As expected the euro continued moving towards the downside, reached our first target at 1.2869, and came within 26 pips of reaching our second target at 1.2801.

There are many signs that the current downtrend, which had lasted for nearly two months, may be coming to a temporary end. In fact, we expect that the coming 3 weeks or so will witness a period of sideways movement with an upwards bias.

We’re updating our count to reflect the most recent price action and to present tighter targets and invalidation points.

6-Hour Main Count

– Invalidation Point: 1.3504

– Confirmation Point: 1.2931 – 1.2996

– Upwards Target : 1.3040 – 1.3166

– Wave number: Minor 4

– Wave structure: Corrective

– Wave pattern: Zigzag, Flat, Triangle, or Combination

Main 6-Hour Wave Count

The bigger picture sees the euro moving downwards in intermediate wave (A), which is forming an impulse labeled minor waves 1 through 5.

Minor wave 3 formed an impulse labeled minute wave i though v, and has reached over 161.8% the length of minor wave 1.

Within it, minute wave v formed an impulse labeled minuette waves (i) through (v), and has reached 161.8% the length of minute waves i and iii.

Within it, minuette wave (iii) formed an impulse labeled subminuette waves i through v, and reached 261.8% the length of minuette wave (i).

Minuette waves (v) formed impulse labeled subminuette waves i through v, and has reached almost 161.8% the length of minuette wave (iii).

Within it, subminuette wave i formed an impulse labeled micro waves 1 through 5.

Subminuette wave iii also formed an impulse labeled micro waves 1 through 5, reaching 261.8% the length of subminuette wave i.

Subminuette wave iv unfolded as a double zigzag labeled micro waves W, X and Y, retracing nearly 50% of subminuette wave iii.

Subminuette wave v unfolded as an impulse labeled micro waves 1 through 5, and has reached almost 161.8% the length of subminuette wave i.

This count expects that minor wave 3 is now complete or very near completion, and that the euro will soon start moving towards the upside in minor wave 4. This will be initially confirmed by movement above 1.2931, with higher confidence above 1.2996.

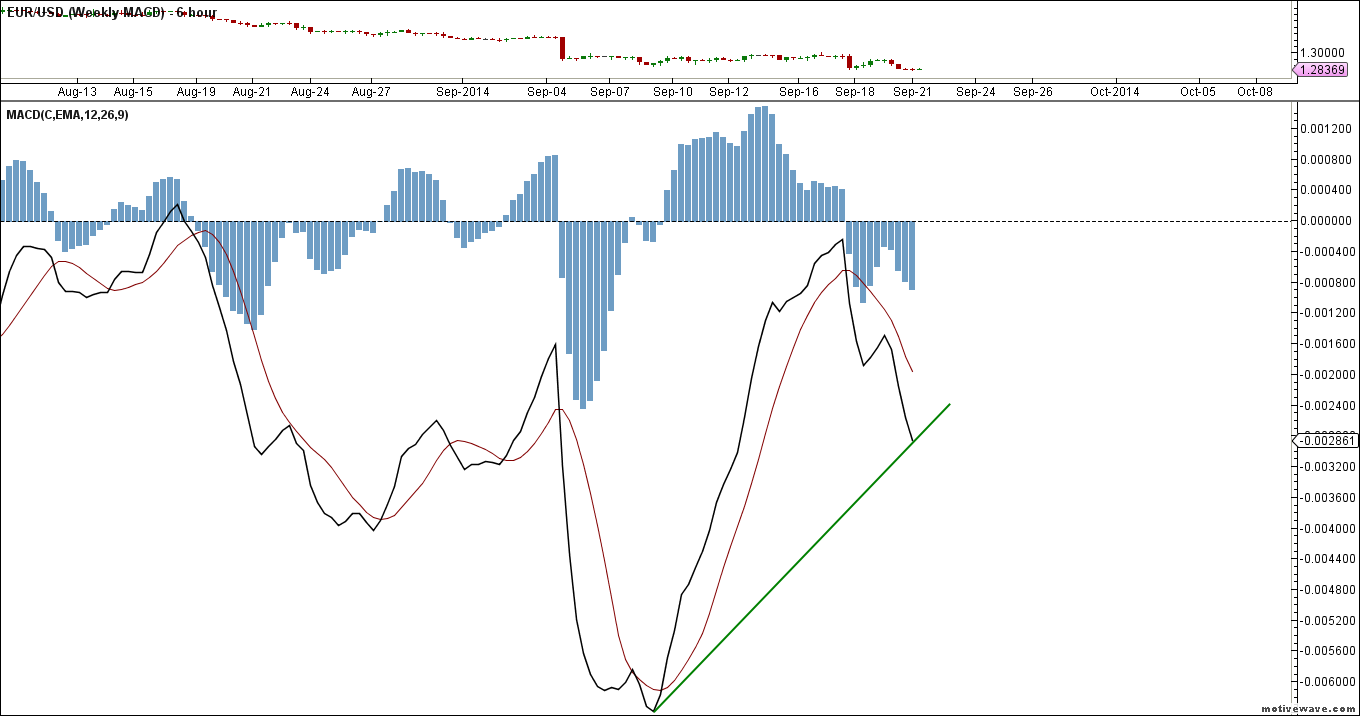

The MACD indicator supports this count by showing a clear bullish divergence, which is the typical momentum indication of a trend-reversal or interruption.

In terms of candlestick analysis, no clear pattern appears at this point.

At 1.3040 minor wave 4 would retrace 23.6% of minor wave 3, then at 1.3166 it would retrace 38.2% of its length.

This wave count is invalidated by movement above 1.3504 as minor wave 4 within this impulse may not enter the price territory of minor wave 1.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.