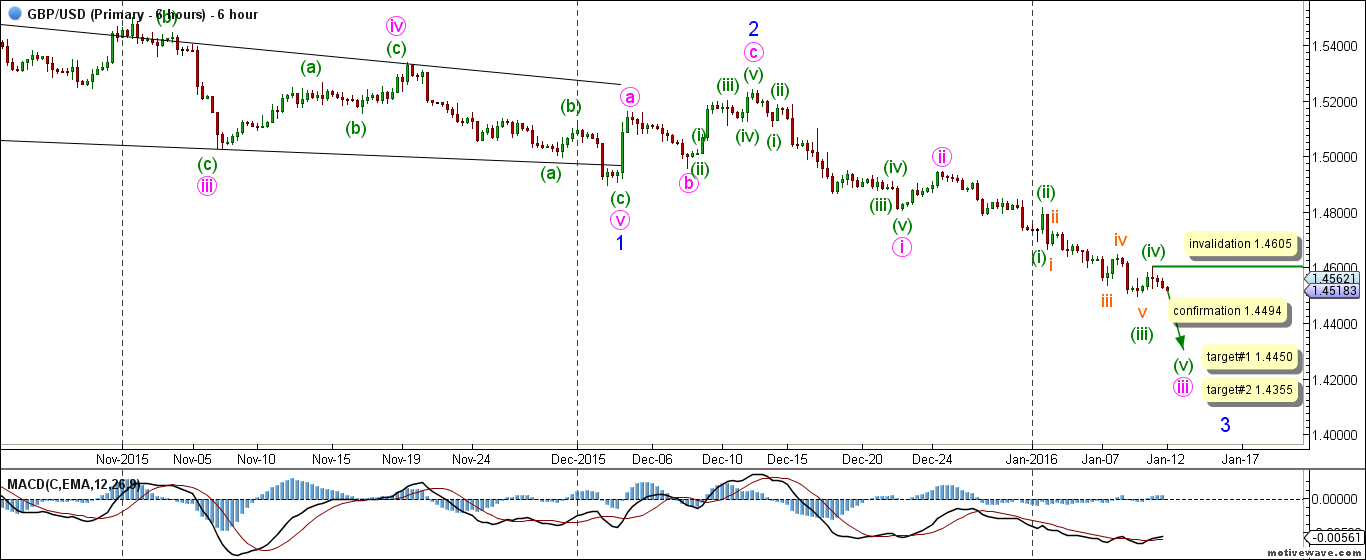

Main Count

- Invalidation Point: 1.4605

- Confirmation Point: 1.4494

- Downwards Targets: 1.4450 -- 1.4355

- Wave number: (v) green

- Wave structure: Motive

- Wave pattern: Impulse/Ending diagonal

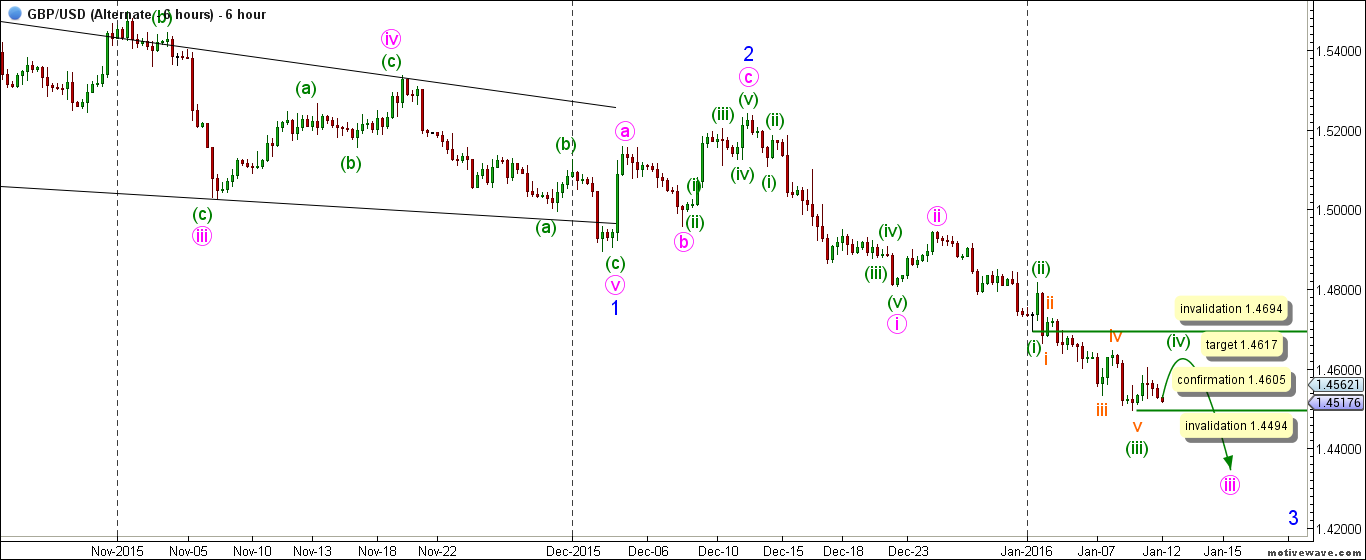

Alternate Count

- Invalidation Point: 1.4694 -- 1.4494

- Confirmation Point: 1.4605

- Upwards Targets: 1.4617

- Wave number: (iv) green

- Wave structure: Corrective

- Wave pattern: Double Zigzag

Main Wave Count

This count expects that primary wave B maroon is complete and that primary wave C maroon is unfolding towards the downside.

Within wave C maroon intermediate waves (1) and (2) black might be complete and intermediate wave (3) black has started unfolding downwards.

Intermediate wave (2) black unfolded as a zigzag labeled waves A, B and C blue.

Wave B blue unfolded as a zigzag labeled waves a, b and c pink.

Wave C blue unfolded as an impulse labeled waves i through v pink.

Within intermediate wave (3) black it is expected that minor waves 1 and 2 blue are complete with wave 1 blue unfolding as a leading diagonal labeled waves i through v pink.

Wave iii pink unfolded as a zigzag labeled waves (a), (b) and (c) green.

Wave iv pink unfolded as a zigzag labeled waves (a), (b) and (c) green.

Wave v pink unfolded as a zigzag labeled waves (a), (b) and (c) green.

Minor wave 2 blue was a shallow second wave and it unfolded as a zigzag correction labeled waves a, b and c pink.

Within minor wave 3 blue it is likely that minute waves i and ii pink are complete and that minute wave iii pink has started unfolding downwards.

It should be noted that Cable is starting to exhibit an increase in momentum on the 6 hours chart to support a third wave being underway.

This count would be confirmed by movement below 1.4494.

At 1.4450 wave (v) green would reach 0.618 of wave (i) green and at 1.4355 wave (v) green would reach equality with wave (i) green.

This count would be invalidated by movement above 1.4605 as within wave (v) green no second wave may retrace more than 100 % of its first wave.

Alternate Wave Count

The difference between both main and alternate counts is within the subdivisions of wave (iv) green.

This count expects that wave (iv) green has more to offer upwards.

This count would be confirmed by movement above 1.4605.

At 1.4617 wave (iv) green would reach 0.382 of wave (i) green.

This count would be invalidated by movement above 1.4694 as wave (iv) green may not enter the price territory of wave (i) green and as well this count would be invalidated by movement below 1.4494 as within -a double zigzag- wave (iv) green no X wave may retrace more than 100 % of its W wave.

We may also wish to keep an eye on the daily update GBP USD Forecast.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

These cryptocurrencies could face selling pressure according to an analyst: STRK, ENA, OMNI, JUP, ONDO

Thor Hartvigsen, investor at Heartcore Capital and a crypto analyst has identified a list of cryptocurrencies that are expected to see a massive increase in their supply. Typically, an increase in selling pressure negatively impacts an asset’s price.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.