In our previous analysis "GBPUSD: Mid and Long-term Elliott Wave perspective", the main count expected Cable to unfold downwards and -so far- Cable is unfolding inline with the main count`s view.

This week we are back to the short term view for Cable and before delving further into this week`s analysis, it should be mentioned that both counts have almost equal probabilities and we should stress on waiting for either count`s confirmation point to be reached to determine the highly probable count.

The main count expects Cable to unfold upwards in a corrective manner to complete a second wave, while the alternate count expects Cable to continue moving downwards to complete a five wave sequence.

It is worth noting that at this stage, a second alternate count is present expecting that wave iii orange has started unfolding downwards. Even though this count is very much a possible count, we decided to present the two conservative counts and we will update members accordingly when\if the possibility increases.

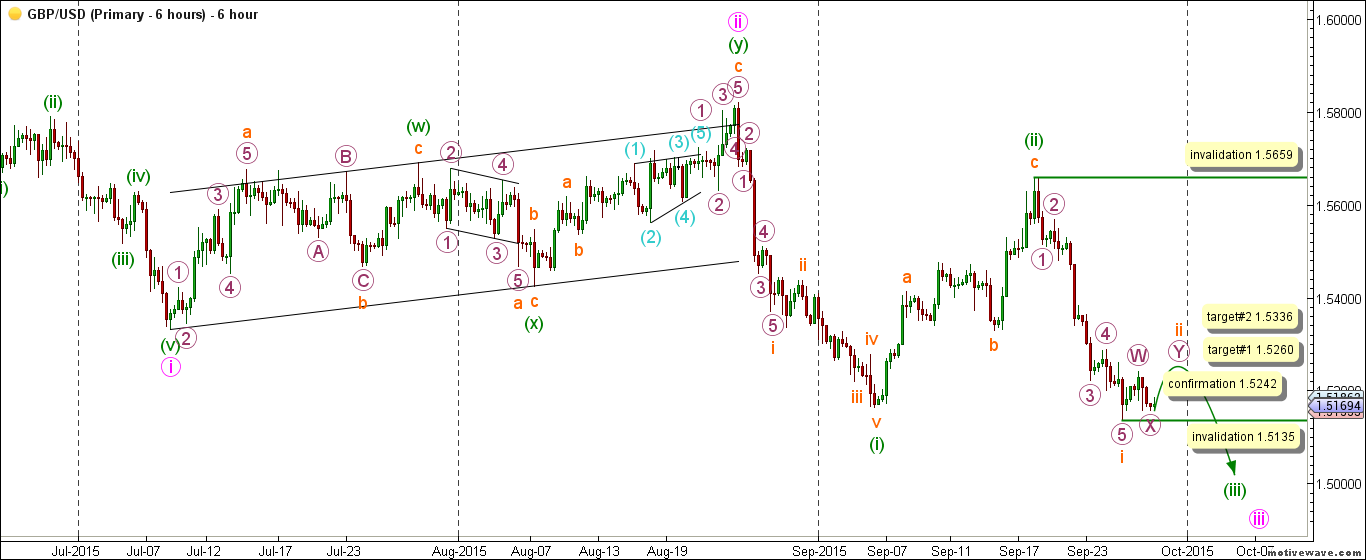

Main Count

- Invalidation Points: 1.5135 -- 1.5659

- Confirmation Point: 1.5242

- Upwards Targets: 1.5260 -- 1.5336

- Wave number: ii orange

- Wave structure: Corrective

- Wave pattern: Double Zigzag

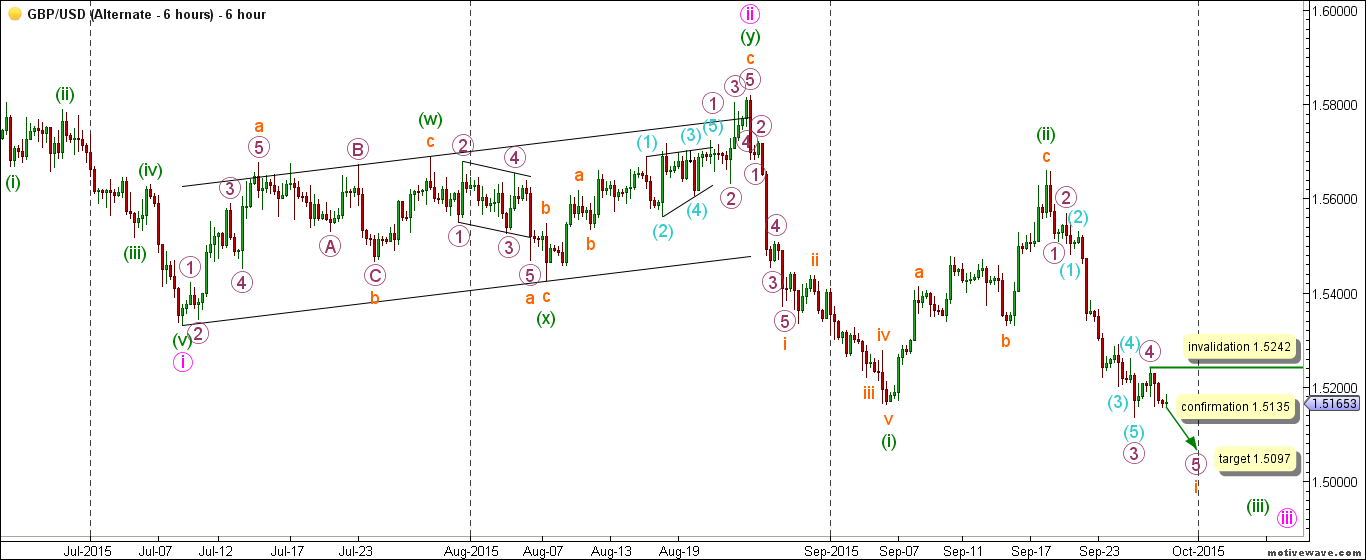

Alternate Count

- Invalidation Point: 1.5242

- Confirmation Point: 1.5135

- Downwards Targets: 1.5097

- Wave number: 5 purple

- Wave structure: Motive

- Wave pattern: Impulse/Ending Diagonal

Elliott Wave chart analysis for the GBPUSD for 28th September, 2015. Please click on the charts below to enlarge.

Main Wave Count

This count expects that primary wave C maroon is unfolding downwards and within it intermediate waves (1) and (2) black might be complete and that intermediate wave (3) black has started unfolding towards the downside.

Within intermediate wave (3) black, it is expected that waves i and ii pink are complete and wave iii pink is underway.

Wave i pink unfolded as an impulse labeled waves (i) through (v) green.

Wave ii pink unfolded as a double zigzag labeled waves (w), (x) and (y) green.

Wave (w) green unfolded as a zigzag labeled waves a, b and c orange.

Wave a orange unfolded as an impulse labeled waves 1 through 5 purple.

Wave b orange unfolded as a zigzag labeled waves A, B and C purple.

Wave (x) green unfolded as a zigzag labeled waves a, b and c orange.

Wave a orange unfolded as a leading diagonal labeled waves 1 through 5 purple.

Wave (y) green unfolded as a zigzag labeled waves a, b and c orange.

Wave c orange unfolded as an impulse labeled waves 1 through 5 purple with wave 1 purple unfolding as a leading diagonal labeled waves (1) through (5) aqua.

This count expects that wave iii pink is at its early stages with waves (i) and (ii) green complete and wave (iii) green is underway.

Wave (i) green unfolded as an impulse labeled waves i through v orange.

Wave i orange unfolded as an impulse labeled waves 1 through 5 purple.

Wave (ii) green unfolded as unfolding as a zigzag labeled waves a, b and c orange.

Within wave (iii) green it is likely that wave i orange is complete as an impulse labeled waves 1 through 5 purple and wave ii orange is unfolding towards the upside.

Wave ii orange is expected unfolding as a double zigzag labeled waves W, X and Y purple with waves W and X purple complete and wave Y purple is underway.

This count would be confirmed by movement above 1.5242.

At 1.5260 wave Y purple would reach equality with wave W purple and we should keep in mind that at 1.5261 wave ii orange would reach 0.236 of wave i orange and finally at 1.5336 wave ii orange would reach 0.382 of wave i orange.

This count would be invalidated by movement above 1.5659 as wave ii orange may not retrace more than 100 % of wave i orange and as well this count would be invalidated by movement below 1.5135 as within wave ii orange, wave Y purple may not retrace more than 100 % of wave W purple. It should be noted that the invalidation point will be moved to the end of wave X purple once we have confirmation on the hourly chart that wave Y purple is underway.

Alternate Wave Count

The only difference between both main and alternate counts is within the subdivisions within wave i orange.

This count expects that wave i orange is incomplete and that it has more to offer towards the downside.

Within wave i orange it is likely that waves 1 through 4 purple are complete and that wave 5 purple is unfolding downwards.

Wave 4 purple unfolded as a zigzag labeled waves (A), (B) and (C) aqua.

This count would be confirmed by movement below 1.5135.

At 1.5097 wave 5 purple would reach equality with wave 1 purple.

This count would be invalidated by movement above 1.5242 as within wave 5 purple no second wave may retrace more than 100 % of its first wave.

We may also wish to keep an eye on the daily update GBP USD Forecast.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.