Last week Cable unfolded as expected and both targets were reached and exceeded.

Last week Cable unfolded towards the upside as expected and targets are yet to be reached.

Cable`s recent upwards movement was choppy in nature which characterizes a correction. That movement was not as clear as we would have preferred and therefore we have three structured counts which trace and follow price action as close as possible.

As always we will wait for either counts confirmation point to be reached to determine the highly probable count.

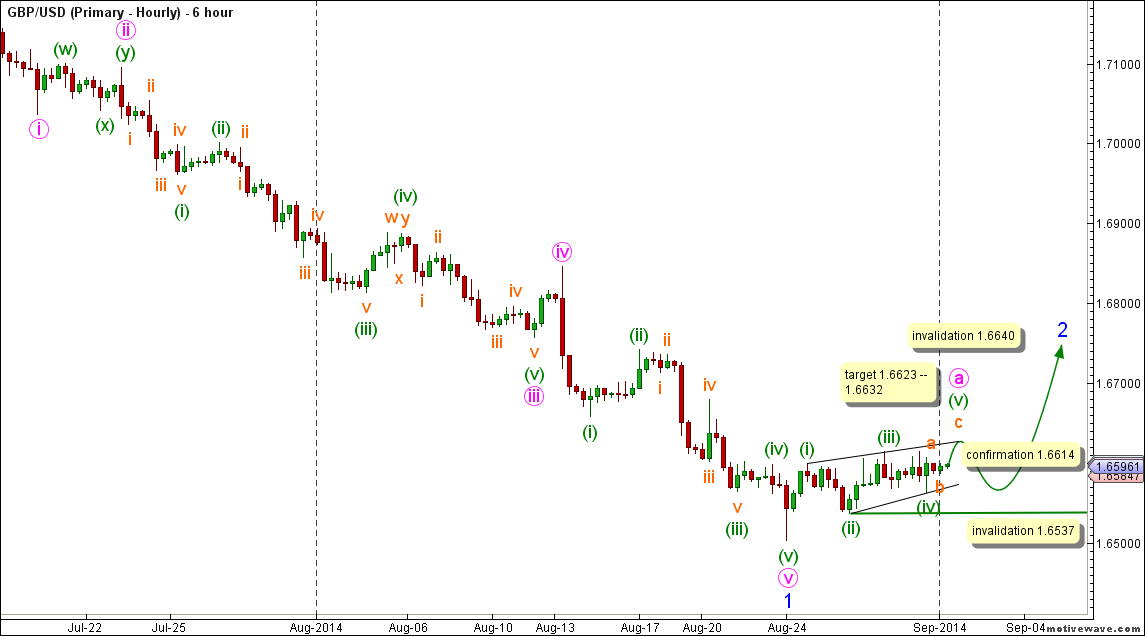

6-Hours Main Count

- Invalidation Point: 1.6640 -- 1.6537

- Confirmation Point: 1.6614

- Upwards Targets: 1.6623 -- 1.6632

- Wave number: a pink

- Wave structure: Motive

- Wave pattern: Leading Diagonal

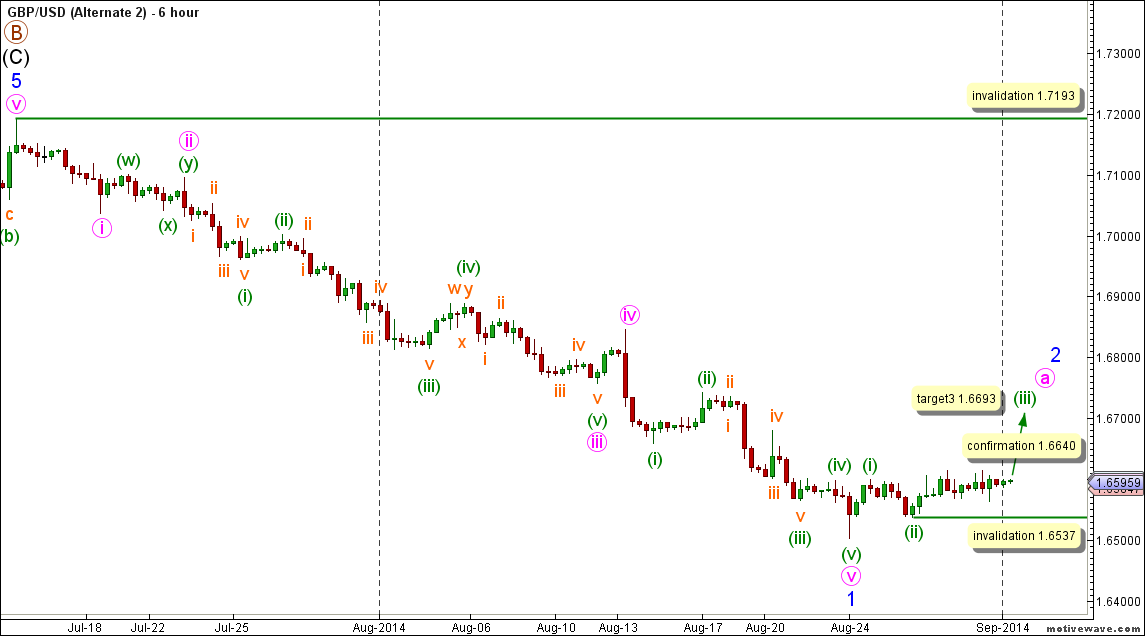

6-Hours First Alternate Count

- Invalidation Point: 1.7193 -- 1.6537

- Confirmation Point: 1.6640

- Upwards Targets: 1.6693

- Wave number: a pink

- Wave structure: Motive

- Wave pattern: Leading Diagonal

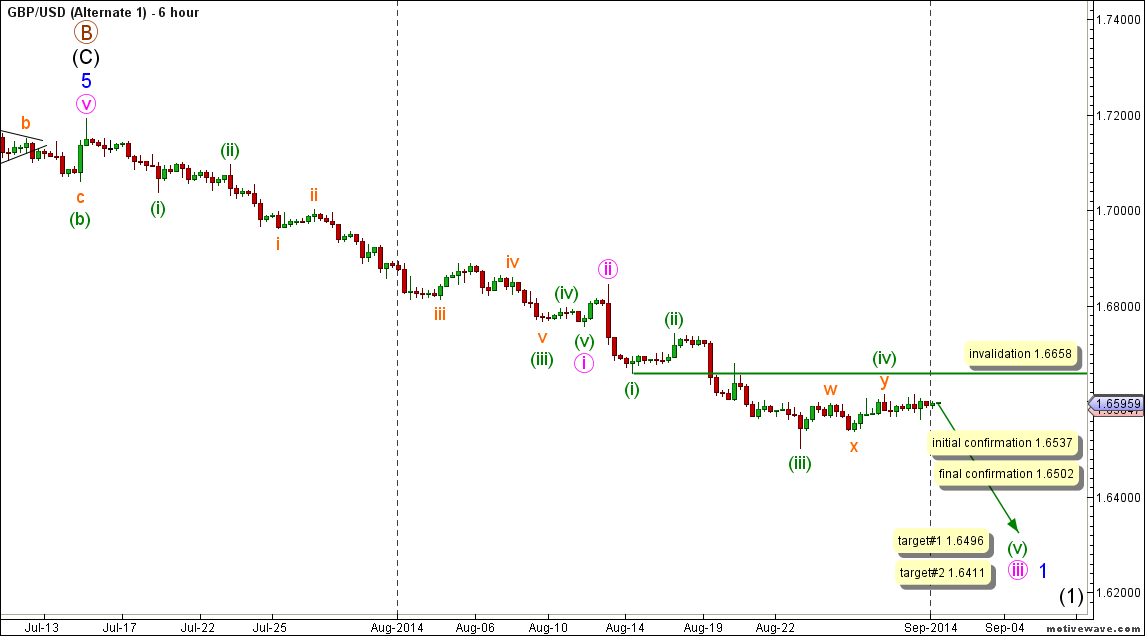

6-Hours Second Alternate Count

- Invalidation Point: 1.6658

- Confirmation Point: 1.6537 -- 1.6502

- Downwards Target: 1.6496 -- 1.6411

- Wave number: iii pink

- Wave structure: Motive

- Wave pattern: Impulse

Main Wave Count

This count expects that wave B maroon is complete as a zigzag labeled waves (A), (B) and (C) black and that wave C maroon is starting to unfold towards the downside.

Wave (C) black within wave B maroon unfolded as an impulse labeled waves 1 through 5 blue.

Wave 5 blue is complete as an ending diagonal labeled waves i through v pink.

Wave iv pink unfolded as a zigzag labeled waves (a), (b) and (c) green.

Wave v pink unfolded as a zigzag labeled waves (a), (b) and (c) green with wave (a) green unfolding as an impulses labeled waves i through v orange.

Within wave C maroon wave (1) black is expected to be underway with wave 1 blue likely complete and that wave 2 blue is underway.

Wave 1 blue unfolded as an impulse labeled waves i through v pink.

Wave ii pink unfolded as a double combination labeled waves (w), (x) and (y) green.

Wave iii pink unfolded as an impulse labeled waves (i) through (v) green.

Wave (i) green unfolded as an impulse labeled waves i through v orange.

Wave (iii) green unfolded as an impulse labeled waves i through v orange.

Wave (v) green unfolded as an impulse labeled waves i through v orange.

Wave v pink unfolded as an impulse labeled waves (i) through (v) green with wave (iii) green unfolding as an impulse labeled waves i through v orange.

Within wave 2 blue wave a pink is unfolding towards the upside likely as a leading diagonal with waves (i) through (iv) green complete and wave (v) green is underway.

Within wave (v) green wave a orange is complete, as well wave b orange is likely complete and wave c orange is starting to unfold towards the upside.

This count would be confirmed by movement above 1.6614.

At 1.6623 wave (v) green will reach 0.786 the length of wave (iii) green and at 1.6632 wave a orange will reach equality with wave c orange.

This count would be invalidated by movement above 1.6640 as by movement above that level wave (iii) green will be rendered the shortest wave. As well, this count would be invalidated by movement below 1.6537 wave (iv) green may not move below the end of wave (ii) green within a leading diagonal and it should be noted that the invalidation point will be moved to the end of wave (iv) green once we have confirmation on the hourly chart that wave (v) green is underway.

First Alternate Wave Count

This count is presented as Cable`s recent upwards movement was choppy and is not as clear as we would have preferred.

The difference between both main and first alternate counts is within the subdivisions of wave a pink as this count expects wave a pink to be unfolding as an impulse.

Within wave a pink, waves (i) and (ii) green are expected complete and wave (iii) green is unfolding towards the upside.

This count would be confirmed by movement above 1.6640.

At 1.6693 wave (iii) green will reach 1.618 the length of wave (i) green.

This count would be invalidated by movement above 1.7193 as wave 2 blue may not retrace more than 100 % the length of wave 1 blue and as well this count would be invalidated by movement below 1.6537 as wave (iv) green may not move below the end of wave (ii) green within a leading diagonal.

Second Alternate Wave Count

This count expects that wave i pink within wave 1 blue was an extended first wave and that wave 1 blue has more to offer towards the downside.

Wave i pink unfolded as an impulse labeled waves (i) through (v) green.

Wave (iii) green unfolded as an impulse labeled waves i through v orange.

Within wave iii pink waves (i) through (iii) green are expected complete and wave (iv) green is likely complete, therefore Cable is expected to resume moving towards the downside within wave (v) green.

Wave (iv) green unfolded as a double zigzag labeled waves w, x and y orange.

This count would be initially confirmed by movement below 1.6537 and the final confirmation point is at 1.6502.

At 1.6496 wave (v) green will reach 0.618 the length of wave (i) green and at 1.6411 wave iii pink will reach equality with wave i pink.

This count would be invalidated by movement above 1.6658 as wave (iv) green may not enter the price territory of wave (i) green and it should be noted that the invalidation point will be moved to the end of wave (iv) green once we have confirmation on the hourly chart that wave (v) green is underway.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.