The following are the latest technical setups for EUR/USD, USD/JPY, AUD/USD, NZD/USD, USD/CAD as provided by the technical strategy team at Barclays Capital.

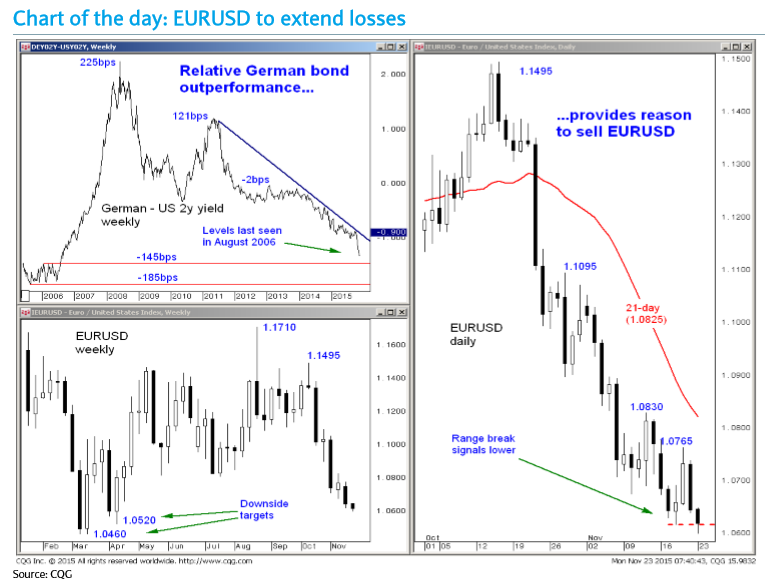

EUR/USD: The break below support near 1.0615 encourages our bearish view. We are looking for a move lower towards targets near 1.0520 and then the 1.0460 year-to-date lows.

USD/JPY: We are bullish and look for buying interest in the 122.20 area to underpin a move higher. Above 123.75 would open our targets near the 125.30/125.85 highs.

AUD/USD: We are bearish and look for a move lower 0.7070 towards our initial targets near 0.7015. Below there would confirm downside traction towards our next targets near the 0.6935/0.6895 lows.

NZD/USD: Our bearish view was encouraged by Friday’s topping candle. We are looking for a move lower through 0.6430 to open our targets near 0.6375 and then the 0.6235 year-to-date lows.

USD/CAD: Weaker crude oil prices are helping to provide selling interest for CAD. The break above nearby resistance in the 1.3370 area encourages our bullish view towards targets near the 1.3460 highs and then the 1.3535 area. Our greater targets are near 1.4000.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.