The following are the latest technical setups for EUR/USD, USD/JPY, EUR/CHF, AUD/USD, NZD/USD, and USD/CAD as provided by the technical strategy team at Barclays Capital.

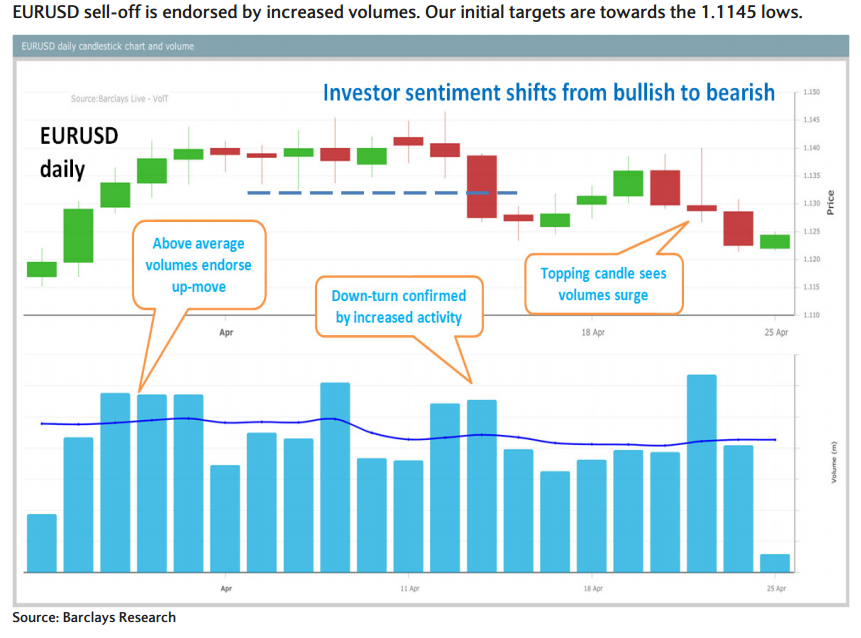

EUR/USD: Our bearish view was initially encouraged by the move below 1.1230. We now look for an extension below 1.1210 to open our next targets near the 1.1145 range lows and then the 1.1065 area. Beyond there, we are targeting a move towards the 1.0820 area.

USD/JPY: We have turned neutral following the unexpected break above the 110.65 former range lows. The risk is a squeeze higher in range towards 113.30. Overall the trend is bearish and we are looking for reasons to re-establish a bearish view towards the 1.0760 lows.

EUR/CHF: We are overall bullish and look to buy dips while the 1.0840 lows underpin. A move above our initial targets near the 1.1025 March range highs would point higher towards 1.1060 and then the 1.1115 area.

AUD/USD: Last weeks ‘‘doji’’ candle signals a breather from the recent up-move. We look for a dip within range towards the 0.7590 area. We would then look for signs of a base near the 0.7475 range lows.

NZD/USD: Failure to sustain a breach of resistance near 0.6990 along with last week’s topping candle helps to keep us bearish. We are looking for a move lower towards targets near 0.6760 and then the 0.6670 area. A bullish weekly reversal in AUDNZD points towards our targets near 1.1335/1.1360.

USD/CAD: The move below our targets in the 1.2670 area endorses our greater bearish view. We expect upticks to find selling interest near the 1.2780 area and look for further downside towards 1.2050/1.1915.

This content has been provided under specific arrangement with eFXnews.

Advertisement

Advertisement

For a live simulators for bank trade positions and forecasts, sign-up to eFXplus

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.