In our previous analysis “GBPUSD: The New Kid in Uptrend Town!”. Cable was expected to continue moving upwards to complete a second wave before reversing directions in an impulsive manner within a third wave.

Cable unfolded exactly as expected and targets were reached and exceeded by 22 pips before reversing directions sharply towards the downside.

We are updating the main count`s according to the latest price action with short term targets, invalidation and confirmation points.

The alternate count expects that Cable has more to offer towards the downside to complete a fifth wave before entering a short consolidation phase.

As always we will wait for either count`s confirmation point to be reached to determine the highly probable count.

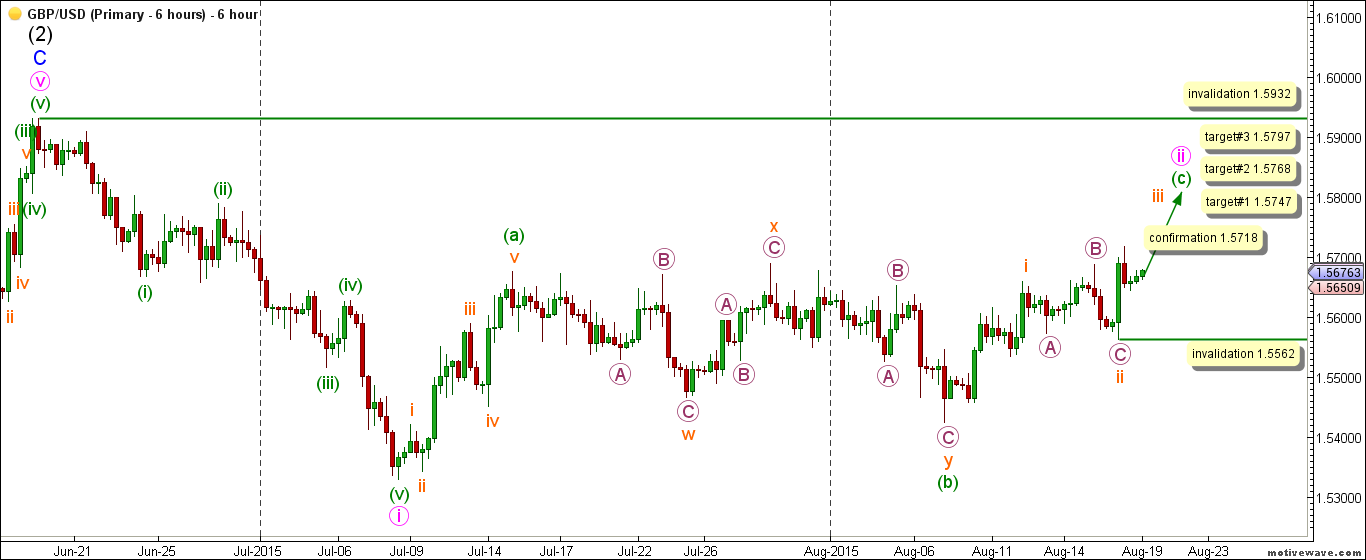

Main Count

– Invalidation Points: 1.5820 — 1.5370

– Confirmation Point: 1.5445

– Upwards Targets: 1.5455 — 1.5476 — 1.5528

– Wave number: (ii) green

– Wave structure: Corrective

– Wave pattern: Expanding Flat

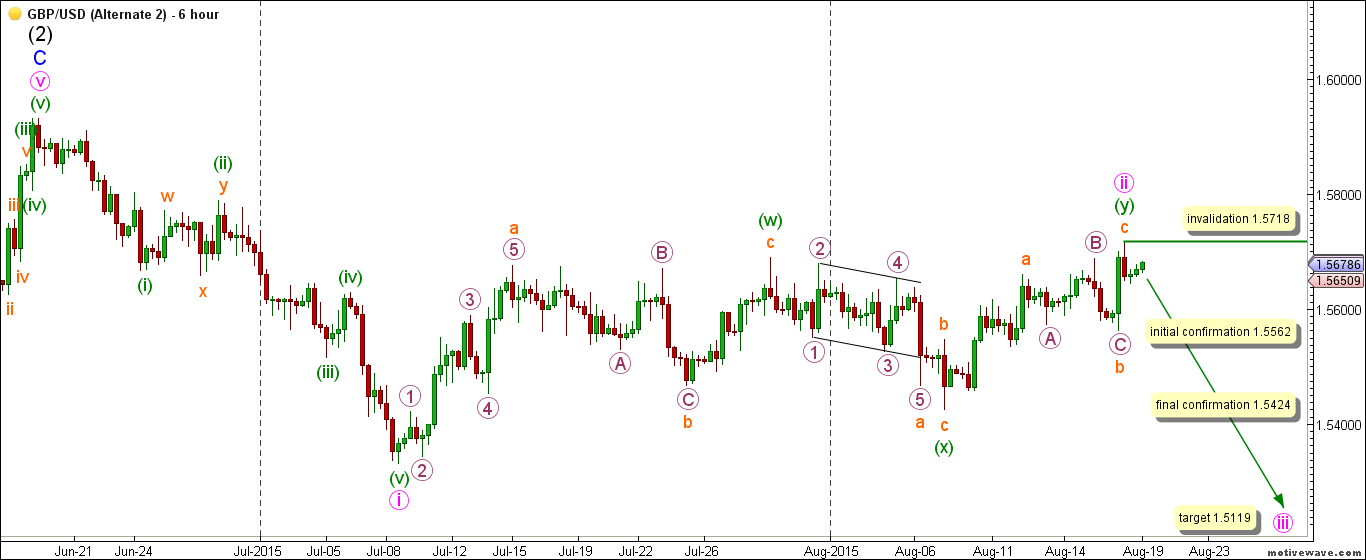

Alternate Count

– Invalidation Point: 1.5510

– Confirmation Point: 1.5335

– Downwards Target: 1.5321 — 1.5290

– Wave number: v orange – Wave structure: Motive

– Wave pattern: Ending diagonal

Main Wave Count

This count expects that wave C blue and therefore intermediate wave (2) black might be complete and that intermediate wave (3) black has started unfolding towards the downside.

Within intermediate wave (3) black, it is expected that waves i and ii pink are complete and wave iii pink is underway.

Wave i pink unfolded as an impulse labeled waves (i) through (v) green.

Wave ii pink unfolded as a double zigzag labeled waves (w), (x) and (y) green.

Wave (w) green unfolded as a zigzag labeled waves a, b and c orange.

Wave a orange unfolded as an impulse labeled waves 1 through 5 purple.

Wave b orange unfolded as a zigzag labeled waves A, B and C purple.

Wave (x) green unfolded as a zigzag labeled waves a, b and c orange.

Wave a orange unfolded as a leading diagonal labeled waves 1 through 5 purple.

Wave (y) green unfolded as a zigzag labeled waves a, b and c orange.

Wave c orange unfolded as an impulse labeled waves 1 through 5 purple with wave 1 purple unfolding as a leading diagonal labeled waves (1) through (5) aqua.

This count expects that wave iii pink is at its early stages with wave (i) green complete as an impulse labeled waves i through v orange and wave (ii) green is unfolding as an expanded flat correction towards the upside.

Within wave (ii) green, waves a and b orange are complete and wave c orange is underway.

This count would be confirmed by movement above 1.5445.

We have a target zone that starts at 1.5455 as at that level wave c orange will reach 1.618 of wave a orange and that target zone ends at 1.5476 as at that level wave (ii) green will reach 0.236 of wave (i) green. Finally if exceeded then the next logical target is at 1.5528 as at that level wave c orange will reach 2.618 of wave a orange.

This count would be invalidated by movement above 1.5820 as wave (ii) green may not retrace more than 100 % of wave (i) green. As well, this count would be invalidated by movement below 1.5335 as within wave c orange no second wave may retrace more than 100 % of its first wave.

Alternate Wave Count

The only difference between both main and alternate counts is within the subdivisions of wave v orange.

This count expects that wave v orange is incomplete and that it is unfolding downwards as an ending diagonal labeled waves 1 through 5 purple with waves 1 and 2 purple complete and wave 3 purple is underway.

This count would be confirmed by movement below 1.5335.

Since wave v orange exceeded equality with wave i orange by 1 pip, the next logical target is at at 1.5321 as at that level wave v orange would reach 1.382 of wave i orange and the second target is at 1.5290 as at that level wave v orange would reach 1.618 of wave i orange.

This count would be invalidated by movement above 1.5510 as wave 2 purple may not retrace more than 100 % of wave 1 purple.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.