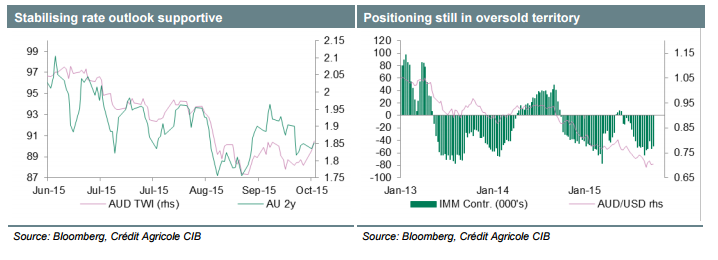

The AUD has been in demand for most of the week, mainly due to stabilising RBA monetary policy expectations and improving global risk sentiment. Even though the RBA left monetary policy unchanged, it still left open all options regarding additional policy action later on. As such, incoming data should have a heightened impact on investors’ central bank rate expectations.

In that respect next week’s employment data will be closely watched. In an environment of muted external demand conditions it appears unlikely that the corporate sector’s hiring activity increased in September. As such it is likely that next week’s data will disappoint.

Elsewhere, caution is warranted when it comes to global risk sentiment. While Fed rate expectations are unlikely to fall further from the current levels, next week’s Chinese trade and inflation data may provide further fuel for risk aversion.

We remain in favour of selling current AUD rallies.

This content has been provided under specific arrangement with eFXnews.

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits US data and Fed verdict

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.